6 Real Estate Insights from Q3 2024 and What They Mean for You

September 27, 2024

As we move through Q3 2024, the real estate market is showing signs of significant change.

Cap rate spreads are beginning to reveal potential opportunities compared to other investment options. In the multifamily sector, future supply growth appears limited, yet some high-growth markets are experiencing rent declines due to oversupply. At the same time, industrial markets are seeing a normalization that could impact investment strategies moving forward.

We dive into each of these shifting dynamics below, providing a closer look at what they might mean for investors and asset managers in the months ahead.

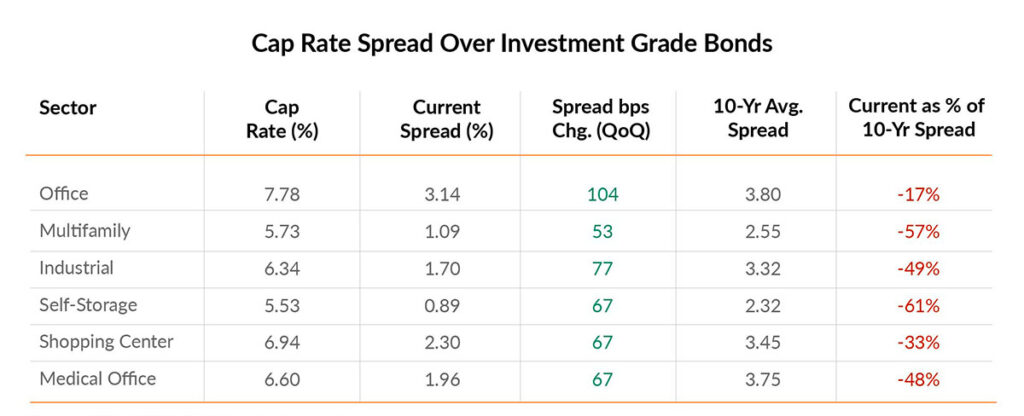

1. Cap Rate Spreads Widen as Bond Yields Move Lower

As bond yields dipped this quarter, the spread between cap rates and bond yields has widened. This provides a more favorable environment for real estate investments compared to fixed income investments.

What this means for you:

Widening cap rate spreads suggest that real estate may offer better risk-adjusted returns relative to certain bond investments. Investors should increasingly consider real estate opportunities, including in select office and retail sectors, where cap rates remain high.

We believe high quality (e.g. Class A) and appropriately amenitized offices may provide compelling future returns, as companies continue to push employees back to the office, taking a cue from Amazon’s recently announced return to office policy.

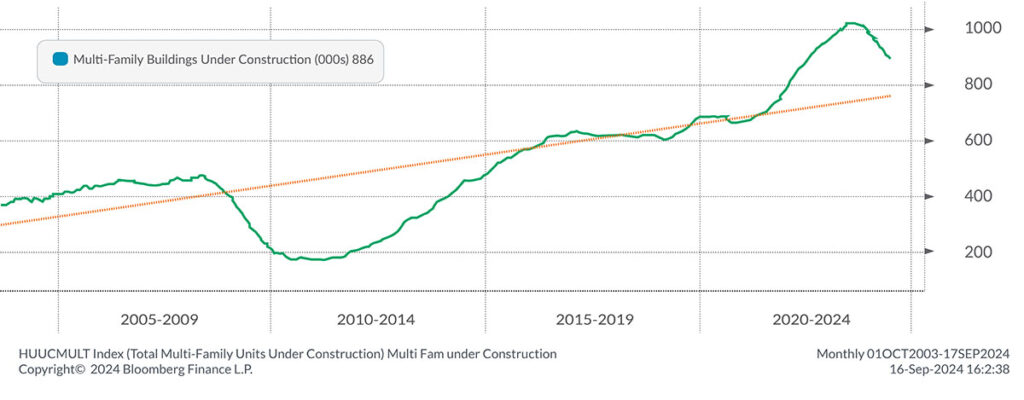

2. Oversupply of Multifamily Housing Slows New Construction

Multifamily buildings under construction

Multifamily construction has significantly slowed as developers react to oversupply in the market. While demand for multifamily remains steady, the excess inventory continues to weigh on rent growth and absorption in key markets.

What this means for you:

Investors should exercise caution in oversupplied multifamily markets. For investors considering deploying capital into multifamily, there may be bargains in acquiring assets to relieve existing asset owners’ stressed balance sheets.

For existing owners, focus on enhancing property value through amenities. We believe targeting areas with limited new construction can provide a competitive advantage.

