6 Manufacturing & Distribution Insights from Q2 2025 and What They Mean for You

April 21, 2025

U.S. manufacturing is showing signs of renewed strain, as demand has softened and both New Orders and Production have slipped back into contraction. Rising input costs—particularly in steel, copper, and natural gas—are creating margin pressure, while hiring has leveled off and backlogs are gradually thinning. Although logistics data is mixed, the overall environment calls for careful planning as the cushion for inefficiencies continues to narrow.

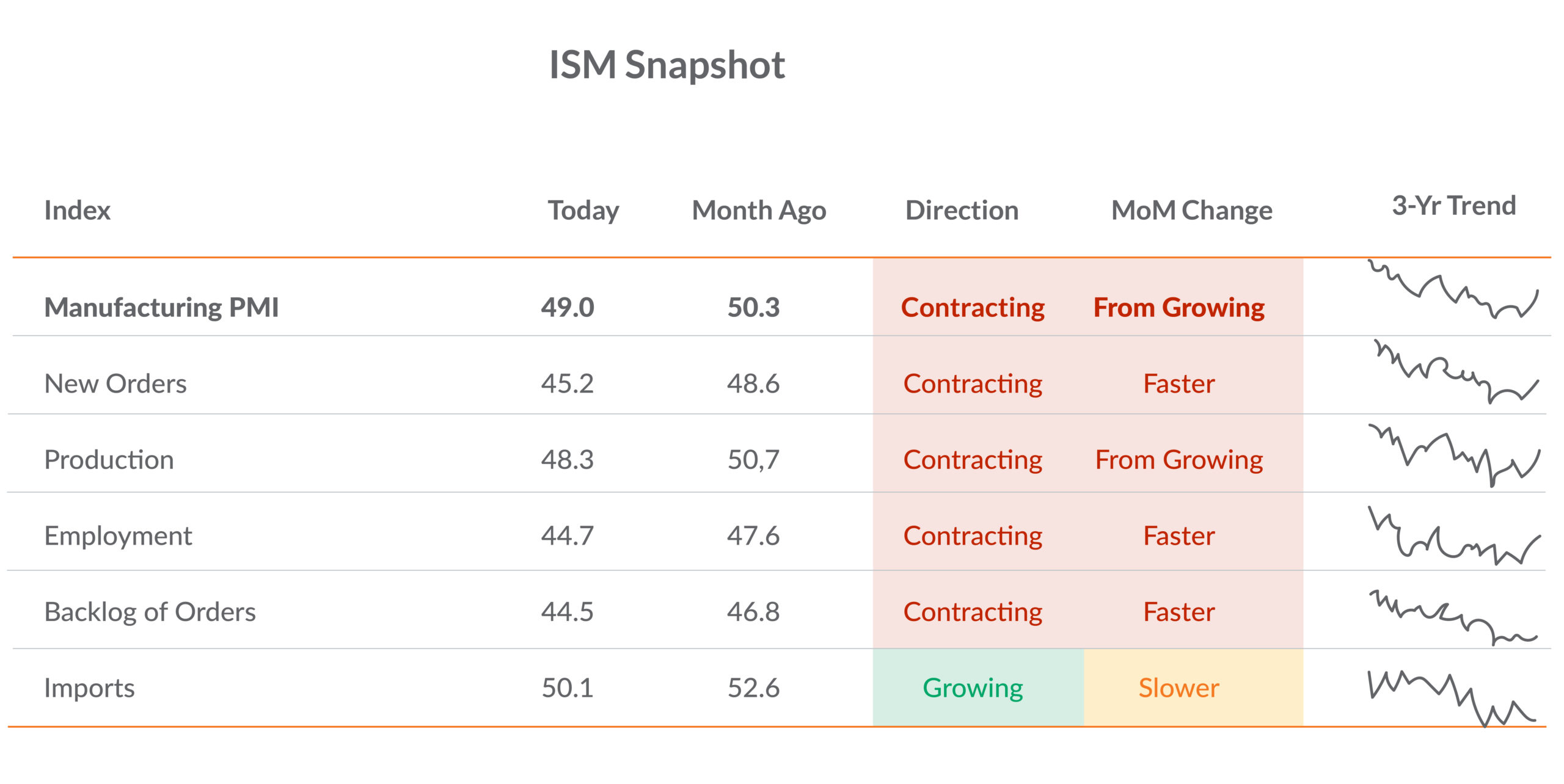

1. ISM Manufacturing PMI Slides Back into Contraction

Source: Institute of Supply Management (ISM)

Results from the ISM Manufacturing Index have declined to 49.0 in March from 50.3, technically slipping into contraction. New Orders (45.2) and Production (48.3) both fell below 50, signaling slower factory activity. Employment (44.7) and Backlogs (44.5) have also deteriorated, signaling a reduction in workforce and future work in the pipeline. Imports have begun to edge higher reflecting anticipation of the since-announced tariffs, but at a slower rate.

