Here’s an Easier Way to Understand Your ERC Eligibility

April 28, 2021

At a Glance:

- THE MAIN TAKEAWAY: The Consolidated Appropriations Act provided millions more businesses the opportunity to be eligible for the Employee Retention Credit (ERC).

- IMPACT ON YOUR BUSINESS: Sifting through the complex jargon can be difficult, especially if there are significant changes that have happened in your business due to the pandemic.

- NEXT STEPS: To assess your eligibility, there are some basic concepts that you need to know, which we’ve outlined below.

Need professional help assessing your ERC eligibility? Contact Aprio’s expert ERC team to find out if you qualify.

The full story:

If you’ve kept a pulse on the federal stimulus programs and the changes surrounding their guidelines, then you may already know that the Consolidated Appropriations Act, which was passed at the end of last year, made several changes to the Employee Retention Credit (ERC) — changes that may make millions of new businesses eligible to reap the benefits of the program.

Are you wondering if you qualify for the ERC? To assess your eligibility, there are some basic concepts you need to know.

Key considerations and terms to help you understand the ERC

First, you should understand what percentage of your qualified wages is used for calculating the credit; for 2020, that is 50% of up to $5,000 per employee, and for 2021, that is 70% of up to $10,000 per employee per quarter. The maximum credit per employee is up to $33,000, or $5,000 for 2020 and $7,000 per quarter in 2021.

It’s also necessary to understand how qualified wages are determined under the ERC guidelines. In 2020, qualified wages include wages paid between March 13, 2020, and December 31, 2020. In 2021, qualified wages include wages paid between January 1, 2021, and December 31, 2021. Remember that you cannot “double dip,” or use the same wages toward both the ERC and forgiveness of your Paycheck Protection Program (PPP) loan or other programs, such as the Families First Coronavirus Response Act or R&D tax credits.

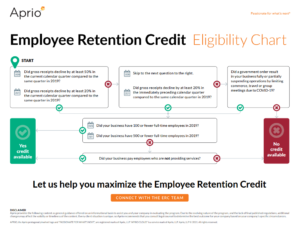

An easier way to understand your ERC eligibility

In the basic flow charts below, we’ve outlined a few key questions to help you determine eligibility for the ERC, which you must assess by quarter:

- Defining a qualifying quarter: This is when a business experienced either (1) a full or partial suspension on operations due to government shutdowns that had more than a nominal impact or (2) a significant decline in gross receipts.

- Defining government shutdowns: This is defined as orders, proclamations or decrees from the federal government or a state or local government limiting commerce, travel or group meetings due to COVID-19. An example of this scenario is a government stating that all nonessential businesses must close for a period or require residents to stay home unless they work for an essential business. But essential businesses can be eligible, too! The IRS has also put together an FAQ document that will help you better understand the definition.

- Defining a significant decline in gross receipts: This is evaluated by calendar quarter compared to the same quarter in 2019. When evaluating 2020, a significant decline occurs when receipts dropped by at least 50%. This threshold was lowered for 2021, where a significant decline in gross receipts is a reduction of at least 20%. Each quarter is evaluated separately. Alternatively, you can satisfy the “gross receipts test” by looking at your gross receipts in the immediately-preceding calendar quarter; for instance, for Q1 2021, you can use Q4 2020 and compare it to Q4 2019.

- Defining business receipts: These are gross receipts (after returns and allowances) and interest, dividends, rents and royalties (and any gains on the sale of assets). Gross receipts are generally not reduced by cost of goods sold, but are generally reduced by the taxpayer’s adjusted basis in capital assets sold.

- Business operating periods: If your business didn’t operate for all or any of 2019, alternative calculations to determine a significant decline in gross receipts are permitted.

- Defining the eligible number of employees: The number of employees equals the aggregate number of full-time employees of all/any affiliated companies with more than 50% common ownership. A full-time employee is calculated based on the regulations provided for by the Affordable Care Act, which defines a full-time employee as an employee providing services for 30 hours per week, or 130 hours per month. The calculation is performed monthly and then, in most cases, divided by 12 to determine the average for 2019.

The bottom line

Once you better understand your ERC eligibility, you can take the necessary steps to file for the credit and obtain more support to help your business grow through 2021 and navigate the COVID-19 pandemic. At Aprio, we are proud to have a nationally recognized team of experts that has a deep understanding of the ERC guidelines and can help you navigate the filing process to achieve the best outcomes for your business.

If you have questions about the flow chart above or would like to discuss your situation in greater detail with our team, contact us today.

Disclaimer for services provided relative to SBA programs and the CARES Act

Aprio’s goal is to provide the most up to date information, along with our insights and current understanding of these programs and regulations to help you navigate your business response to COVID-19.

The rules regarding SBA programs are constantly being refined and clarified by the SBA and other agencies In certain instances, the guidance being provided by the agencies and/or the financial institutions is in direct conflict with other competing guidance, regulations and/or existing laws.

Due to the evolving nature of the situation and the lack of final published rules, Aprio cannot guarantee that additional changes or updates won’t be needed or forthcoming and the original advice given by Aprio may be affected by the evolving nature of the situation.

You need to evaluate and draw your own conclusions and determine your Company’s best approach relative to participation within these programs based on your Company’s specific circumstances, cash flow forecast and business strategy.

In situations where resources are provided by third parties, those services should be covered under a separate agreement directly with that service provider. Aprio is not responsible for the actions of any other third party.

Aprio encourages you to contact your legal counsel to address the legal implications of the impact of the CARES Act and specifically your participation in any of the SBA programs.

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.