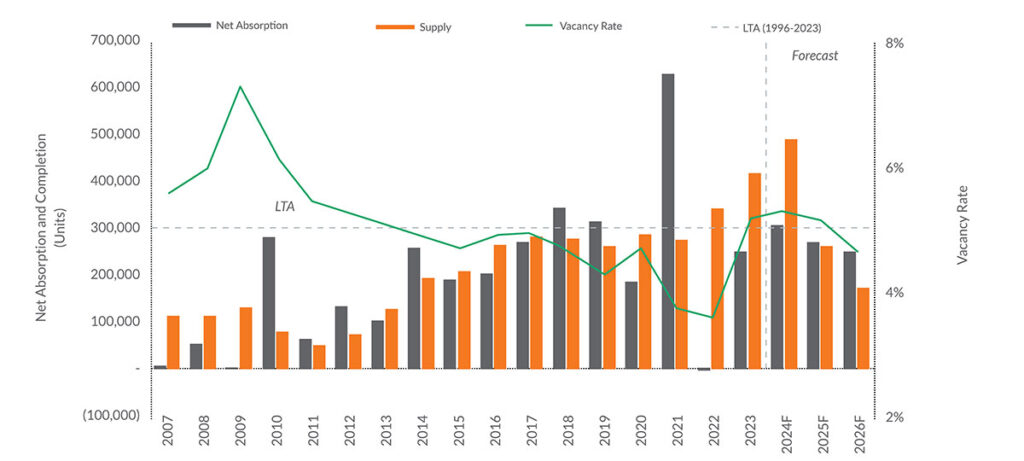

3. Demand for Multifamily Housing Remains High, But Oversupply Looms

Multifamily Snapshot

The demand for multifamily units remains robust, particularly in growing regions. However, oversupply continues to pose challenges, particularly in urban markets where rent growth has stalled.

What this means for you:

Investors should monitor regions like the Midwest, where rent growth remains strong, while the Southeast struggles due to oversupply.

Identifying markets with resilient demand and constrained supply will be key to optimizing investments.

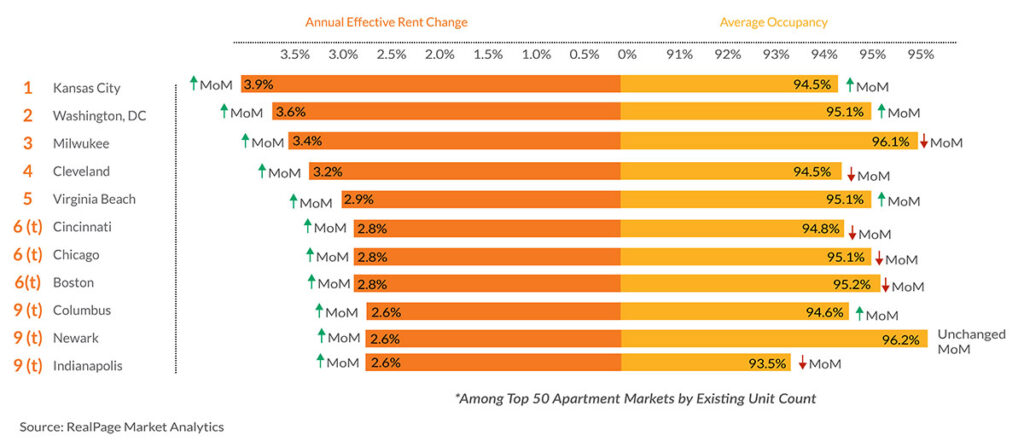

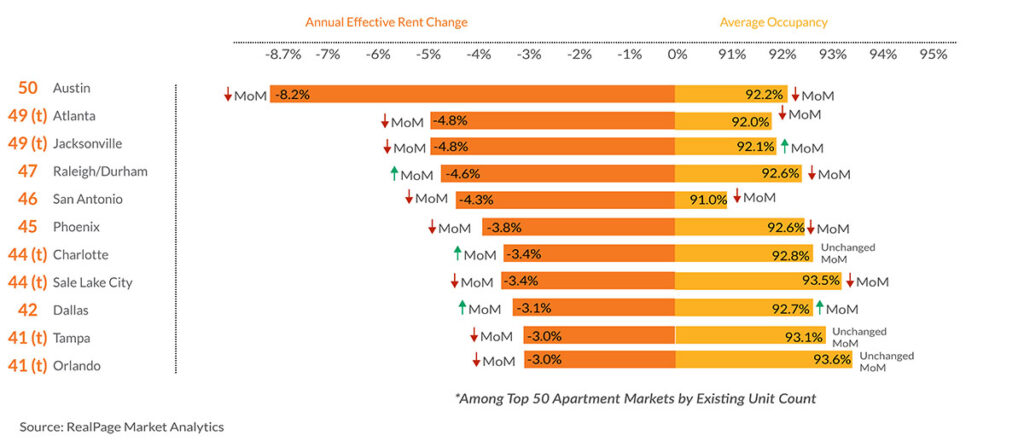

4. Rent Growth Trends Diverge by Region

Rent Growth by City

Rent growth is showing significant regional divergence. While the Midwest is experiencing stronger growth, the Southeast is facing lagging performance due to an influx of new inventory.

