Got Crypto? The IRS Doubles Down on Cryptocurrency Income

October 9, 2020

In 2019, the IRS initiated a new crackdown on virtual currencies and tax compliance. First, the IRS released new guidance on the taxability of virtual currency – the first in five years. They followed that guidance with the introduction of a new compliance measure included on the Form 1040, Schedule 1 for Additional Income and Adjustments to Income.

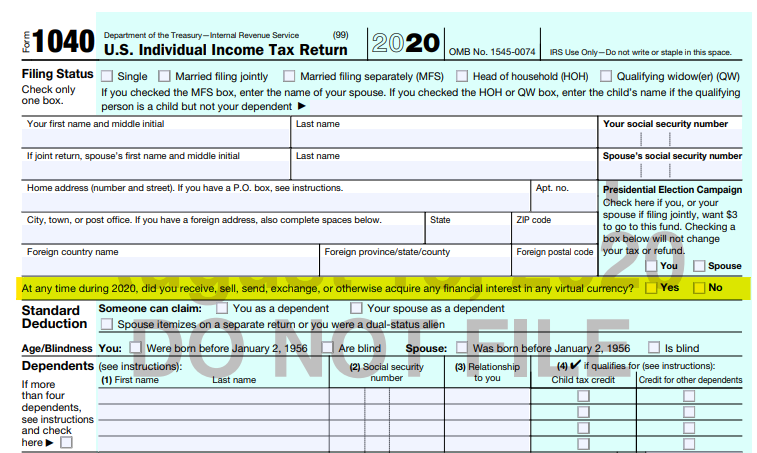

Then, on August 18, 2020, the IRS released the newest Draft Form 1040 for 2020 Individual Income Tax Returns, moving that new question front-and-center for all individual taxpayers to respond (as pictured below).

“Got crypto” question now up-front-and-center

When the IRS first introduced the Draft Form 1040, Schedule 1 in 2019 that included the new reporting mechanism for crypto-related income, Aprio wrote about this schedule, which is not used by every taxpayer.

The IRS is seemingly strengthening their position by making the question about receiving, selling, sending, exchanging, or otherwise acquiring virtual currency mandatory on 2020 returns for all individual taxpayers – highlighting the question for all taxpayers to address.

The IRS continues to send warning letters to taxpayers for a failure to accurately report income related to virtual currency. If you receive one of these letters, or if you have not properly reported your virtual currency transactions in the past, please contact your Aprio tax advisor.

The bottom line

If you receive, buy, sell, or use virtual currencies, the IRS wants to know – and they’re seeking more information than ever before. It is critical to work with a knowledgeable advisor to understand your tax burdens related to crypto-related investments.

Aprio has remained a pioneer in the intersection of virtual currencies and tax liabilities since 2013, and we are equipped to help you stay ahead of all the potential changes from the IRS. Contact Mitchell Kopelman for more information.

Recent Articles

About the Author

Mitchell Kopelman

National Leader in Aprio’s Technology Practice, and Tax Partner, Mitchell works with SaaS companies in FinTech, HealthTech, Transaction Processing, Blockchain and Gaming. Whether a company is pre-revenue, starting up, growing, or preparing for a liquidity event, Mitchell works with them to maximize their potential at each stage. He is known for promoting research, innovation and entrepreneurship by enabling companies to be successful, regardless of where they are in their business lifecycle.

(404) 898-8231

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.