Brace for Impact: Changes to R&D Deductions Begin This Year

May 31, 2022

At a glance

- The main takeaway: New requirements eliminating the ability to immediately deduct research and development (R&D) expenditures went into effect this year after every attempt to reverse the change failed.

- Impact on your business: Businesses that have historically benefitted from the favorable tax treatment of fully deducting research expenditures as incurred could be facing a much larger tax burden.

- Next Steps: Reach out to your Aprio advisor to start tax planning and register for Aprio’s upcoming webinar to dive further into the potential implications.

The full story:

The Tax Cuts and Jobs Act (TCJA) of 2017 may seem like ancient history, but some portions of the legislation are just beginning to come to fruition, including unfavorable changes to how taxpayers should treat their R&D costs (also referred to as research and experimentation (R&E) costs in the tax code).

Prior to January 1, 2022, Section 174 of the tax code enabled companies performing R&D to fully deduct the eligible costs from their taxable income in the year those costs were incurred, which created an incentive for companies to continue investing in research. When the TCJA passed, it established a provision that altered Section 174 to eliminate this immediate deduction and require companies to capitalize and amortize those costs over a 5-year period (15 years for foreign research), beginning January 1, 2022.

This change will potentially disincentivize companies’ investment in research efforts and could severely undercut the Research and Development (R&D) Tax Credit, the separate tax incentive that allows taxpayers to reduce their tax liability with a credit for qualifying R&D costs (which are defined and computed differently than R&D for purposes of financial accounting and reporting). Aside from a conforming amendment to Section 174, the law around the R&D Credit remains essentially unchanged, but the changes to Section 174 could affect how taxpayers benefit from the credit. Therefore, supporters and beneficiaries of the R&D Credit have continuously pursued strategies to reverse the change before it took effect. Unfortunately, since the Build Back Better Act met its final demise in 2021, along with several subsequent failed attempts to repeal or defer this change, companies are now forced to face the implications. Taxpayers’ most pressing concerns will be:

- Understanding the applicable expenses

- The new changes generally apply to any and all costs “incident” to research and development efforts. Until further guidance is provided by the Treasury, the term “incident” remains ambiguous in its interpretation. Therefore, the identification, justification, and documentation of these expenditures– as well as understanding the potential impacts of the 174 changes– may be difficult to identify without the help of a tax advisor.

- Domestic R&D expenses must be amortized over 5 years and foreign R&D expenditures over 15 years. However, companies must use the mid-year convention which only allows half a year of amortization in the first and final years, which means taxpayers are really amortizing these expenditures over 6 years for domestic activities and 16 years for foreign activities.

- All R&D expenditures must follow these amortization rules, even if those efforts are abandoned within the amortization period.

- Planning for impacts on your tax return

- To adhere to the new rules, taxpayers must carefully identify all Section 174 expenditures and distinguish these expenses from other categories, even those that were previously eligible for multiple types of tax treatment.

- Taxpayers must ensure that only the deductible portion of identified Section 174 expenditures are reflected in quarterly estimates, provision computations, and income tax returns, increasing the administrative burden.

- Companies with losses, including companies with net operating losses carried into 2022, will be severely impacted as these previously deductible expenditures can no longer be fully deducted from taxable income in the year they are incurred. Similarly, growth companies with significant investments in R&D and no taxable income may not have the cash budgeted to pay the income tax resulting from the Section 174 change.

- The associated impact on taxable income will have further-reaching implications on state and international tax issues, made more complicated by the fact that not all states will adopt the changes at the same time, if ever.

- Exploring effects on the R&D Tax Credit

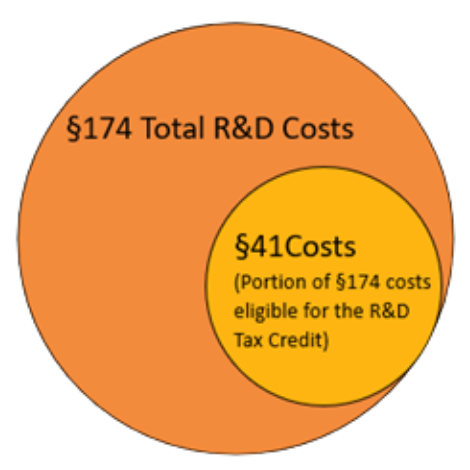

- All expenditures a company would count towards its R&D Tax Credit (e.g., wages, supplies, and contract research) are Section 174 costs, but not all Section 174 costs (e.g., depreciation, patent filing fees, overhead, etc.) qualify for the R&D Credit.

- Historically many companies claimed the R&D Credit on certain expenditures without separately categorizing those expenditures as Section 174 costs on their tax return or supporting schedules.

- For tax years beginning on or after January 1, 2022, companies will be required to include all costs claimed in their R&D credit with their other 174 costs subject to the new capitalization requirement.

- The potential implications are vast. Please register for Aprio’s upcoming webinar to explore the issues more thoroughly and understand the impact to your company.

The bottom line

After holding out hope for many years, many tax professionals now concede the change is highly unlikely to be reversed. Although a retroactive deferral is still possible, companies must begin preparing for the tax impact of this change.

Adhering to the new rules will require the careful assessment of a seasoned tax advisor that can analyze every aspect of your business and create the tax strategy that is most attuned to your needs, especially given the lack of clear guidance from the IRS and the far-reaching implications on other tax considerations and taxable income. If your company has historically reduced taxable income by sizeable R&D costs, this webinar will provide critical information pertinent to your potential tax impact.

Schedule a consultation today for help exploring the impact these changes will have on your business, and stay tuned for our next article diving into implications specific to the R&D Tax Credit.

Related resources

Recent Articles

About the Author

Carli Huband

Carli is the partner-in-charge of R&D Tax Credit Services at Aprio. Carli has dedicated the last five years to performing R&D Tax Credit studies for clients in a variety of industries, with a specialty in the manufacturing and technology industries. She has worked to prepare R&D Tax Credits for companies ranging from startups to Fortune 500 businesses, performing technical interviews with subject matter experts, calculating complex credits and preparing technical reports.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.