What this means for you: The surge earlier in the year has quickly fizzled as we fall back in a soft patch. Orders are cooling and manufacturers are responding by pulling back on production and headcount. Businesses should brace for a slower pace and prioritize short-cycle planning, conservative production targets, and tighter cash flow management.

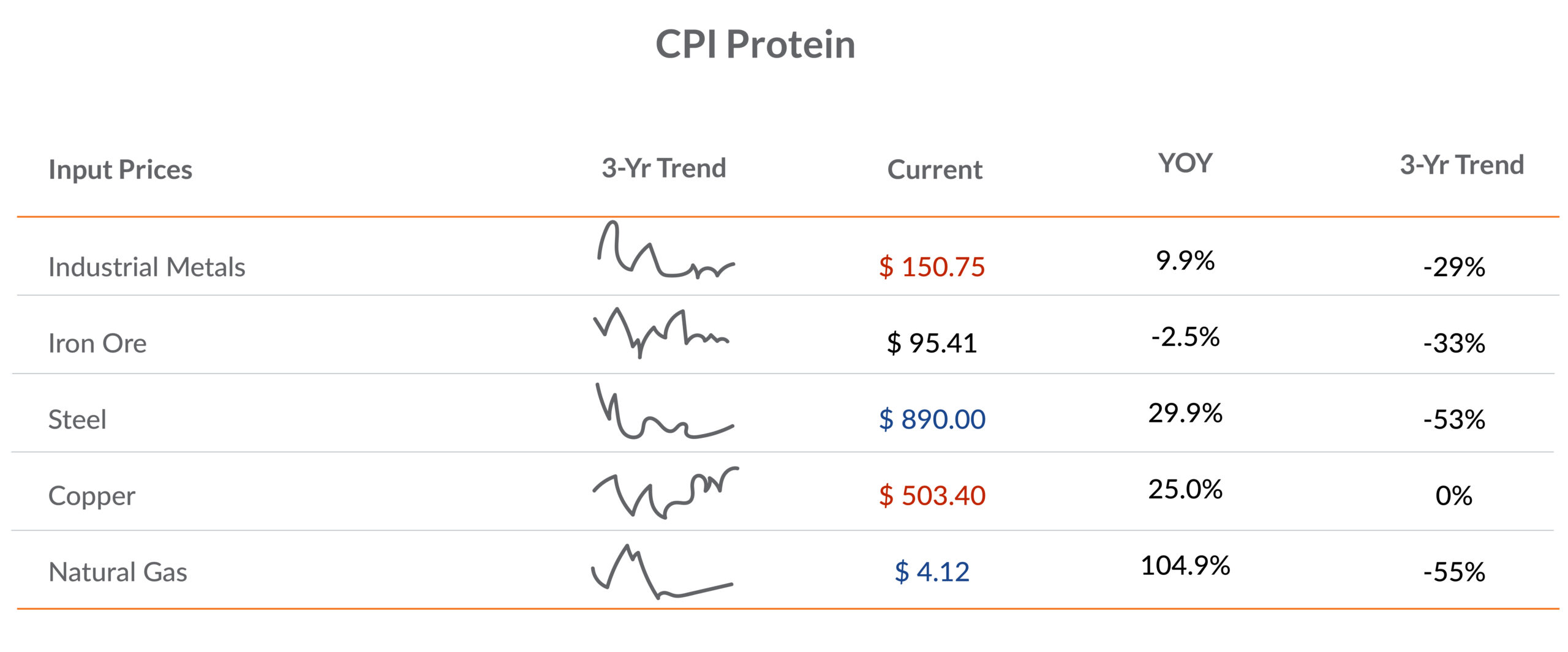

2. Steel, Copper, and Gas Lead the Rise in Input Prices

Source: Bloomberg Finance, LP

After two years of mostly declining input costs, key materials are turning higher—steel is up nearly 30%, copper 25%, and natural gas has more than doubled year-over-year. Prices remain below recent peaks, but the trend has clearly shifted upward, and that matters for margins.

What this means for you: While what we are currently experiencing is not 2021-style inflation, cost creep is real and is now compounded by the return of tariffs. With higher duties on imported steel and aluminum driving up material costs, it’s time to revisit supplier agreements, evaluate hedging strategies, and strengthen cost tracking. If your balance sheet allows, strategic pre-buys of critical inputs could help insulate margins from further policy-driven price volatility.

