It’s Here: The HHS Releases New Provider Relief Fund Guidance on Reporting

June 17, 2021

At a glance:

- The main takeaway: The U.S. Department of Health and Human Services (HHS) has released new guidance that sheds some much-needed light on Provider Relief Fund (PRF) reporting requirements.

- Impact on your business: The HHS’s guidance specifically provides information on PRF usage deadlines and time periods, reporting responsibilities and how to conduct the reporting process.

- Next steps: The PRF reporting portal will open soon, so providers should use the next few weeks to ready themselves for the process.

Need help reporting on your PRF? Contact Aprio today for assistance.

The full story:

The U.S. Department of Health and Human Services (HHS) released additional Provider Relief Fund (PRF) guidance via a Post-Payment Notice of Reporting Requirements, dated June 11, 2021. Providers have sought additional clarity regarding looming reporting requirements. The most recent notice provides:

- Deadlines to use PRF

- Reporting time periods for using the funds

- Responsibilities for reporting

- Steps for reporting on fund usage

Key dates and deadlines providers should know

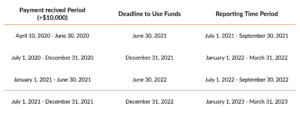

The below chart summarizes reporting requirements based on the date providers received PRF payments. PRF recipients are required to submit a report for each period they have received a payment, based on this timeline.

The HHS has not provided a date for when the reporting portal will open — only reporting deadlines.

Reporting requirements

In the notice, the HHS also includes clarification regarding entities’ responsibilities for reporting. Generally, recipients of payments of $10,000 or more will each have their own reporting requirements. However, parent entities with subsidiaries can report on behalf of their subsidiaries if they received General Distribution PRF under their billing TINs and are associated with providers that were responding to or preventing possible cases of COVID-19.

Note that this treatment does not apply to subsidiaries that received Targeted Distribution PRF; in those cases, subsidiaries will be the reporting entity for purposes of Targeted Distribution PRF.

Providers will be expected to report their PRF usage in a manner that is consistent with their method of accounting (cash or accrual). The new Post-Payment Notice indicates that PRF reporting will occur in the following order:

1. Interest earned on PRF payments

2. Other assistance received

3. Net unreimbursed expenses attributable to the coronavirus

4. Lost revenues reimbursement

In terms of timing, providers that are reporting expenses attributable to the virus must do so by quarter. For recipients of skilled nursing facility (SNF) and Nursing Home Infection Control Distribution Payments, these amounts must be reported prior to the use of General or other Targeted Distribution Payments.

Final note: unused PRF

The process for returning unused PRF is not included in the Post-Payment Notice. The HHS has updated their FAQ to indicate that when the first reporting period begins, providers will be able to return unused funds via their reporting portal.

The bottom line

While long-awaited guidance from the HHS has arrived, providers now need to consider reporting requirements based on when they received PRF. We anticipate that the HHS will release additional information in the upcoming months regarding the usage of PRF, as well as audit requirements for certain recipients of PRF and other forms of government assistance in excess of $750,000.

Related Resources

- The Key Reporting Changes Provider Relief Fund Recipients Should Know for 2021

- CARES Act Reporting Requirements for Provider Relief Funds

- HHS Releases Reporting Requirements for Provider Relief Fund Recipients

For more clarification on this guidance and assistance with navigating it, reach out to an Aprio advisor today. We’re here to help you prepare for what’s next.

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.