6 Manufacturing & Distribution Insights from Q3 2024 and What They Mean for You

July 19, 2024

We see a manufacturing and distribution sector with significant cross currents. The sector has contracted after briefly expanding in March as declining new orders and backlogs weaken. Yet profitability is not uniformly impacted as EBITDA margins, after contracting in 2022 and 2023, are now expanding in building products and industrials, but not for transportation and electronic manufacturing. Margins are pressured by soaring shipping container rates from Shanghai to the U.S., while input prices for industrial metals, such as copper and steel, are climbing. This is somewhat offset by rising interest in “warehouse jobs” and “factory jobs,” indicating a favorable labor market for employers. Further, year-over-year wage growth is slowing, potentially helping future margins.

1. U.S. Manufacturing Sector’s Expansion is Short-Lived as it Re-enters a Contraction

ISM Snapshot

In March, the manufacturing sector showed signs of recovery and briefly expanded, offering hope for sustained growth. However, this was short-lived as the sector quickly fell back into contraction, with the decline recently accelerating. The primary drivers of this downturn were a significant drop in new orders and a backlog of existing orders, which together slowed production. Manufacturers, whose products flowed into end products that are tied to financing and interest rates, have faced more pressure than others.

What this means for you: Demand for many manufactured goods is weakening, posing challenges for manufacturers to maintain production levels and profitability. As demand decreases, manufacturers may face increased pressure to reduce costs, manage inventory more efficiently, and adjust staffing levels to maintain financial stability. Additionally, the slowdown in production could impact supply chains, lead to delays in order fulfillment, and reduce overall industry competitiveness.

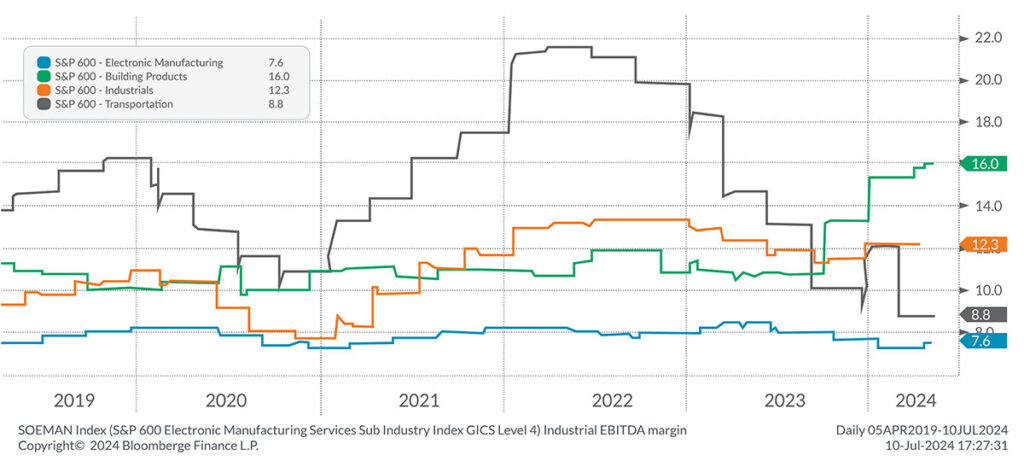

2. EBITDA Margins Show Mixed Signals for the Manufacturing Sector

EBITDA Margins

EBITDA margins generally contracted in 2022 and 2023. However, in 2024, margins have started to expand in sectors like building products and industrials, while continuing to contract in transportation and electronic manufacturing.

What this means for you: The recent trends in EBITDA margins suggest a mixed financial outlook. While some sectors like building products and industrials are experiencing improved profitability in 2024, perhaps benefitting from improved supply chains and specific input costs, indicating potential growth opportunities and a healthier financial position, other sectors such as transportation and electronic manufacturing are still facing margin pressure. Manufacturers in struggling sectors may need to focus on cost reduction strategies and efficiency improvements, whereas those in expanding sectors might have more flexibility to re-invest in growth and innovation.

