6 Dental Insights from Q1 2024 and What They Mean for You

May 20, 2024

The labor market is changing and affecting dentistry. Dental office job postings on Indeed.com have declined by 12.5% over the past year while wage growth rose in 2023 for dental hygienists, indicating that there is a rising demand for high-quality professionals. Conversely, dental assistant wages mostly declined.

We see tighter labor conditions, indicated by a rise in healthcare job openings and declining quit rates since October 2023. Demand for dental services may be weakening as searches for “dentists near me” have reached their lowest levels post-pandemic. Recent years have seen faltering growth in the number of dental practices in the market due to consolidation and a decline in dentists per capita. Although healthcare consolidation post-pandemic has normalized, the increasing frequency of smaller deals potentially affects dental offices.

Here are the top six takeaways to keep in mind heading into the next quarter.

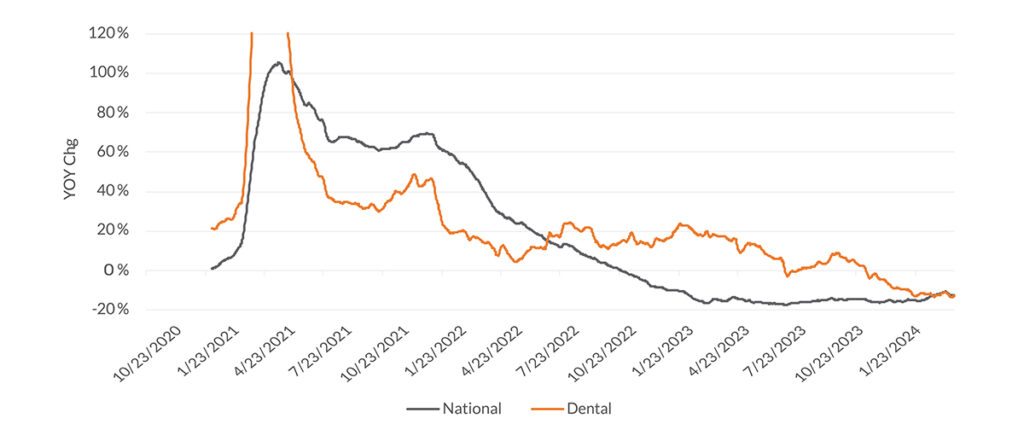

1. Dental job opportunities continue to decline.

Dental office job postings on Indeed.com have declined 12.5% over the past year, in line with the broader economy. The number of dental job postings peaked in September 2023.

Indeed.com Job Postings for Dental

Key takeaway: The decline in dental office job postings on Indeed.com mirrors the national trend and suggests a broader economic shift rather than a trend unique to the dental industry. For dental offices, this may indicate stabilization in staffing and budget for lower recruiting expenses. Owners should build team camaraderie and coordination to manage their practice efficiently.

