6 Manufacturing Insights from Q4 2022 and What They Mean for You

November 8, 2022

As the US heads into an economic slowdown, overall manufacturing conditions are weakening as ISM indices are showing a reduction in new orders and backlogs. However, a slowdown in the economy has relieved many of the inflationary pressures that manufacturers have been experiencing as input prices have dropped considerably from their three-year highs. Further, truckload spot rates have also declined, with contractual rates expected to follow suit in the coming months. The manufacturing labor market is improving as wage growth appears to have peaked, quit rates are reversing and the demand for manufacturing jobs is rising.

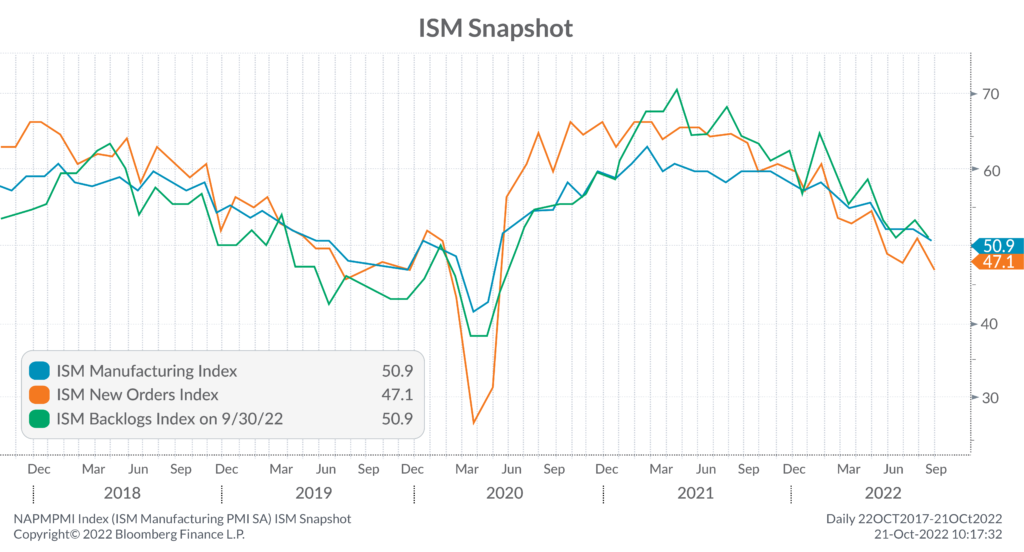

1. ISM measures are weakening

Manufacturing conditions continue to weaken with the ISM Manufacturing Index steadily decreasing. More specifically, new orders have contracted, and backlogs are approaching contraction.

What this means for you: Expect lower demand to continue into the near-term as the economy begins to slow down. To better manage inventory, consider moderating production to meet the constraints of diminishing new orders and backlogs.

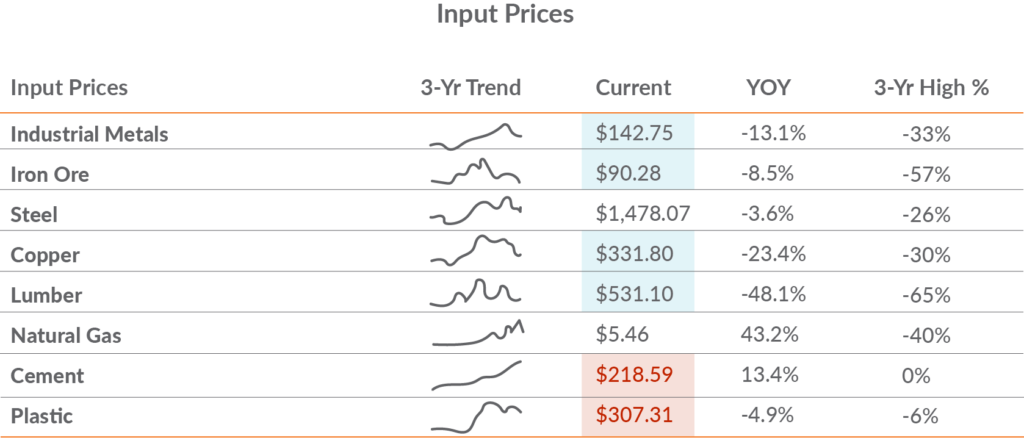

2. Input costs continue to decline

Input prices continue to trend lower as the Federal Reserve’s (Fed) Quantitative Tightening (QT) policies curb inflationary pressures. Cement and plastic prices remain elevated, yet these indices tend to lag, so expect them to decline in the future.

What this means for you: Lower input prices will provide relief from the inflationary pressures that manufacturers have experienced through higher costs of goods sold. Yet, the reversal of these input prices also reflects weakening demand, so anticipate a further slowdown in new orders in the near-term.