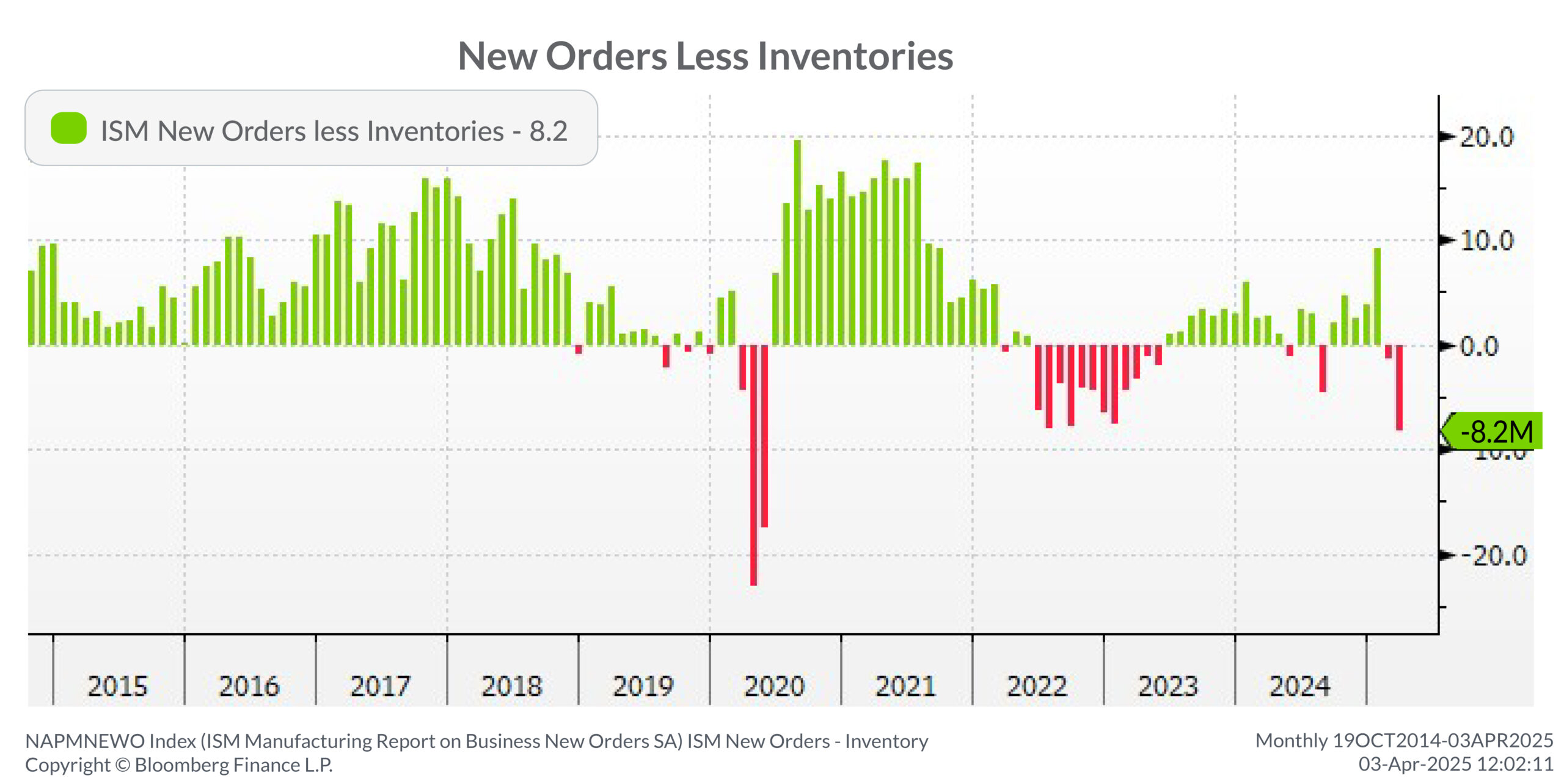

3. New Orders Are Falling Behind Inventories

Source: Bloomberg Finance, LP

The ISM’s New Orders minus Inventories reading has turned sharply negative at -8.2. Historically, when this figure stays below zero, it signals deteriorating demand and excess inventory.

What this means for you: A caution flag is waving at manufacturers in the form of falling new orders. Inventories accelerated ahead of tariffs, yet orders aren’t keeping up. Manufacturers should remain vigilant in watching inventory turns, especially for slow-moving items and use near-term forecasting tools to match future purchasing with real-time demand.

