6 Real Estate Insights from Q1 2023 and What They Mean for You

February 24, 2023

Rising interest rates and a slowing economy have created headwinds for the real estate sector but also provide greater opportunities as property valuations become relatively more attractive. While private real estate cap rate spreads appear less compelling compared to historical data, the direction of public REITs’ cap rates and the lag in private real estate suggest that cap rates should become more appealing for real estate buyers over the next year.

We are seeing this in the public markets as Funds from Operations (FFO) valuation multiples for publicly traded REITs are now at sizable discounts relative to their 10-year averages. Banks are tightening their lending standards for commercial and residential real estate due to concerns over the direction of the economy and signs of weakening demand, such as declining square feet net absorption in commercial real estate, while higher mortgage rates are impacting residential real estate as both construction and affordability of single-family homes decreases.

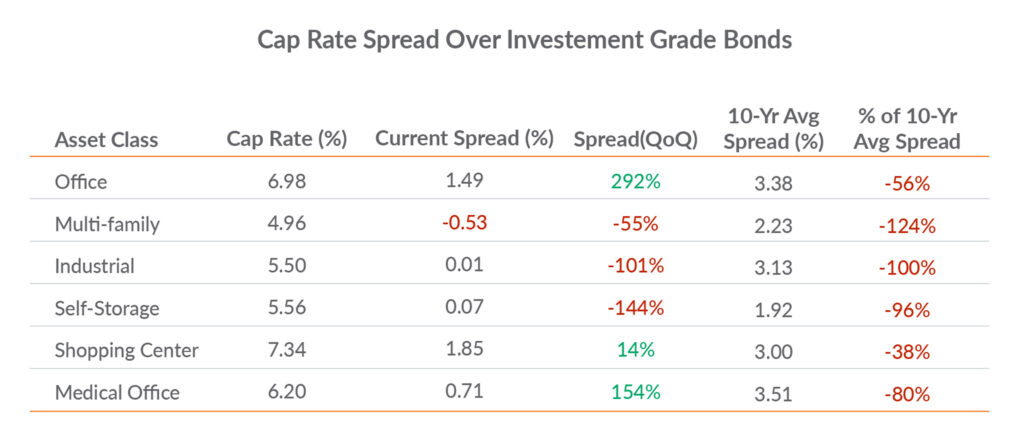

1. Spreads between cap rates and investment grade bonds remain historically narrow

The spread (or difference) of cap rates to investment grade bonds narrowed considerably as rising interest rates pushed bond yields higher, which pressured property values. However, in Q4 of 2022, cap rate spreads widened in office and shopping centers, and narrowed in self-storage, industrial and multi-family, as investors focused on segments with clear Net Operating Income (NOI) growth.

What this means for you: Relative to investment grade bond yields, cap rate adjustments lag the market. With the Federal Reserve communicating its intent to continue increasing rates and executing Quantitative Tightening (QT), expect cap rate spreads to widen, pressuring valuations. As a result, NOI growth is increasingly important to drive investment returns for asset owners. Rising cap rates may create opportunistic deals as valuations become more attractive.

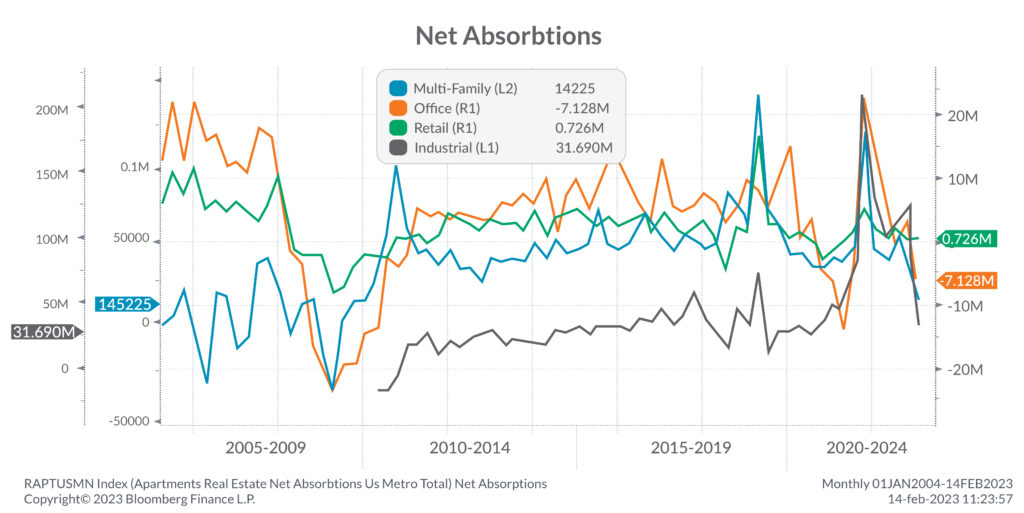

2. Net Absorptions have come down dramatically in 2022

After peaking in Q3 of 2021, net absorptions (i.e., the square feet that became occupied less the combination of that which became vacant and new supply in the market) have declined rapidly. The office sector continues to face challenges with remote work becoming more persistent and has resulted in negative net absorptions. Retail has remained resilient with net absorptions only moderately contracting in 2022, yet multi-family net absorptions are sliding to levels not seen since the end of the 2008-2009 financial crisis.

