6 Real Estate Insights from Q1 2024 and What They Mean for You

March 27, 2024

Recent commercial real estate trends reflect an asset class in transition. Cap rate spreads have widened slightly due to rising cap rates and falling bond yields, with multifamily and industrial sectors seeing the most significant shifts. Concurrently, loosening lending standards indicate a relatively more favorable borrowing environment than past quarters, albeit with lingering tightness. Meanwhile, the housing market sees a tilt towards an increase in the supply of single-family homes, potentially impacting multifamily investments. Declining multifamily net operating income (NOI) growth, coupled with record-high completions and subsequent rent cuts, underscores the sector’s headwinds.

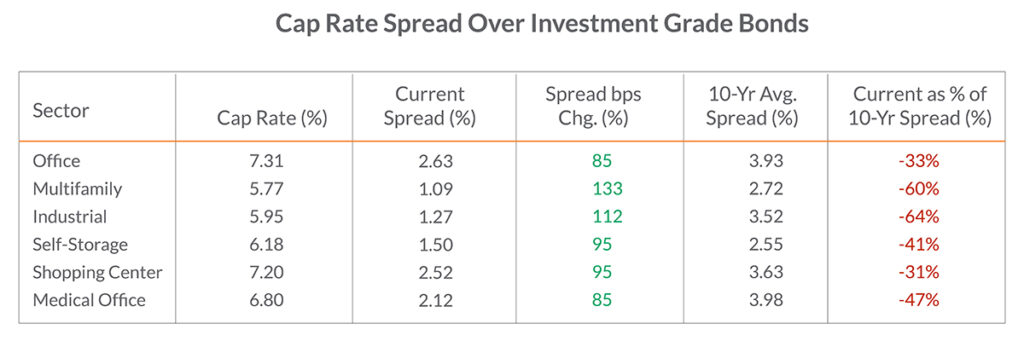

1. Cap rate spreads expand amid rising cap rates and falling bond yields

Cap Rate Spreads

With both cap rates rising and investment grade bond yields falling, cap rate spreads saw a long-awaited increase, but remain historically narrow. This means they became a marginally better value. The multifamily and industrial real estate sectors saw the largest increase in their spreads as their cap rate rose more substantially, while the others were predominantly driven by falling bond yields.

What this means for you: Widening cap rate spreads indicate increasing risk perceptions or market uncertainty, yet represent better value directionally compared to investment alternatives. If you’re investing or considering an acquisition, focus on properties with stable income streams or potential for value-added opportunities, if financing can be secured. Additional due diligence and conservative valuations can help mitigate risks in a volatile market.

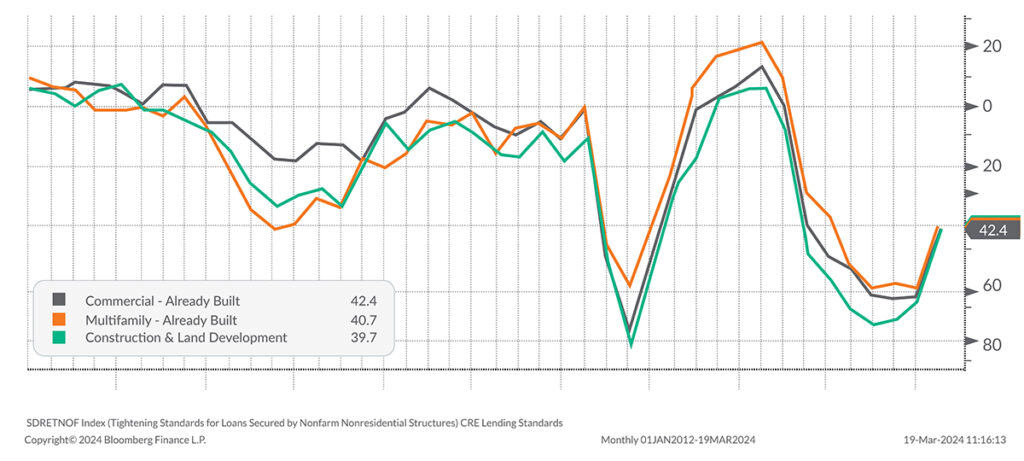

2. Shift towards looser commercial real estate lending standards in 2024 signals an ease in borrowing conditions

Lending Standards

Commercial real estate lending standards became substantially looser heading into 2024 as lenders become more comfortable with the current real estate environment due to the Federal Reserve signaling that its interest rate hiking cycle is ending. While overall standards are still tight, such a change indicates that the tightest of standards may be behind commercial real estate borrowers.

What this means for you: Looser lending standards will provide easier access to financing for borrowers. Be cautious, as looser lending standards may lead to aggressive borrowing by others, resulting in inflated property prices and overleveraging. Prioritize thorough due diligence, conservative valuation, and maintaining adequate reserves to mitigate risks and ensure long-term investment stability.

