What Are the Most Common Asset Misappropriation Schemes and Who Are Conducting Them?

March 20, 2025

At a glance

- The main takeaway: Looking out for behavioral patterns and red flags in your organization can help identify potential fraud risks early on.

- Impact on you: Asset misappropriation can result in grave financial losses and reputational damage to your business.

- Next steps: Aprio’s Forensic Services team has the deep industry experience and training to support businesses in the most challenging disputes and fraud cases. Get in touch with us today.

Schedule a consultation

The full story:

Asset misappropriation is a form of fraud that involves the theft or misuse of an organization’s assets by an employee or other individuals who have access to them. This type of financial crime occurs when someone intentionally takes or uses company resources—such as cash, inventory, or property—for personal gain, often without the knowledge or consent of the organization. It is also often difficult to detect, especially if the person involved holds a managerial position. Asset misappropriation can include stealing physical assets, using company assets for personal purposes, and more.

The Most Common Types of Asset Misappropriation Schemes

According to the ACFE’s 2024 Report to the Nations, the following asset misappropriation schemes pose the greatest overall risk to organizations:

- Check and payment tampering: An employee may write fraudulent checks for personal use or to divert funds. They might forge signatures or alter the payee information on company checks.

- Billing scheme: A fraudulent disbursement scheme in which an employee causes their employer to issue a payment by submitting invoices for fictitious goods or services, inflated invoices, or invoices for personal purchases.

- Theft of noncash assets: The act of stealing or misappropriating physical assets, property, or resources that are not cash but still hold value. In other words, tangible and intangible items that a company uses in its operations but are illiquid. These assets could be anything from equipment, inventory, raw materials, office supplies, and even intellectual property.

Other Common Types of Asset Misappropriation Schemes

- Payroll fraud: An employee manipulates the payroll system. Some common scenarios include adding “ghost employees” or non-existent people to the payroll, inflating hours worked, or taking excessive overtime pay.

- Expense reimbursement fraud: Employees may submit false or inflated expense reports for reimbursement, including but not limited to submitting personal expenses as business expenses or claiming expenses that were never incurred.

- Inventory theft: Employees may steal physical goods, inventory, or materials from the company for personal use or resale. This is most common in retail and manufacturing sectors.

- Lapping: An employee steals money from one customer’s payment and uses the next customer’s payment to cover the theft. It often involves a complex web of transactions to cover up the original theft.

- Falsification of financial records: Employees might alter financial statements or records to conceal the theft or misappropriation of assets, such as inflating revenues, understating expenses, or omitting transactions.

- Skimming: This is the act of stealing cash before it is entered into the company’s accounting system. For example, an employee working in a cash-handling position might pocket a portion of the cash they received from customers.

- Vendor fraud: Employees may collude with vendors to overcharge for goods and/or services or divert payments to fictitious vendors they control. They may create fake invoices and approve them for payment.

- Misuse of company credit cards: Employees might use company-issued credit cards for personal purchases, misrepresenting them as legitimate business expenses.

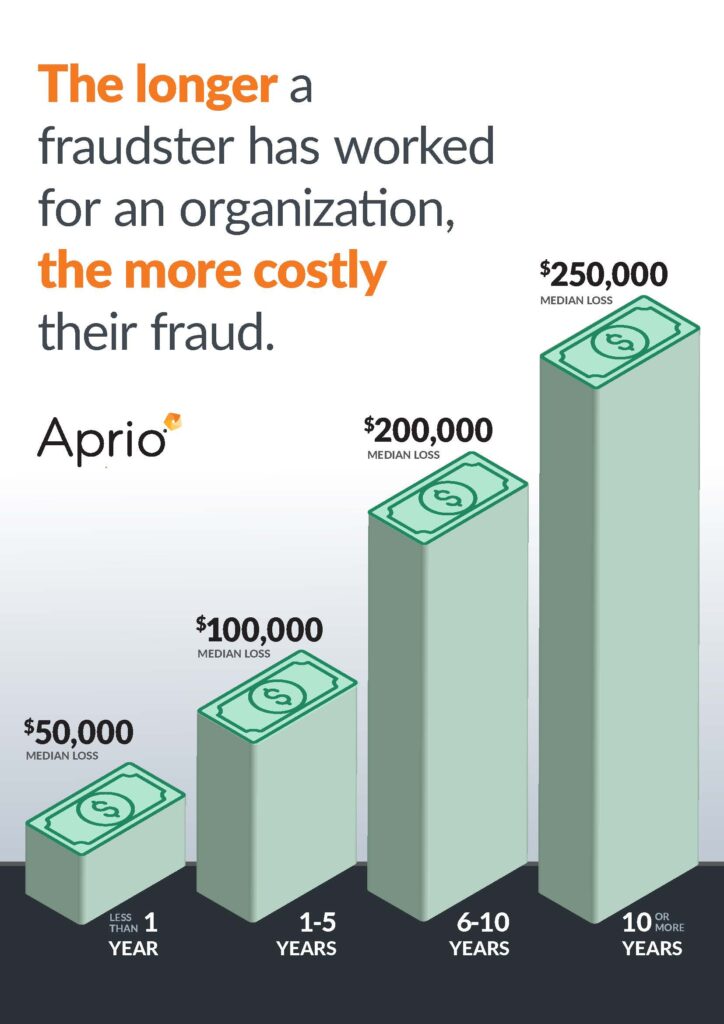

Duration of Fraud Schemes: How Much Do They Cost?

