Income Tax and Estate Planning

Aprio has been helping high-net-worth individuals and families preserve, transfer and grow generational wealth since 1952.

Aprio’s coordinated white-glove approach simplifies effective income and estate tax planning for wealthy individuals. Discover a better income and estate tax planning experience.

Chris Davis

Partner-in-Charge, Aprio Private Client Tax Services

Aprio Advisory Group, LLC

Aprio delivers income and estate tax planning results

At Aprio, we focus on outcomes because the preservation of wealth and advancement of legacy are predicated on delivering value through results.

Aprio’s contextual advisory services coordinate family income and estate tax planning and leverage the use of family entities, trusts, family gifts, private charitable vehicles and other techniques designed to protect and maximize generational wealth.

Top Reasons Families Choose Aprio to Preserve and Maximize Generational Wealth

Aprio has been helping high-net-worth individuals and families preserve, transfer and grow generational wealth since 1952.

Aprio’s coordinated white-glove approach simplifies effective income and estate tax planning for wealthy individuals. Discover a better income and estate tax planning experience.

Contextual income and estate tax planning = confidence

Managing multiple sources of income, addressing the interests of family members and future generations, and navigating the shifting tax legislation all require long-term strategic planning and the coordination of expert advisors.

Aprio’s coordinated Private Client approach to income and estate tax planning and financial and investment advisory provides contextual advice that takes every aspect of your financial landscape into consideration.

Aprio delivers the service and insights you need to make important financial decisions with confidence.

Preserve your legacy through gift and estate planning

Transferring your wealth is one of the most satisfying ways to ensure that your heirs flourish for decades to come. However, outcomes can fall short of your intended goals without intelligent estate and gift tax planning.

- How much can you afford to give your children and safeguard principle and ensure your comfort?

- Does your current estate plan take full advantage of lifetime estate and gift tax exemptions?

- Are you utilizing the generation-skipping tax exemption to maximize multigenerational wealth transfers?

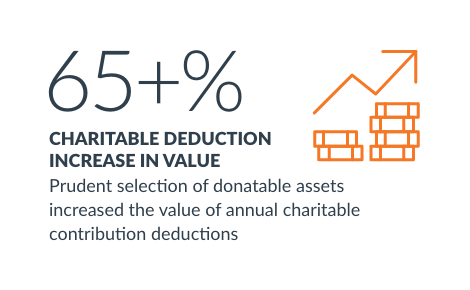

Maximize philanthropy and charitable donations

Aprio's advisors can help you design a philanthropic giving strategy that aligns with your family's charitable intent, ensuring that your family legacy is preserved and managed to grow over time.

- Define the right types of assets to donate to maximize tax benefits and social impact.

- Analyze the impact of giving to public charities versus creating a private family foundation.

Individual and Family Tax

RESOURCES

Articles & Downloadable Material

Videos

Currently there are no videos for this topic. Please check back soon.

Solutions

Aprio can help your family thrive.

Discover a better tax and estate planning experience.