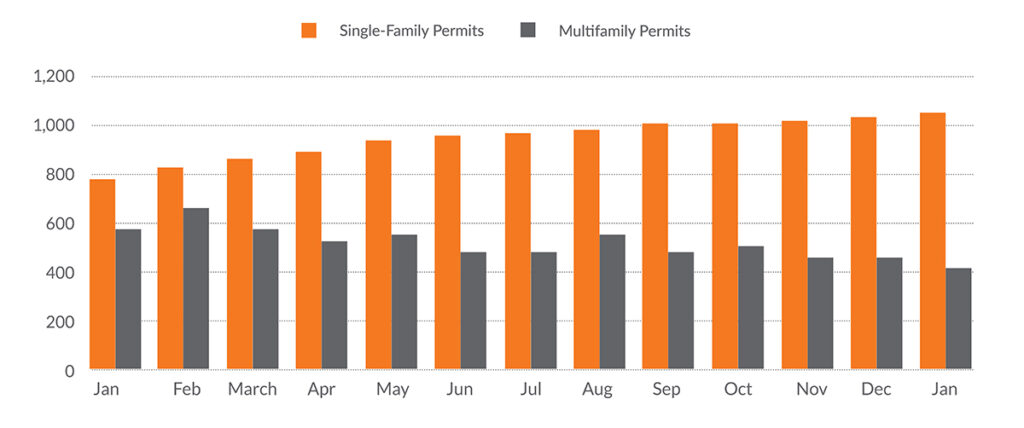

3. Changing housing trends favor single-family homes over multifamily developments

Single-Family and Multifamily Permitting

Housing supply is shifting in favor of single-family homes as building permits for single-family houses continues to climb, while permits for multifamily housing continues to fall. In February, single-family housing starts increased by 35.2%, while multifamily (five units or more) declined by 35.9%.

What this means for you: The shift towards single-family housing may signal decreased tenant demand for multifamily properties in markets where there is significant single-family permitting growth. It’s important for multifamily owners to focus on scenario planning for the impact of lower effective rents and investing in more amenities to retain existing tenants and attract new ones.

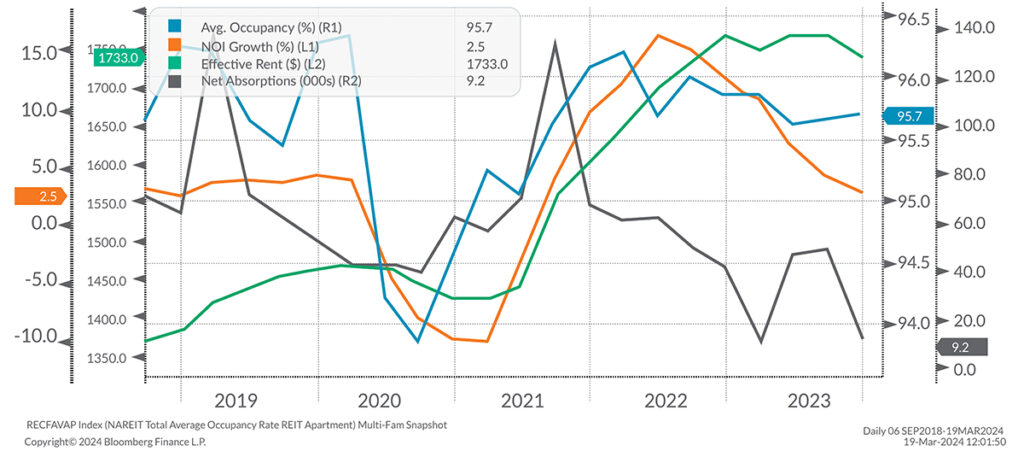

4. Challenges mount for multifamily real estate

Multifamily Snapshot

Multifamily real estate has experienced declining NOI growth and relatively low net absorptions. Effective rent appears to have topped out and average occupancy, while still high, has modestly declined since the first quarter of 2022.

What this means for you: The stagnating NOI growth, plateauing rents, and declining occupancy in multifamily housing suggests a market nearing saturation with some markets experiencing a near-term oversupply. Investors should focus on diversification, greater market research, and selecting properties with stable cash flows and resilient demand to mitigate risks in this competitive landscape. Think opportunistically to identify good assets with have bad balance sheets, where new capital can be supplied with compelling future multi-year returns.

