How to Reduce or Eliminate Capital Gains Tax on the Sale of Real Estate

November 15, 2024

At a glance

- For individual homeowners: When an individual (or married couple) sells their personal residence for more than the original purchase price (plus improvements), they could be subject to capital gains tax, however, homeowners may qualify for a special gain exclusion.

- Impact on investment property: Individual or entity owners of investment real estate property may be able to defer or avoid capital gains tax on their property by using a technique known as a Section 1031 Like-Kind Exchange.

- Next steps: Aprio’s Real Estate team identifies issues surrounding the property, provides alternative solutions other than just a straight sale, and offers long-term planning.

Schedule a consultation

The full story:

A long-term capital gain occurs when a qualifying property is held at least for one year plus a day. There is a special preferred capital gains rate to encourage long-term real estate investment. Individuals will generally incur a 20% capital gains tax rate, although lower rates can apply based upon your overall income.

When people hold buildings (such as commercial buildings), the depreciation they take on that property when they sell it in the future may trigger capital gains. Real estate gets a tax benefit on depreciation recapture at a lower rate of 25%; anything over and above that amount for appreciation is taxed at the regular rate of 20%.

How do you calculate gain?

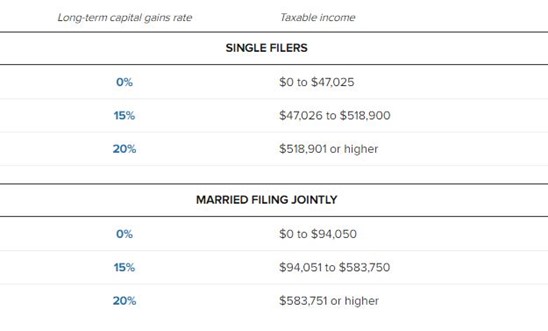

The answer: gain is simply proceeds less basis. Basis is the original cost of a property plus improvements less accumulated depreciation. When an individual sells their home for more than what they paid for, they could be subject to capital gains tax on their projected earnings. The capital gains tax is determined by three factors: an individual’s taxable income, their filing status, and how long they owned their property before they sold it. Here are the capital gains tax rates for 2024:

What is the capital gains tax inclusion for homeowners?

When someone sells their personal residence $500,000 of gain just off the top is excluded for married-filing-joint or $250,000 for single taxpayers. There are strategies that individuals can use to evaluate selling or renting their homes or converting them into business property to get a better rate — or they could engage in a 1031 exchange.

Who qualifies for the home sale capital gains tax exclusion?

According to the Internal Revenue Service (IRS), individuals may qualify to exclude up to $250,000 for single filers, and up to $500,000 for married couples filing jointly. Additionally, individuals may be eligible for the exclusion if they pass the two-year test. The two-year test states that individuals must have owned and used their home as their primary residence for at least 730 days (24 months) in the five years immediately preceding the closing date of their home’s sale. If the individual is part of a married couple, both spouses must have individually used the property for 24 out of the last 60 months to qualify for the full principal residence exclusion.

Should the individual fail to pass the two-year test due to unforeseen circumstances, they can apply for a partial exclusion. The percentage of the exclusion is directly proportional to the percentage of time you were in your home. For example, if the individual has lived in their home for only one out of the last five years, then they have met 50% of the use requirement and can qualify for 50% of the exclusion on gains: $125,000 for single filers and $250,000 for married filing jointly.

The Section 1031 real estate exchange

The Section 1031 real estate exchange allows owners of business real estate property — such as commercial real estate or multifamily properties like apartment buildings — to defer capital gains taxes if they reinvest the proceeds into other qualifying properties.

Planning and completing a 1031 exchange and avoiding a sale that would trigger capital gains taxes is one of the most significant overlooked tax strategies Additionally, this strategy can provide significant savings and opportunities for wealth accumulation over time, making it an essential consideration for savvy real estate investors looking to maximize their financial benefits.

The importance of proactive real estate planning

It is critical to start the real estate planning process as early as possible, well before retirement (which is when many individuals engage in property sales to pad their nest eggs). Early real estate planning can help reduce taxes, build legacy wealth accumulation, or make charitable donations to organization important to you.

The bottom line

Whether your objective is to preserve your family wealth, provide for the next generation, fund your children’s education, or donate to a charitable cause, Aprio is here to help ensure your real estate strategy reflects your goals.

Reach out to us if you are thinking about potentially selling your property, converting your property to a rental, or planning to maximize your gain exclusion. As economic trends continue to present new challenges to real estate financing and profitability, Aprio’s Real Estate team can identify issues surrounding the property, provide alternative solutions other than just a straight sale, and offer long-term financial and tax planning.

Related Resources/Assets/Aprio.com articles/pages

Aprio’s Real Estate CPA Services

Recent Articles

About the Author

Kevin McAdams

Kevin McAdams provides guidance to companies primarily involved in multifamily and commercial real estate, construction, private equity, and manufacturing and distribution on everything from partnerships and restructuring to tax and operations.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.