What this means for you: With an anticipated slowdown in economic growth in 2023, expect demand to weaken. To mitigate the risk of decreasing net absorptions, look to competitively price rents with short-term leases to keep occupancy high, net absorptions stable and the flexibility to adjust rents higher when the market tightens.

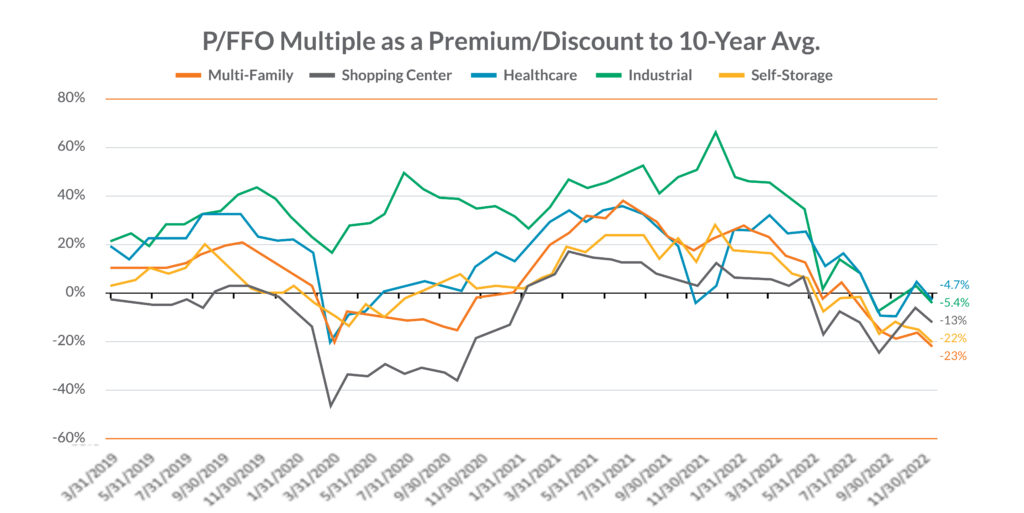

3. Publicly traded REITs look attractive with P/FFO at a discount to their 10-year averages

With publicly traded REITs sold off in 2022 over concerns of rising interest rates and an economic slowdown, valuations appear attractive as their prices decline and their FFO remains relatively stable. Relative to their 10-year averages, the discounts for multi-family and self-storage REITs are most compelling.

What this means for you: Public markets tend to lead private markets, so with large reductions in public valuations, expect private real estate valuations to compress. Further, expect acquisitions of publicly traded REITs, as private buyers and private equity funds capitalize on the lower valuations in the public markets.

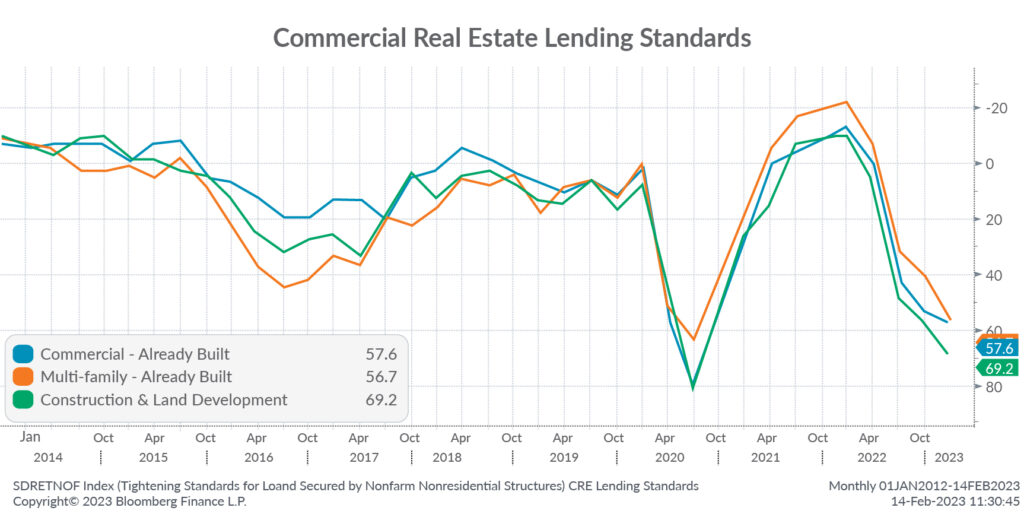

4. Banks continue to tighten lending standards over economic uncertainty

Banks continue to tighten lending standards for commercial real estate over the uncertainty of the economy. While lending standards are still slightly looser than they were during the peak of the pandemic, historically they are tight.