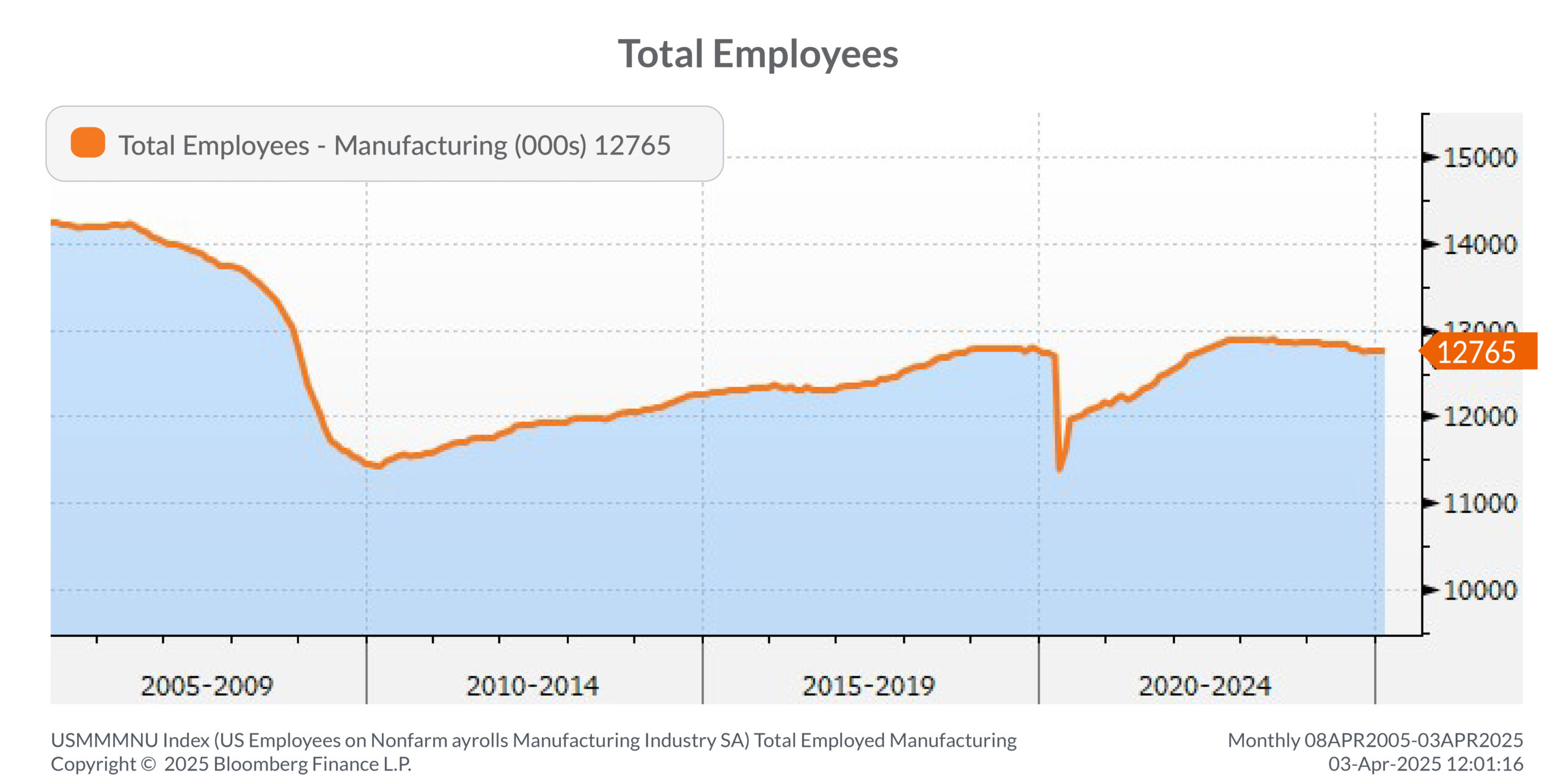

4. Factory Employment Growth Has Stalled

Source: Bloomberg Finance, LP

After a solid recovery post-COVID, total U.S. manufacturing employment has plateaued at around 12.8 million workers. Hiring has flattened, and the trend shows no recent signs of expansion.

What this means for you: The talent market may be stabilizing, but it’s not loosening. Use this time to focus on retention, training, and automation, especially for hard-to-fill or repetitive roles. Consider cross-training teams to build flexibility into your labor force and avoid over-hiring if orders remain weak.