What this means for you:

As all real estate is local, investors should focus on market-specific analysis, particularly in regions where rent growth is projected to continue.

Understanding local dynamics will be essential for making sound investment decisions.

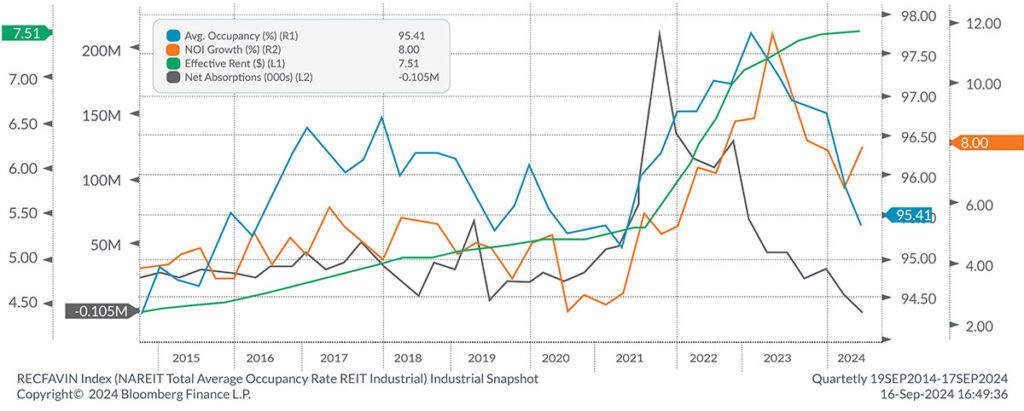

5. Industrial Real Estate Adjusts After Post-Pandemic Surge

Industrial Snapshot

The industrial real estate sector saw sharp growth during the pandemic, yet it is now reverting to more normalized levels. Fundamentals remain strong with positive net absorptions, primarily driven by logistics and warehousing needs.

What this means for you:

The industrial sector continues to offer long-term value.

Investors should look at logistics hubs and areas with strong infrastructure to capitalize on sustained demand in the sector. We expect these trends to continue as the eCommerce sector’s market share grows, as evidenced by companies competing on reduced delivery times and supply chains moving towards increased on- and near-shoring.

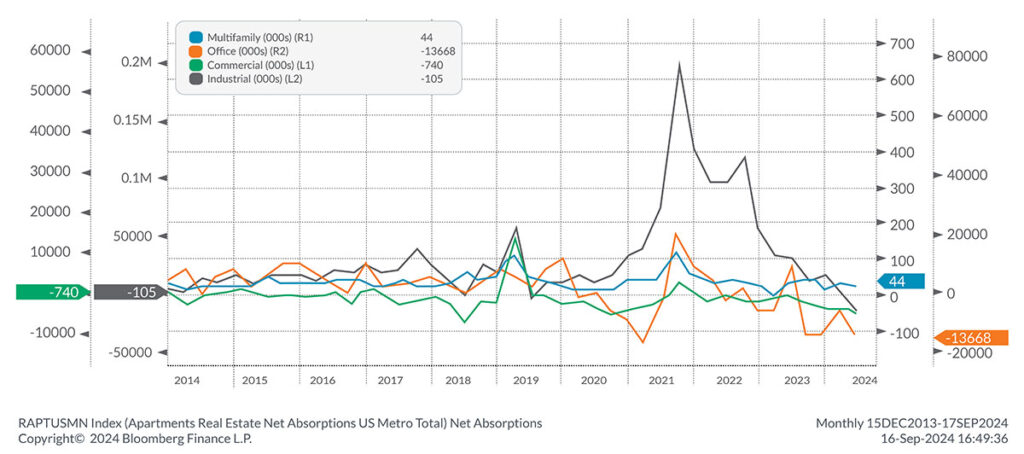

6. Multifamily Sector Continues to Lead in Net Absorptions

Net Absorptions

While many real estate sectors face challenges, multifamily remains a leader in net absorption rates. Despite the oversupply, the demand for multifamily housing continues to drive positive absorption in many regions. As housing affordability remains an issue for many, it forces greater demand for rental units.

What this means for you:

Multifamily still presents strong investment opportunities, particularly in regions with robust population growth. The key is to focus on recent and expected supply growth.

Investors should focus on markets with resilient demand to offset the risks posed by oversupply.

This commentary is brought to you by our advisors at Aprio. Contact our team today.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities are offered through Purshe Kaplan Sterling Investments (PKS), member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. PKS and Aprio Wealth Management, LLC are not affiliated companies.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Alan Vaughn

Alan is the Real Estate and Construction Practice Leader at Aprio and a Tax Partner. Alan advises all types of real estate and construction clients on various 1031 exchanges, structuring of LLCs, and creative exit planning strategies.

Darrin Friedrich

Darrin is a Tax Partner in Aprio’s Real Estate and Construction Practice. Darrin advises C-level executives and business owners within real estate, construction, retail, and hospitality on tax preparation and business consulting.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.