The median duration of occupational frauds is approximately one year, according to data from the ACFE report. The longer the fraud continues, the more it costs the victim. The ACFE found that fraud caught within the first 6 months had a median loss of $30,000, compared to $250,000 for fraud that lasted between 2-3 years. Fraud cases that remain undetected for more than 5 years caused a median loss of $875,000.

Typical Perpetrators of Asset Misappropriation Cases

According to the 2024 ACFE report, more than half of all fraud cases came from employees in the following departments:

- Operations (14%),

- Accounting (12%),

- Sales (12%),

- Customer Service (9%), and

- Executive/Upper Management (9%).

While the above statistic refers to the median loss by the duration of fraud, it’s worth noting that the longer an employee has worked at the company, the more costly their fraud tends to be. According to the ACFE, this is due to a longer tenure employee usually having greater access to sensitive information, resources, and opportunities to manipulate systems.

Take a look at these interesting statistics:

Source: Occupational Fraud 2024: A Report to the Nations

Be Vigilant: Common Behavioral Red Flags of Fraud Perpetrators

A behavioral red flag of fraud refers to a noticeable change in an employee’s behavior or actions that might signal they are involved in fraudulent activity. The ACFE report revealed that 84% of fraudsters displayed at least one behavioral red flag.

Red flags can be indicators that your employee is trying to cover up suspicious behavior or is under financial pressure that could lead to fraudulent actions. As an employer, it can be wise to look out for employees exhibiting the following:

- Living beyond their means: Employees who suddenly start spending noticeably more than their salary or lifestyle could be a sign of fraud, especially if they are trying to keep up appearances.

- Unexplained financial difficulties: If an employee is facing personal financial problems, it might increase the likelihood of them committing fraud to help alleviate those issues.

- Reluctance to take vacations: Employees who avoid taking time off or refuse to allow others to take over their responsibilities could be trying to hide fraudulent activity that would be exposed in their absence.

- Excessive secrecy or defensiveness: Employees who become unusually secretive about their work, or are defensive when questioned, may be trying to hide their actions or cover up irregularities.

- Changes in work habits: An employee who starts working long hours or frequently stays late without explanation, especially in a role that doesn’t usually require overtime, might be attempting to cover up fraudulent activities.

- Overly controlling behavior: If an employee starts showing excessive control over processes or refuses to allow others to review or audit their work, it could indicate they’re hiding something.

- Mood changes or stress: Unusual mood swings, irritability, or increased stress may signal an employee is dealing with the pressure of covering up fraudulent activity.

- Sudden lack of accountability: If an employee becomes less willing to explain their actions or the rationale behind their decisions, it could be a sign they are hiding something.

These red flags alone don’t prove fraud, but when combined with other suspicious circumstances, they can become barometers whether further investigation is warranted. Keeping an eye out for patterns of behavior over time can help identify potential fraud risks early.

The bottom line

At Aprio, our Forensic Services team members have the experience, knowledge, and training to support businesses in the most challenging disputes and fraud cases. We deliver proven computer forensics, collections, interviewing, forensic document analysis, and investigative techniques to assist with determining the extent of alleged wrongful acts for internal matters. Don’t hesitate to schedule a consultation with us today.

Related Resources/Assets/Aprio.com articles/pages

Recent Articles

About the Author

Haley Beatty

Haley Beatty is a forensic accounting and financial crime reporting expert. Her specialties include white-collar crime investigations, fraud detection, and anti-money laundering (AML) and know your client (KYC) investigations, and regulatory compliance. Haley has advised some of the world’s largest financial institutions and has led teams of up to 500 investigators. She works closely with clients to establish and advance AML compliance, monitoring, and reporting programs that exceed regulatory requirements. Haley has experience advising a broad spectrum of financial industry clients, from FinTech companies to MSBs and transaction processors.

(470) 567-5230

Cristina Hazelwood

As a manager and consultant in Aprio’s Forensics Services practice, Cristina Hazelwood specializes in quantifying damages in fraud investigations and litigation disputes. Cristina has helped manage and delegate work in multi-million-dollar cases. She has extensive experience dealing with a wide range of financial crimes consulting matters, including asset misappropriation investigations and anti-money laundering (AML) transaction lookback reviews.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.