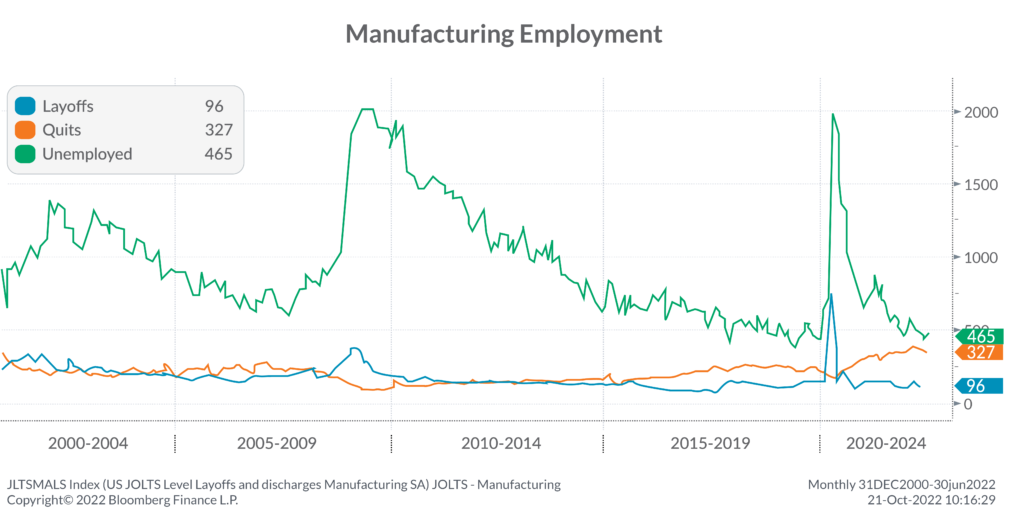

3. Labor conditions improve as the number of quits decreases

In the post-pandemic world, quit rates in the Manufacturing & Distribution sector have been historically high as wage inflation had low-skilled laborers gravitating towards higher paying jobs within any sector. More recently, the number of quits has diminished as a slowdown in the economy may be shifting employees’ mindsets toward job security, and less on higher wages.

What this means for you: Although the demand for labor appears to be less competitive and the power is shifting more into the hand of the employer rather than the employee, the overall number of quits remains historically elevated. Continue to offer appealing benefits packages for new and existing employees to deliver a better customer experience to protect revenue as the economy slows, while implementing more variable compensation opportunities.

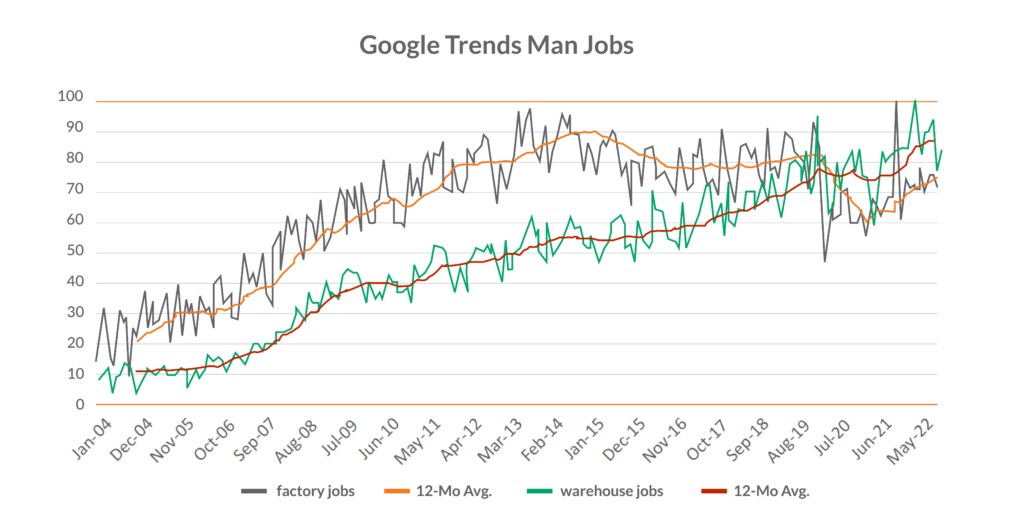

4. Warehouse and factory jobs are rising in demand

According to data from Google Search Trends, demand for “warehouse jobs” and “factory jobs” continues to climb. With lower-skilled workers searching for the highest pay regardless of industry, it appears, from this data, that the manufacturing sector may be relatively well-positioned to attract talent.