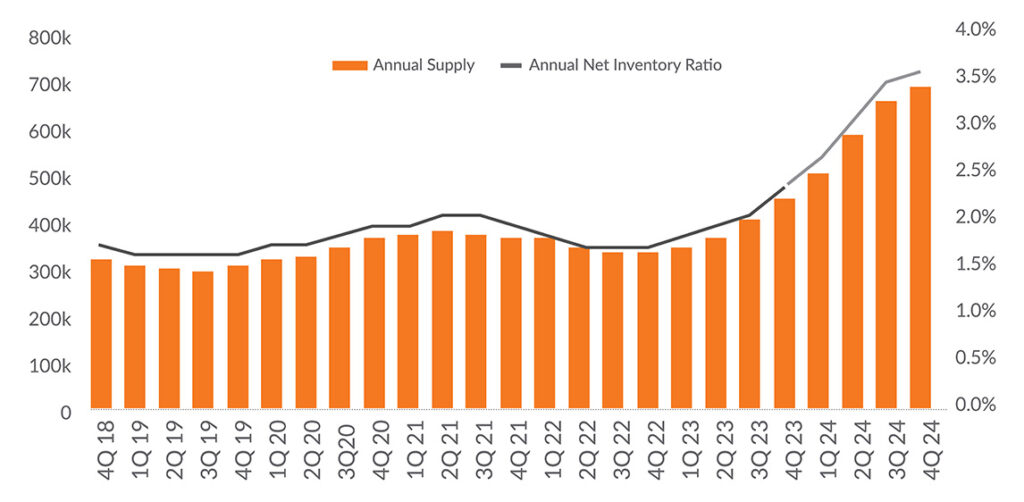

5. Multifamily construction surge signals potential oversupply in 2024

Multifamily Supply

The multifamily sector experienced a surge in permitting and construction in response to high occupancy and rent growth in 2021 and 2022, leading to a record 36-year high of nearly 440,000 apartment completions in 2023. However, 2024 is anticipated to surpass this record with scheduled completions totaling around 670,000 units, signaling a potential oversupply and increased competition in the market.

What this means for you: The surge in multifamily construction, resulting in record-high completions, suggests a near-term potential oversupply, leading to increased competition for tenants and pressure on rents. Investors should evaluate market saturation and focus on opportunities with strong demand fundamentals to mitigate risks and optimize investment returns. However, we believe that the oversupply is likely a two-to-three-year headwind. In markets where there is expected population growth, we expect compelling opportunities beyond two-to-three years due to constrained new supply after 2024.

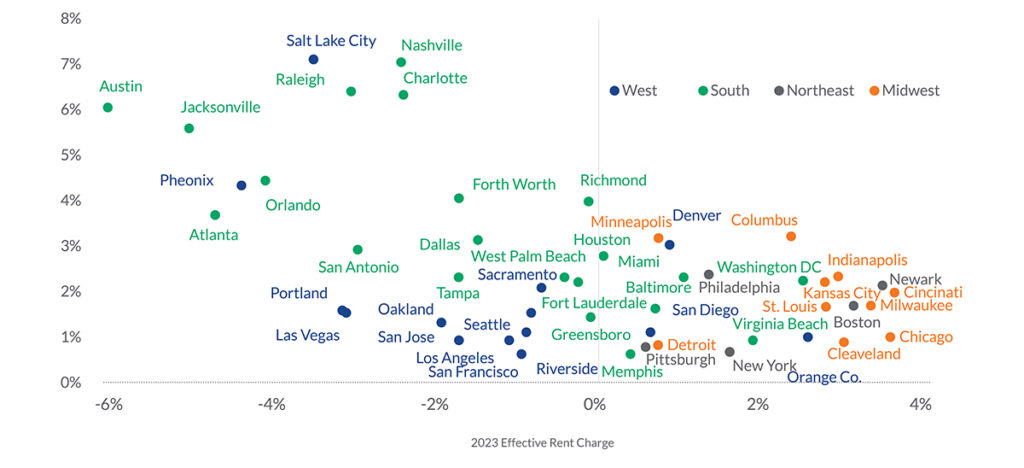

6. The impact of surging apartment construction on occupancy and rents

2023 Rent Change vs. Inventory Growth

From 2021 to 2023, a surge in apartment construction led to a significant increase in inventory, resulting in a 90-basis points dip in occupancy and only a minor 0.2% rent growth nationwide in 2023. Markets with the highest influx of new units experienced deeper rent reductions, particularly in Salt Lake City, Nashville, Austin, Jacksonville, and Atlanta.

What this means for you: The surge in multifamily construction, and subsequent oversupply, negatively impacted occupancy rates and rent growth, especially in cities with high new unit and population growth. Commercial real estate investors should monitor supply levels closely and focus on markets with more balanced supply and demand dynamics to mitigate risks and improve investment returns.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (March 27, 2024) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Alan Vaughn

Alan is the Real Estate and Construction Practice Leader at Aprio and a Tax Partner. Alan advises all types of real estate and construction clients on various 1031 exchanges, structuring of LLCs, and creative exit planning strategies.

Darrin Friedrich

Darrin is a Tax Partner in Aprio’s Real Estate and Construction Practice. Darrin advises C-level executives and business owners within real estate, construction, retail, and hospitality on tax preparation and business consulting.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.