Is Preferred Equity Right for Your Deal?

August 19, 2019

As CRE Lending Tightens, Preferred Equity Makes a Comeback

Preferred equity is nothing new in commercial real estate, but we can expect the funding strategy to become more attractive in the coming months and into 2020. As we enter the final stages of the latest real estate expansion, preferred equity could help developers push deals across the finish line. If you intend to make preferred equity part of your capital stack, it’s important to know how it works and how it’s viewed by lenders.

Interest Limitations Don’t Apply to Preferred Equity Payments

With tax reform came certain limitations on how much interest expense can be deducted by companies. That makes preferred equity a more useful tool for developers looking for a less costly, less restrictive alternative to common stock and mezzanine financing. If structured properly, payments on preferred equity are not considered interest. Preferred equity payments don’t count against the interest expenses you could write off.

Using preferred equity, developers can raise money at a lower rate than traditional equity with a fixed return. While preferred equity functions like debt because of the way it’s organized, it’s considered equity for tax purposes — the best of both worlds.

How Preferred Equity Stacks Up to Debt and Common Equity

As capital from traditional sources becomes harder to come by or require higher returns, preferred equity helps developers bridge the capital gap in a more cost-effective manner.

Preferred equity sits between senior debt and common equity in the capital stack. It’s generally cheaper than common equity. As a result, it works to increase the returns on common equity. Preferred equity takes liquidation priority over common equity and may include recourse provisions in the case of default. In addition, some preferred equity arrangements include a share of the upside upon exit.

How Do Lenders View Preferred Equity

While conservative bank lending requirements are driving down the amount of debt you can get — and new tax laws make preferred equity more attractive — lenders are always on the lookout for subordinate investment vehicles.

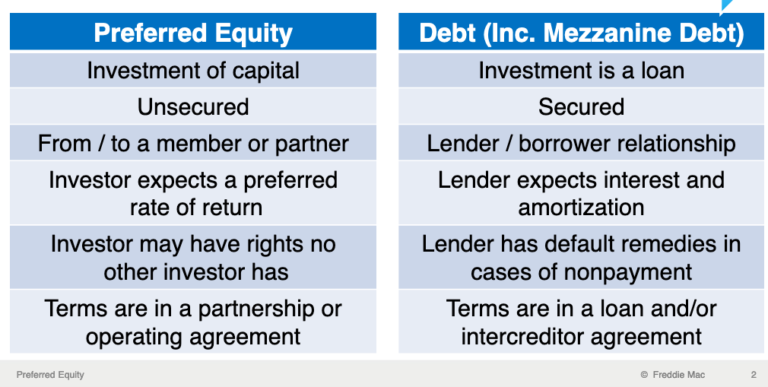

Source: Freddie Mac

In evaluating preferred equity from the lender’s perspective, one must consider hard vs. soft preferred equity. “Soft pay” preferred equity functions for all intents and purposes like common equity because returns are payable only out of net cash flow.

According to Freddie Mac, “hard pay” preferred equity has at least one of the following attributes:

- The preferred return must be paid even if there is insufficient net cash flow, with no provision for forgiveness or accrual

- A set redemption date (unless more than 1 year after loan maturity)

- The right to exercise a controlled takeover based on the property’s inability to meet quantifiable performance measures such as occupancy or DSCR

- Investor may require a forced sale if the preferred return or the preferred contribution is not paid

While preferred equity investments are considered equity for tax purposes, they should be reviewed by your legal advisor for advice on how to structure equity arrangements as part of an overall deal package with your lender.

Want to learn more? Contact Alan Vaughn at alan.vaughn@aprio.com or 404-898-8233.

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.