6 Real Estate Insights from Q4 2024 and What They Mean for You

December 13, 2024

The diversity of commercial real estate subsectors, each with their own fundamentals, currently presents both challenges and opportunities, requiring an understanding of sector dynamics and regional trends. While cap rate spreads have narrowed in private markets, publicly traded companies in sectors like Multifamily and Industrial offer discounts relative to historical valuations. In private markets, despite the narrower-than-historical cap rate spreads to Treasuries, muted new development activity and constrained future supply support strategic investments today that could position investors for outsized returns in the future.

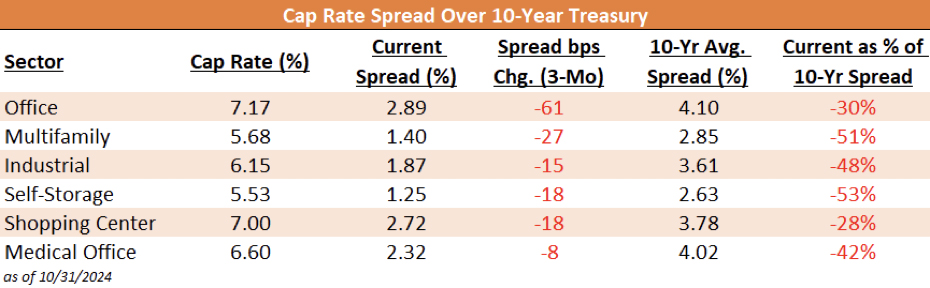

1. Cap Rate Spreads Widen as Bond Yields Move Lower

Cap Rate Spreads

Source: RCA, NAREIT, & ICA Data Indices, LLC

The spread, or difference in yield, between cap rates and the 10 Year US Treasury note has narrowed across sectors, with current levels significantly below their 10-year averages. While Office and Shopping Centers maintain their wider cap rates spreads, they are historically tight as interest rates remain higher than recent history. Sectors like Multifamily and Self-Storage are facing much narrower spreads that are more than 50% below their 10-year averages. This tightness implies reduced risk-adjusted returns for real estate, compared to other investment options, such as bonds.

What this means for you:

Narrowing spreads suggest that real estate investors need to be more selective and risk aware when evaluating opportunities. Sectors with higher cap rates, such as Office and Shopping Centers, may provide higher yields, but these opportunities come with increased tenant risk, particularly in a challenging leasing environment.

Investors should also explore value-add opportunities to create returns that offset the impact of tighter spreads. Meanwhile, in sectors like Multifamily and Industrial, focusing on cash-generating properties with opportunities to grow NOI will help weather periods of reduced spreads.

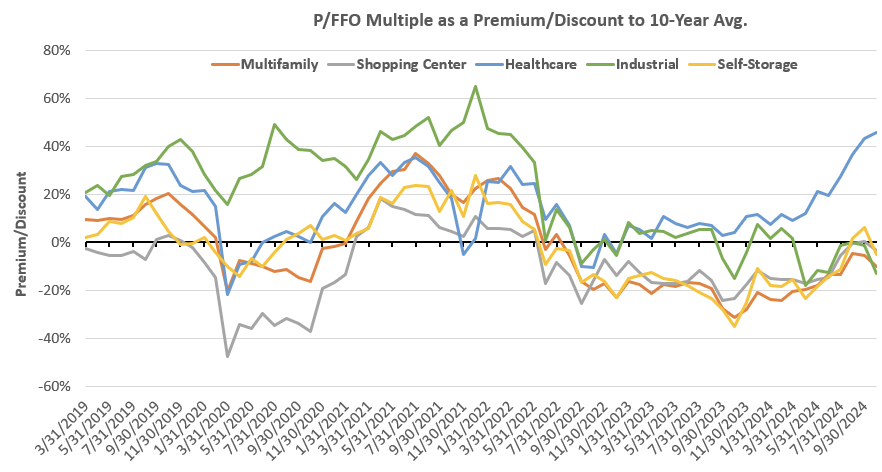

2. Premium/Discount Trends in P/FFO Multiples

FFO Multiples

Source: Bloomberg Finance L.P.

Valuation multiples reveal that the Healthcare sector is trading at a significant premium relative to its 10-year average, driven by stable demand, demographic tailwinds, and investor confidence in its recession-resistant fundamentals. In contrast, other sectors, including Multifamily, Shopping Centers, Industrial, and Self-Storage, are trading at discounts, reflecting lingering market caution and supply-demand imbalances in specific asset classes. Yet valuation discounts can provide opportunity for higher longer-term returns.