3. Shipping Container Rates Continue to Climb in 2024

Container Rates from Shanghai

After skyrocketing post-pandemic, shipping container rates from Shanghai to the U.S. retracted to pre-pandemic lows following restrictive monetary policy. However, in 2024 container rates have started to climb higher quickly as U.S. consumer demand picks-up and international supply chains remain disrupted.

What this means for you: Higher shipping costs for importing raw materials and components can lead to higher production costs, squeezing profit margins. Manufacturers may need to explore alternative suppliers, adjust pricing strategies, or seek efficiencies elsewhere in their operations to mitigate these impacts. Additionally, longer lead times and potential supply chain disruptions could affect production schedules and the timely delivery of finished goods to customers.

4. Input Prices Remain Low but Volatile

Input Prices

Input prices generally remain below their post-pandemic highs, but industrial metals like copper and steel have started to rise over the past year. In contrast, prices for energy, agriculture, and lumber have seen little change during the same period.

What this means for you: For U.S. manufacturers, rising industrial metals prices (e.g., copper, steel, etc.) can increase production costs, squeezing profit margins while potentially leading to higher prices for end products. However, for manufacturers more exposed to energy, agriculture, and lumber prices, there is some relief. Manufacturers with the capacity to store commodities that have significantly declined in price, such as lumber, should consider this an opportunity to buy ahead of demand, which may benefit future profitability.

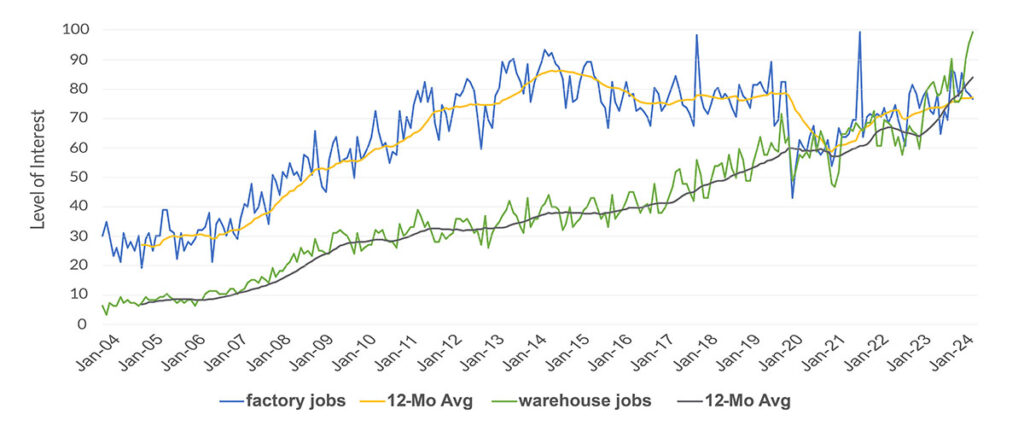

5. Rising Interest in Manufacturing Jobs

Google Trends for “Warehouse Jobs” & “Factory Jobs”

Google Trends data highlights a significant rise in interest for “warehouse jobs” and “factory jobs,” reaching peak levels. This growing interest in manufacturing and distribution-related roles indicates a more favorable labor market for employers, as more individuals are seeking opportunities in these sectors.

What this means for you: The surge in interest for “warehouse jobs” and “factory jobs” reveals an improved labor market, making it easier to fill critical positions in manufacturing and distribution. This can lead to reduced labor shortages, smoother operations, and potentially lower recruitment costs. Manufacturers may find it more feasible to scale up production and meet demand with a more readily available workforce.

6. Growth in Sticky Wages are Trending Lower Yet Remain Historically High

Wage Inflation

Year-over-year wage growth is slowing as prolonged high interest rate policies slow inflation. With the Federal Reserve anticipated to begin lowering rates this year, wage growth may keep declining, though at a relatively reduced pace.

What this means for you: Decelerating wage growth can help manage labor costs, easing some financial pressure, benefiting margins, and cash flows. However, the overall slower wage increases may affect consumer spending power, potentially leading to lower demand for manufactured goods. Manufacturers will need to balance cost management with strategies to stimulate demand in a slower economic environment.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.