What this means for you: Tighter lending standards means that financing transactions in the near term may be more difficult and costly than recent experiences. When considering future deals, explore non-bank options to secure financing, such as the private markets, while keeping rates competitive.

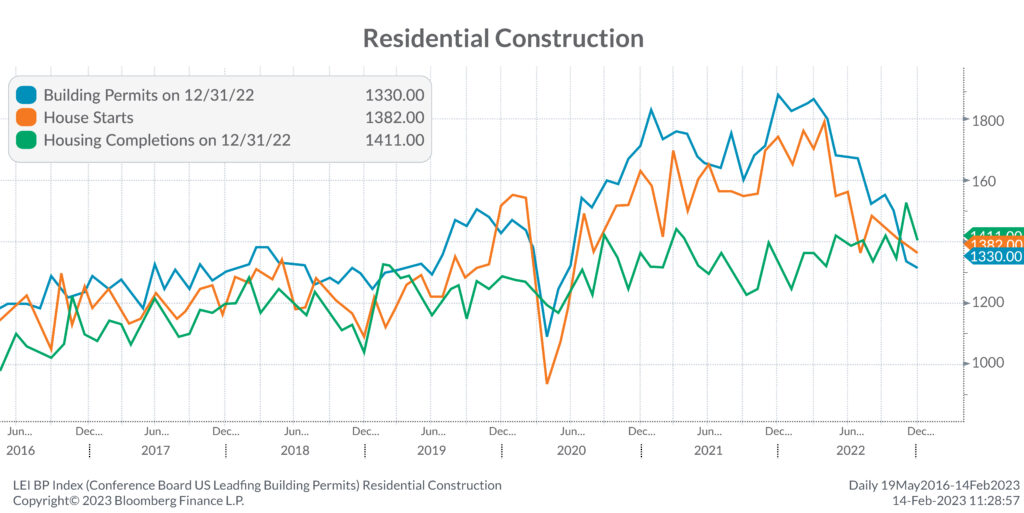

5. Residential construction has slowed with housing starts and building permits declining

Building permits tend to lead housing starts, and with permits now below the level of housing starts, we can anticipate a further decline in these areas. Declining permits is a sign of a weakening economy and housing market as less supply becomes available to those looking to buy a new home.

What this means for you: Weaker demand for single-family homes may provide additional demand for multi-family real estate. Despite the economy decelerating and an overall weakening demand, housing inventory is expected to remain tight, leading to what we expect would be a modest decline – not a crash – in single-family housing prices.

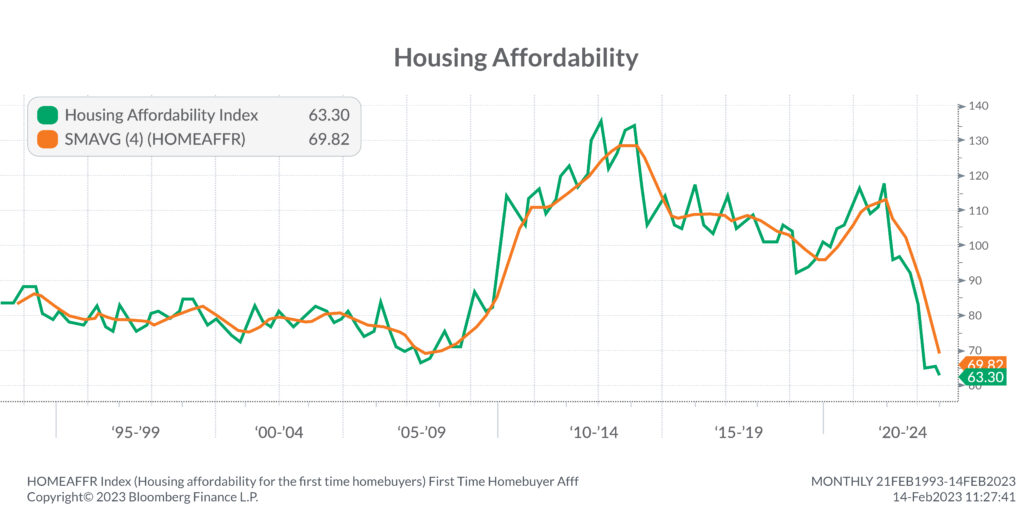

6. Single-family housing affordability for first-time buyers has plummeted as mortgage rates jump and supply remains limited

As mortgage rates soared in 2022, single-family housing for first-time home buyers has reached multi-decade levels of unaffordability. High mortgage rates coupled with limited supply supporting prices have resulted in generational lows for the housing affordability index. (Note, a lower reading indicates housing is less affordable.)

What this means for you: With the single-family housing market facing challenges of affordability, this is another indication that potential first-time home buyers may continue to rent over the near-term. Expect this weakness in the residential housing market to provide support in demand for multi-family housing.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (February 23, 2022) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.