What this means for you:

The Healthcare sector’s premium valuation underscores its status as a defensive investment, particularly in uncertain economic conditions. Investors seeking stability and income should explore opportunities within this space, though they must carefully assess whether the premium is justified by long-term fundamentals.

For sectors trading at a discount, such as Multifamily and Shopping Centers, this could signal undervalued opportunities, especially in regions with improving demand and tighter future supply.

For Industrial and Self-Storage, the discounts suggest room for recovery, particularly as their operational fundamentals remain strong. Balancing defensive assets like Healthcare with value-priced investments in discounted sectors can help investors optimize returns while mitigating risk.

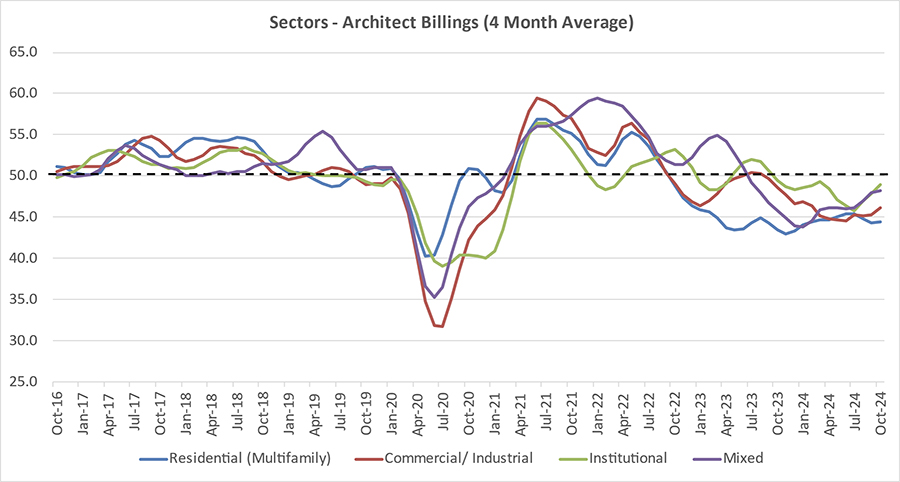

3. Architectural Billing Activity Suggests Continued Caution

Source: The American Institute of Architects

The architectural billings index shows that sectors like residential and commercial/industrial remain below the growth threshold, indicating that developers remain cautious about starting new projects. Institutional and mixed-use developments show greater stability but still lack strong momentum.

What this means for you:

Slower activity in architectural billings could ease oversupply concerns in certain markets, providing relief to owners and investors grappling with declining rents and occupancies. This slowdown presents an opportunity to enhance existing assets, ensuring they remain competitive in markets with limited new supply. For developers and forward-looking investors, this period of caution could lead to scarcity value, making well-positioned projects more desirable in the future.

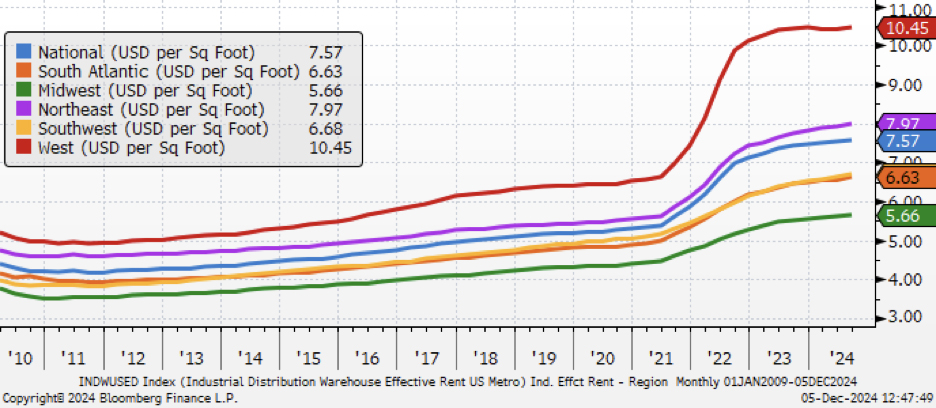

4. Industrial Real Estate Continues to Outperform

Industrial Rent Growth by Region

Source: Bloomberg Finance L.P.

Industrial rents are experiencing growth at historical rates, after a significant increase during the pandemic as shopping habits favored eCommerce. The national average also continues to rise, driven by strong demand from logistics and warehousing sectors.

