IRS Aims to Expose Cryptocurrency-related Income with New Question on Form 1040

December 2, 2019

Earlier this month, the IRS released the first guidance in five years on the taxability for virtual currency transactions, including the Revenue Ruling 2019-24 and a FAQ document that both aimed to support and clarify the IRS’s position on how virtual currency should be treated for federal tax purposes. These two releases provided valuable insight into the IRS’s position on how and when cryptocurrency generates taxable income, but the announcements didn’t stop there. Days later, the IRS proposed a new compliance measure to coincide with taxpayers’ new responsibility for crypto-related income.

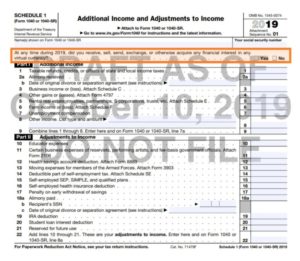

On Friday, October 11, the IRS circulated a new draft of the Form 1040, Schedule 1, Additional Income and Adjustments to Income, which included a notable new checkbox asking:

At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?

The new checkbox is located at the very top of the form and requires taxpayers to respond only if they have crypto-related income to report or if they are already filing Schedule 1 for another purpose.

But while the question is new, the wording is not. In fact, the proposed new compliance measure closely mirrors the IRS’s tactics for identifying taxpayers with income in offshore accounts. Compare the new cryptocurrency checkbox above to the question that appears at the bottom of Schedule B, Part III:

At any time during 2018, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign country?

The similarities in the phrasing of these questions suggest that the IRS might be deploying a compliance-based tactic to spotlight crypto-related income simply by introducing greater accountability for taxpayers’ requirement to disclose virtual currency transactions that generated income. In many ways, this strategy is comparable to the devices the IRS previously developed to track down undeclared income in offshore accounts.

The placement of the new checkbox on Form 1040 is especially questionable and concerning for many tax preparers and tax software companies. Although taxpayers who already do not file Schedule 1 for any other purpose will not need to file Schedule 1 if they do not have crypto-related income to report, the new question might be relevant to taxpayers who would otherwise have no reason to file Schedule 1. And without any other reason to file Schedule 1, the likelihood of overlooking this question increases drastically.

With this in mind, it is possible to interpret the location of the new compliance measure as a targeted effort to hold taxpayers accountable for any failure to report their crypto-related income, even when accidental, rather than simply as a reminder to report their cryptocurrency transactions. Since past legal precedents support that the intentional failure to disclose offshore income is a criminal offense, then it’s likely they will use the cryptocurrency compliance measure to a similar effect, especially in regards to the levying of penalties if the box is overlooked accidentally. As Robert Verzi, Partner, Aprio International Services, explains, the inclusion of this question, and especially it’s location on Form 1040, could provide the IRS with significant ammunition to pursue taxpayers who fail to disclose income generated from cryptocurrency transactions. For instance, if a taxpayer failed to check the new cryptocurrency-related box, the IRS could claim the taxpayer did not file a complete return or interpret the failure as a willful nondisclosure.

Nonetheless, the circulated draft of the new Form is still an early version and has not been released in its final form. In fact, the IRS has not yet released a draft of new instructions to accompany the form, so their approach to highlighting crypto-related income is still highly subject to change. The IRS will be accepting comments via email for a 30-day period that began October 11 in an effort to gather feedback on the new inclusion, and while historical patterns would suggest that this new draft is likely to become the final form for 2019 filings, it is still possible that enough backlash against the location of the question might motivate the IRS to explore alternative options. As has been the case since the first arrival of virtual currencies in the market, the IRS’s approach to determining taxability and instituting compliance measures is still in flux and ever-changing.

If you have questions about your tax liability as it relates to cryptocurrency transactions, Aprio is prepared and equipped to assist. We have been pioneers in the intersection of virtual currencies and tax liability since 2013 and remain at the forefront of the topic as the IRS continues to clarify their stance. Contact Mitchell Kopelman for more information at mitchell.kopelman@aprio.com.

Recent Articles

About the Author

Mitchell Kopelman

National Leader in Aprio’s Technology Practice, and Tax Partner, Mitchell works with SaaS companies in FinTech, HealthTech, Transaction Processing, Blockchain and Gaming. Whether a company is pre-revenue, starting up, growing, or preparing for a liquidity event, Mitchell works with them to maximize their potential at each stage. He is known for promoting research, innovation and entrepreneurship by enabling companies to be successful, regardless of where they are in their business lifecycle.

(404) 898-8231

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.