What this means for you: If quit rates continue to decrease and demand for manufacturing jobs continues to increase, look to potentially reduce overhead costs with more balanced compensation packages. Shifting from a cycle of quantitative easing induced economic growth to a quantitative tightening induced slowdown should provide better leverage to negotiate fairer wages and reduce overhead costs.

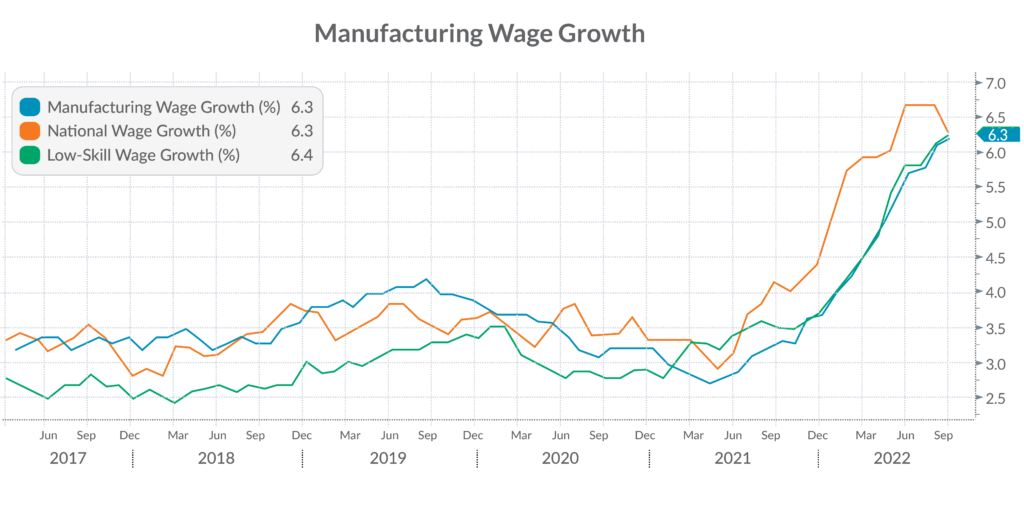

5. Wages for manufacturing jobs may have reached a peak

Manufacturing and low-skilled wage growth continues to climb to historic highs while national wage growth appears to have potentially reached a peak.

What this means for you: As the Fed continues to raise rates to stifle inflation, expect wage pressures to slow.

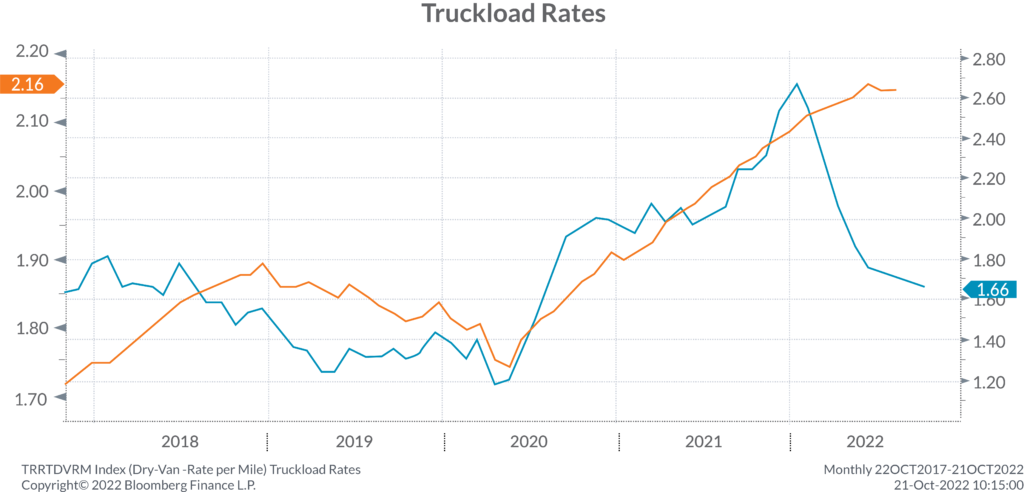

6. Truckload Spot Rates indicate Contractual Rates may need to decline

Truckload spot rates have reverted to normal levels after climbing considerably in a post-COVID, high-inflation environment. While contractual truckload rates remain elevated, they do tend to lag the spot market and may trend lower to reflect the current market reality.

What this means for you: The slowdown of the economy has also hit the logistics market with truckload rates declining. Discuss lower contractual rates with your logistics provider to reduce shipping costs as we head into a period of weaker demand.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (October 30, 2022) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Adam Beckerman, CPA, CGMA

Adam Beckerman is Aprio’s Manufacturing and Distribution Leader and Assurance Partner. Adam's team of 30 professionals focus on the manufacturing industry with 20+ years of experience enabling the success of manufacturing start-ups, growth companies and businesses preparing for equity events.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.