Employee Retention Credit: Are U.S.-based Subsidiaries of International Companies Eligible?

June 29, 2021

At a glance:

- The main takeaway: With changes passed under the Consolidated Appropriations Act, more businesses are eligible for the Employee Retention Credit, potentially those that are U.S.-based subsidiaries of international companies.

- Impact on your business: To assess your eligibility, you need to have a solid understanding of the controlled group rules, which can help you identify eligible employees for the ERC.

- Next steps: Need professional help assessing your ERC eligibility?

Contact Aprio to find out if you qualify.

The full story:

At the end of 2020, the Consolidated Appropriations Act introduced several changes to the Employee Retention Credit (ERC), making many new businesses eligible to reap the benefits of the program. And if your business is a U.S.-based subsidiary of an international company, you might be wondering if you’re one of them.

Here are a few important details you need to know.

How to interpret your ERC eligibility for your U.S.-based Subsidiary

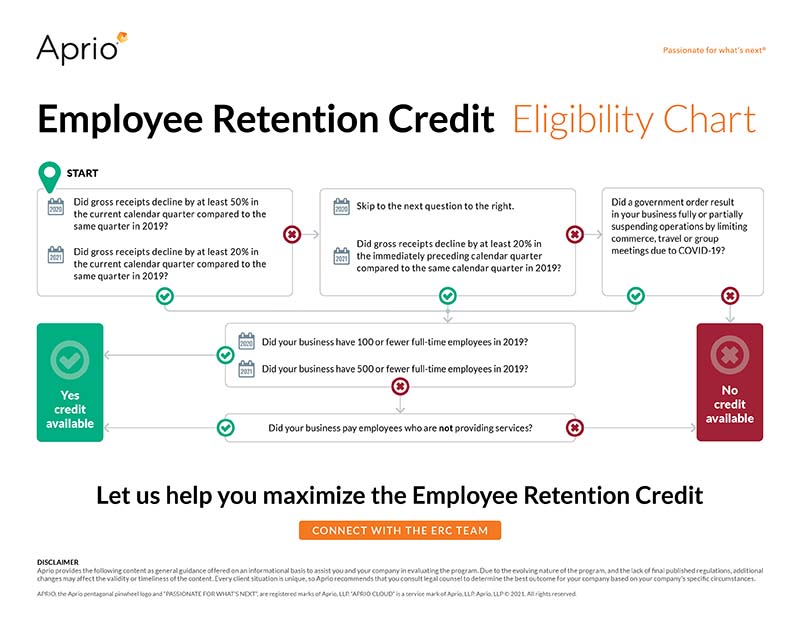

In the flow chart below, we’ve outlined a few key questions to help you determine your U.S.-based subsidiary’s eligibility for the ERC, which you must assess by quarter:

One of the ERC’s key qualification criteria is employer size; specifically, it affects how you will calculate the amount of your credit. To understand your ERC eligibility when it comes to employer size, it’s important to understand the “controlled group rules,” which come with their own set of definitions:

- Parent-subsidiary controlled group: This definition applies to businesses that are members of a parent-subsidiary group in which the parent owns more than half (50%) of the voting power or value of the business.

- Brother-sister controlled group: This definition applies to five or less individuals, trusts and estates that own more than half (50%) of the combined voting power or the stock value of each company.

- Combined group: This definition applies to more than three corporations which are each a member of a parent-subsidiary group or a brother-sister group, and at least one is both the common parent corporation of the parent-subsidiary group and a member of the brother-sister group.

The controlled group rules require all companies to be treated as a single employer if they meet one or more of the criteria above.

International entities are excluded from consideration in the aggregation rules applicable to the ERC and they are also excluded from calculations of 2019 full-time employees. There has been some debate over the correct method for classifying and counting full-time employees when evaluating large or small employer status. It’s important for businesses to use the right methods for calculating employee count so that they aren’t leaving money on the table. Check out this article to learn more.

Key terms to help you understand the ERC

If you do find that your subsidiary business can apply for the ERC, there are some important definitions you need to understand to confirm your official eligibility:

- Defining a qualifying quarter: This is when a business experienced either: (1) a full or partial suspension on operations due to government shutdowns that had more than a nominal impact or (2) a significant decline in gross receipts.

- Defining government shutdowns: This is defined as orders, proclamations or decrees from the federal government or a state or local government limiting commerce, travel or group meetings due to COVID-19. An example of this scenario is a government stating that all nonessential businesses must close for a period or require residents to stay home unless they work for an essential business. But essential businesses can be eligible, too! The IRS has also put together an FAQ document that will help you better understand the definition.

- Defining a significant decline in gross receipts: This is evaluated by calendar quarter compared to the same quarter in 2019. When evaluating 2020, a significant decline occurs when receipts dropped by at least 50%. This threshold was lowered for 2021, where a significant decline in gross receipts is a reduction of at least 20%. Each quarter is evaluated separately. Alternatively, you can satisfy the “gross receipts test” by looking at your gross receipts in the immediately-preceding calendar quarter; for instance, for Q1 2021, you can use Q4 2020 and compare it to Q4 2019.

- Defining business receipts: These are gross receipts (after returns and allowances) and interest, dividends, rents and royalties (and any gains on the sale of assets). Gross receipts are generally not reduced by the cost of goods sold, but they are generally reduced by the taxpayer’s adjusted basis in capital assets sold.

- Business operating periods: If your business didn’t operate for all or any of 2019, alternative calculations to determine a significant decline in gross receipts are permitted.

The bottom line

At Aprio, we are proud to have a nationally recognized team of experts that has a deep understanding of the ERC guidelines and can help you navigate the filing process to achieve the best outcomes for your business. Beyond our ERC team, we also have a renowned International practice that specializes in helping businesses like yours, ones that have complex circumstances that require nuanced expertise.

If you have questions about the flow chart above or would like to discuss your situation in greater detail with our team, contact us today.

Related Resources

Recent Articles

About the Author

Yelena Epova

Yelena is the partner-in-charge of Aprio’s International Services practice. She specializes in advising domestic and international companies on international tax issues and tax planning strategies regarding inbound and outbound operations. She also assists clients with domestic tax issues by providing tax planning and compliance services.

(404) 898-7431

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.