Cost Account Standards Decoded: A Contractor’s Guide to CAS Compliance

September 12, 2023

At a glance

- Cost Accounting Standards (CAS) are codified laws found in 48 CFR Part 9903 – 9905 and comprise a set of nineteen (19) standards that ensure fairness and transparency in Government contracts by enforcing consistent cost accounting practices.

- CAS encompasses Full and Modified coverage, with the latter requiring a subset of CAS requirements aimed at lessening a contractor’s administrative burden.

- Benefits of CAS compliance include unbiased cost allocation, standardized cost data and uniformity for fair competition.

Aprio helps Government contractors comply with cost account standards (CAS), maintain eligibility for Government contracts and ensure accurate and reliable financial reporting. Connect with our dedicated Government Contract Compliance team today for help with your CAS compliance needs.

The full story

What are Cost Accounting Standards?

Cost Accounting Standards (CAS) are a set of nineteen (19) standards passed into law by Congress in the 1970s to ensure consistency, fairness, and transparency in how contractors price and allocate costs when doing business with the Government. These standards help to establish uniformity in cost accounting practices, which is important for ensuring that government contracts are awarded and executed fairly and efficiently.

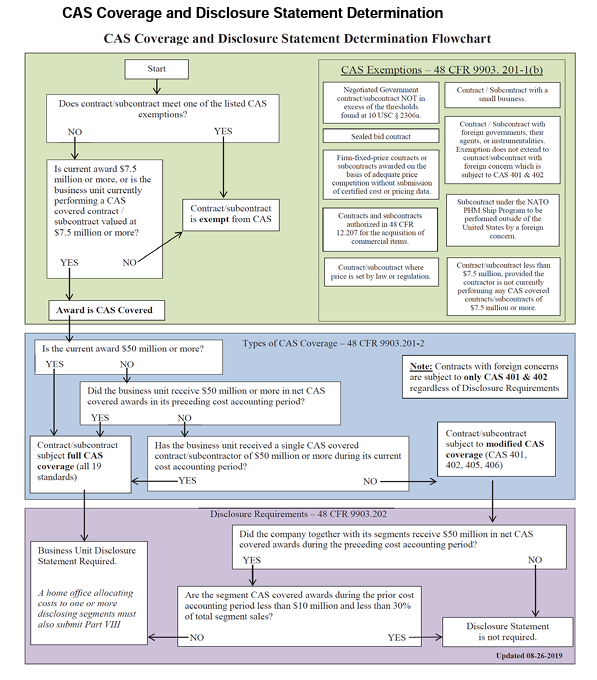

CAS applies to contracts and subcontracts awarded to contractors when certain criteria are met. When a contract or project falls under Full CAS Coverage, all applicable Cost Accounting Standards must be followed. However, not all contracts are subject to the full range of CAS requirements. Modified Coverage comes into play when a contractor is subject to some but not all of the CAS requirements.

Under Modified Coverage, a contractor is required to comply with a subset of CAS requirements (CAS 401, 402, 405, and 406) rather than the complete set. This subset is determined based on the type and size of the contract, as well as the contractor’s previous compliance history. This approach is intended to reduce the administrative burden on smaller contractors or on contracts where the potential impact of full CAS compliance might not justify the cost.

Why should Government contractors follow CAS?

CAS mandates that contractors follow specific accounting practices and procedures in areas such as cost allocation, measurement, accumulation, and assignment. The main objectives of CAS are to:

- Prevent cost misallocation: CAS Full Coverage ensures that costs are allocated to the appropriate cost objectives (such as contracts or tasks) based on standardized methods, preventing bias or manipulation.

- Enhance consistency: By following consistent accounting practices across different contractors and contracts, CAS Full Coverage promotes comparability and transparency in cost reporting.

- Improve contract management: Government agencies benefit from standardized cost data, which aids in evaluating contract performance, making informed decisions, and negotiating future contracts.

- Minimize cost disputes: Since CAS establishes clear guidelines for cost allocation, it reduces the likelihood of disputes between contractors and government agencies regarding cost reimbursement.

- Ensure fair competition: Uniform cost accounting practices help minimize cost manipulation by fostering a level playing field for contractors bidding on government contracts.

What do Cost Accounting Standards cover?

The Cost Accounting Standards (CAS) are managed by the Cost Accounting Standards Board (CASB), which operates under the Office of Federal Procurement Policy within the U.S. Office of Management and Budget (OMB). The CASB is responsible for developing, issuing, and amending cost accounting standards as needed.

The CAS generally covers various aspects of cost accounting, including:

- Consistency in Cost Accounting Practices: CAS requires contractors to use consistent accounting methods across different cost objectives (contracts, projects, etc.) to ensure uniformity and comparability.

- Allocation of Costs: CAS provides guidelines for allocating costs to different cost objectives based on their causal or beneficial relationships. This ensures that costs are distributed appropriately and not double-counted.

- Measurement of Costs: CAS defines how certain costs should be measured, including direct costs, indirect costs, and unallowable costs.

- Cost Accounting Practice Changes: CAPS outlines procedures for making changes to cost accounting practices, ensuring that changes are properly documented and disclosed to the Government.

- Disclosure Statements: Contractors must maintain current Disclosure Statements detailing their cost accounting practices with the Government. These statements help the Government assess the contractor’s compliance with CAS.

- Reporting Requirements: CAS prescribes reporting formats and requirements for disclosing cost information to the Government.

Determining Full vs. Modified Coverage Status and Need for Disclosure

It’s important to know whether a contract is Full or Modified in regards to CAS, and whether or not you need to complete a Disclosure Statement.

The flowchart below can help determine if a contract or subcontract is subject to Full or Modified Coverage or falls under one of the exemptions.

A final word

Compliance with CAS is essential for government contractors to maintain government contract eligibility and ensure accurate and reliable financial reporting.

Non-compliance can result in various penalties, including the potential loss of contracts and the need to directly reimburse the Government for any overcharges resulting from non-compliant practices.

Related Resources/Assets/Aprio.com articles/pages

48 CFR Part 9904 — Cost Accounting Standards

FAR Part 30 – Cost Accounting Standards Administration

Aprio’s dedicated Government Contract Compliance team is here to help with your CAS compliance needs. Connect with us today to discuss your unique situation.

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.