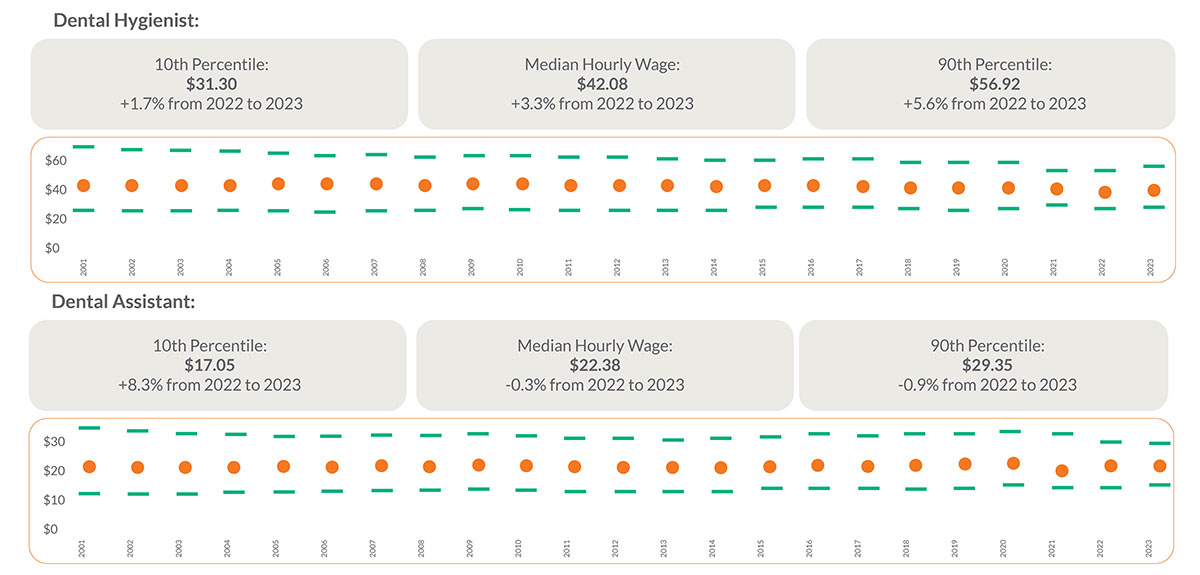

2. Diverging wage growth indicates a reallocation of labor productivity.

Wage growth for dental hygienists rose in 2023 with the median wage rising by 3.3%. Meanwhile, higher-value (90th percentile) hygienists’ wages rose by 5.6% and lower-value (10th percentile) hygienists’ wages rose by 1.7%, indicating greater demand for high-production hygienists.

Dental assistant wages mostly declined in 2023 with the median wage falling 0.3% and the higher value (90th percentile) assistant wages falling 0.9%. However, lower-value (10th percentile) assistant wages rose by a substantial 8.3% in 2023, indicating a demand for the most affordable dental assistants available, which may reflect competing wages within industries outside of dentistry.

Wage Growth

Key takeaway: The divergent wage trends for dental hygienists and assistants reflect varying demand dynamics within the dental industry. The increase in wages for higher-value hygienists suggests a growing demand for skilled professionals, potentially driven by higher production and a focus on quality patient care. Conversely, the rise in wages for lower-value dental assistants indicates a demand for cost-effective support staff, possibly reflecting cost-consciousness among dental offices amidst economic fluctuations. Dental offices should consider these wage trends when assessing their staffing needs and optimizing their workforce for efficiency and quality care delivery.

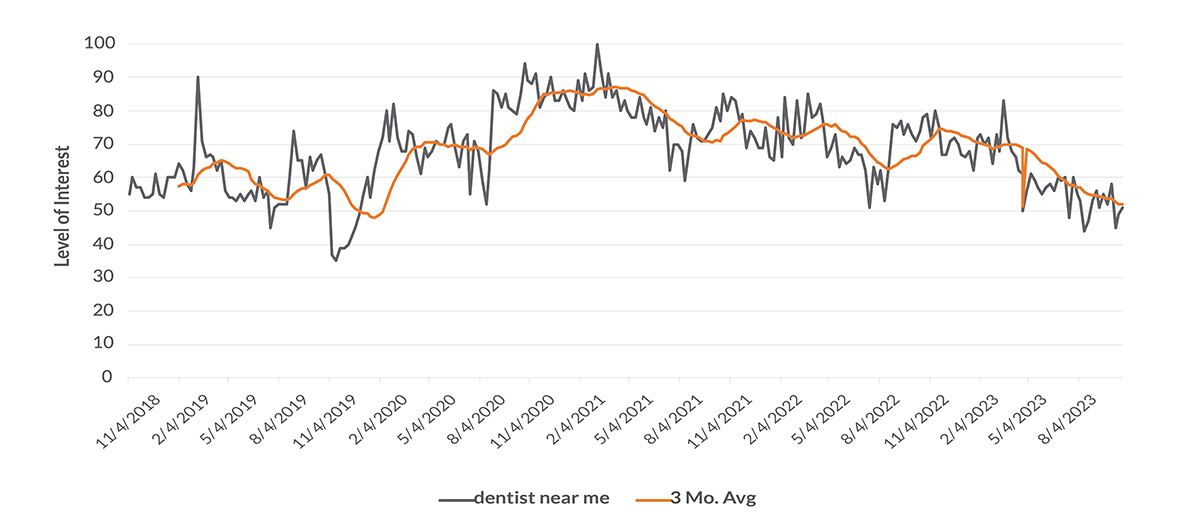

3. Google searches for dentists continue to decline.

After peaking in early 2021, fewer people are searching for dentists in their area. The number of searches for “dentist near me” has reached its lowest levels since the pandemic.