What this means for you:

Investors in industrial real estate can continue to capitalize on strong rent growth by targeting regions with incremental supply constraints such as the West and Northeast, or expanding logistics infrastructure. Long-term leases with strong credit tenants provide stability and mitigate downside risk. For property owners, investing in modern logistics capabilities and emphasizing sustainability can help attract and retain tenants willing to pay a premium.

5. Regional Supply-Demand Imbalances in Multifamily Housing

Multifamily Supply/Demand Delta

Source: RealPage Market Analytics

Multifamily market dynamics reveal significant regional disparities. The Mountains/Deserts and West Coast regions are experiencing tighter market conditions, with demand closely matching supply, while regions such as Texas, the Lower Midwest/Plains, and the Northeast/Mid-Atlantic face substantial supply surpluses, creating challenges for absorption and rent growth.

What this means for you:

In oversupplied regions, distressed asset acquisitions could provide attractive opportunities for investors with a long-term outlook. Value-add strategies, such as enhancing property amenities and improving operational efficiency, can help offset the impact of higher vacancies and lower rents. Conversely, investors in tighter markets like the Mountains/Deserts may focus on properties with stable cash flows and strong tenant demand, benefiting from more consistent performance.

6. Multifamily Demand Recovery Expected in 2025

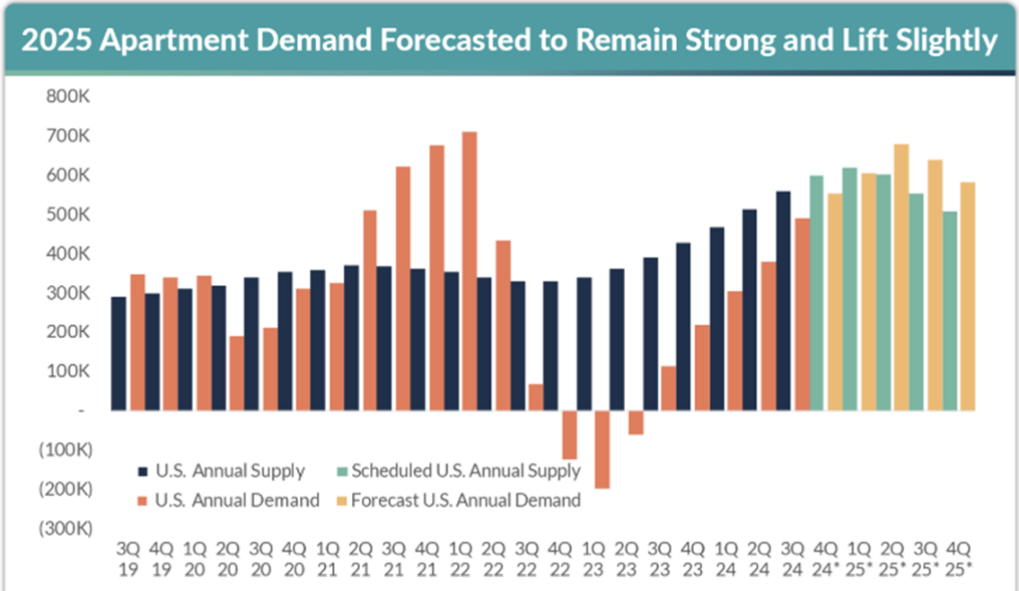

Multifamily Supply/Demand Forecast

Source: RealPage Market Analytics

Projections show that Multifamily supply/demand ratio is expected to become more balanced in 2025. This stabilization comes after years of oversupply pressuring rents in many markets, signaling a potential turning point for the sector.

What this means for you:

For investors, the expected stabilization presents an opportunity to acquire assets in the current market at a relative discount, positioning for recovery. High-growth metro areas with constrained future supply and robust population trends should be a key focus. Owners should also prepare for potential rent increases by ensuring properties are well-maintained and competitively positioned.

This commentary is brought to you by our advisors at Aprio. Contact our team today.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Alan Vaughn

Alan is the Real Estate and Construction Practice Leader at Aprio and a Tax Partner. Alan advises all types of real estate and construction clients on various 1031 exchanges, structuring of LLCs, and creative exit planning strategies.

Darrin Friedrich

Darrin is a Tax Partner in Aprio’s Real Estate and Construction Practice. Darrin advises C-level executives and business owners within real estate, construction, retail, and hospitality on tax preparation and business consulting.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.