Google Trends: “Dentist Near Me”

Key takeaway: The decline in searches for “dentists near me” since early 2021 suggests a significant shift in consumer behavior, potentially indicating reduced demand for dental services. This trend could be attributed to various factors such as changing healthcare priorities, economic conditions, or shifts in digital search habits. Dental professionals may need to adapt their marketing strategies to reach potential patients effectively amidst this decline in local search interest.

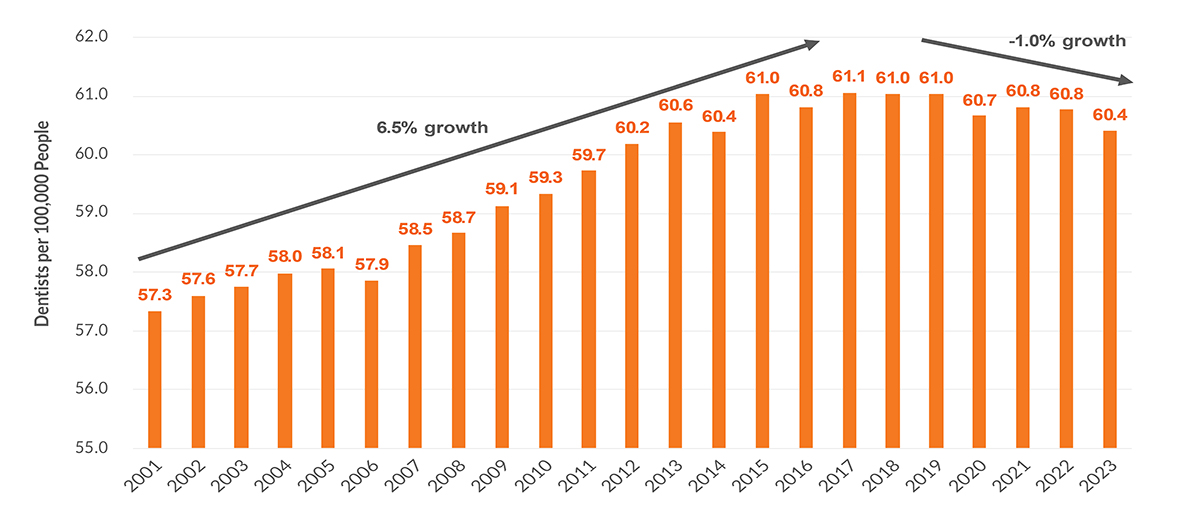

4. Slower practice growth and fewer dentists per capita pose competitive challenges.

The number of dental practices steadily grew over decades as the number of dentists per capita increased by 6.5% from 2001 to 2019. However, from 2019 to 2023, growth has faltered as the number of dentists per capita has declined by 1.0%.

Supply of Dentists

Key takeaway: The slowing growth of dental practices coupled with the declining number of dentists per capita suggests a larger role of private equity-backed consolidators and DSOs plus heightened competition. Dental practices may face increased challenges in attracting and retaining patients amidst this shifting landscape. Dental offices must differentiate through quality of care, innovative services, and strategic marketing to maintain competitiveness.

5. Rising job openings and lower quit rates in healthcare may lead to tighter labor markets.

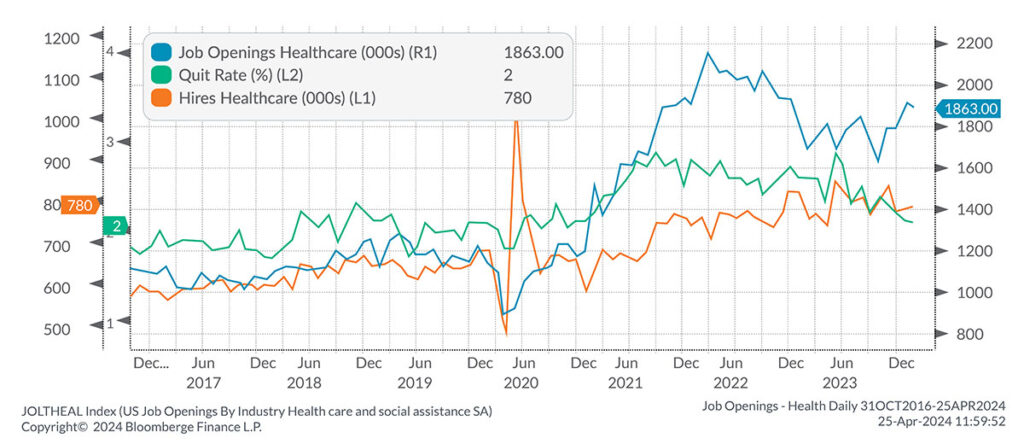

Since October 2023, there has been a notable rise in job openings in the healthcare sector. Concurrently, quit rates have steadily declined and hires have consistently increased, suggesting tighter labor conditions.

Healthcare Jobs Market

Key takeaway: The notable increase in job openings and declining quit rates indicate a tightening labor market. For dental offices, this suggests increased competition for skilled professionals, potentially leading to challenges in hiring and retaining staff. Dental practices may need to reconsider compensation packages and create more attractive work environments to address these labor market dynamics effectively.

6. M&A activity in the healthcare space has subsided to more normal levels.

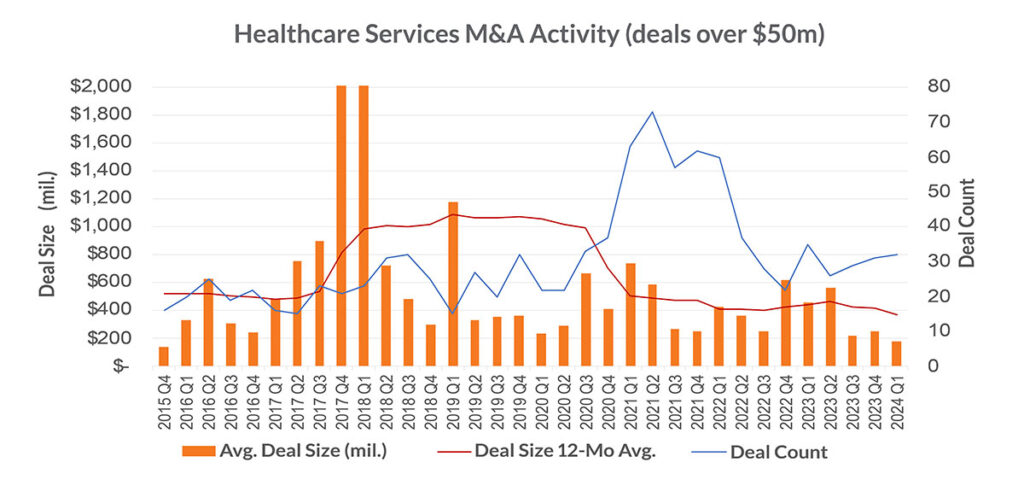

With a significant increase in healthcare consolidation shortly after the pandemic, M&A activity has since reverted to more normal levels. However, over the past three quarters, smaller deals have increased with deal count rising and average deal size remaining relatively low.

M&A Activity

Key takeaway: The reduction in M&A activity post-pandemic and the rise in smaller deals suggest a shift towards localized consolidation within the healthcare industry. For dental offices, this may indicate opportunities for smaller or tuck-in acquisitions, potentially enhancing market positioning and competitiveness. Dentists should consider capitalizing on the evolving landscape to strengthen their practice’s growth prospects.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.