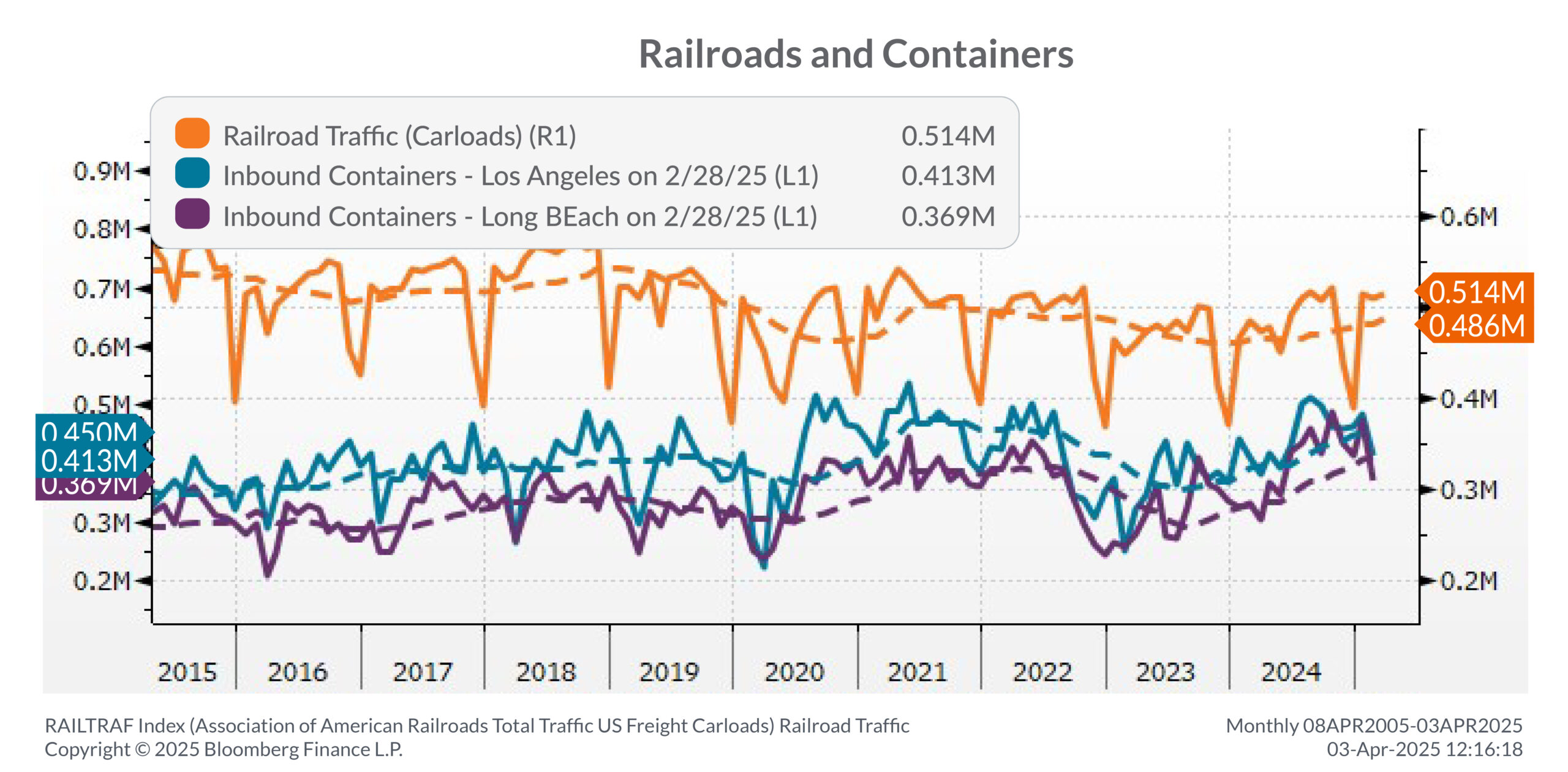

5. Rail and Container Activity Show Signs of Normalization

Source: Bloomberg Finance, LP

Railroad carload traffic has ticked higher pointing towards steady domestic freight movement, potentially benefiting from more import activity. Inbound containers at Los Angeles and Long Beach—two key U.S. ports—are up slightly from last year, though remain well below 2022 levels.

What this means for you: Overall, Logistics is stabilizing but it’s a tale of two channels. If your supply chain depends on overseas goods, delays and variability may persist. On the other hand, increased rail traffic points to continued investment in domestic distribution. Nearshoring and reshoring strategies remain attractive.

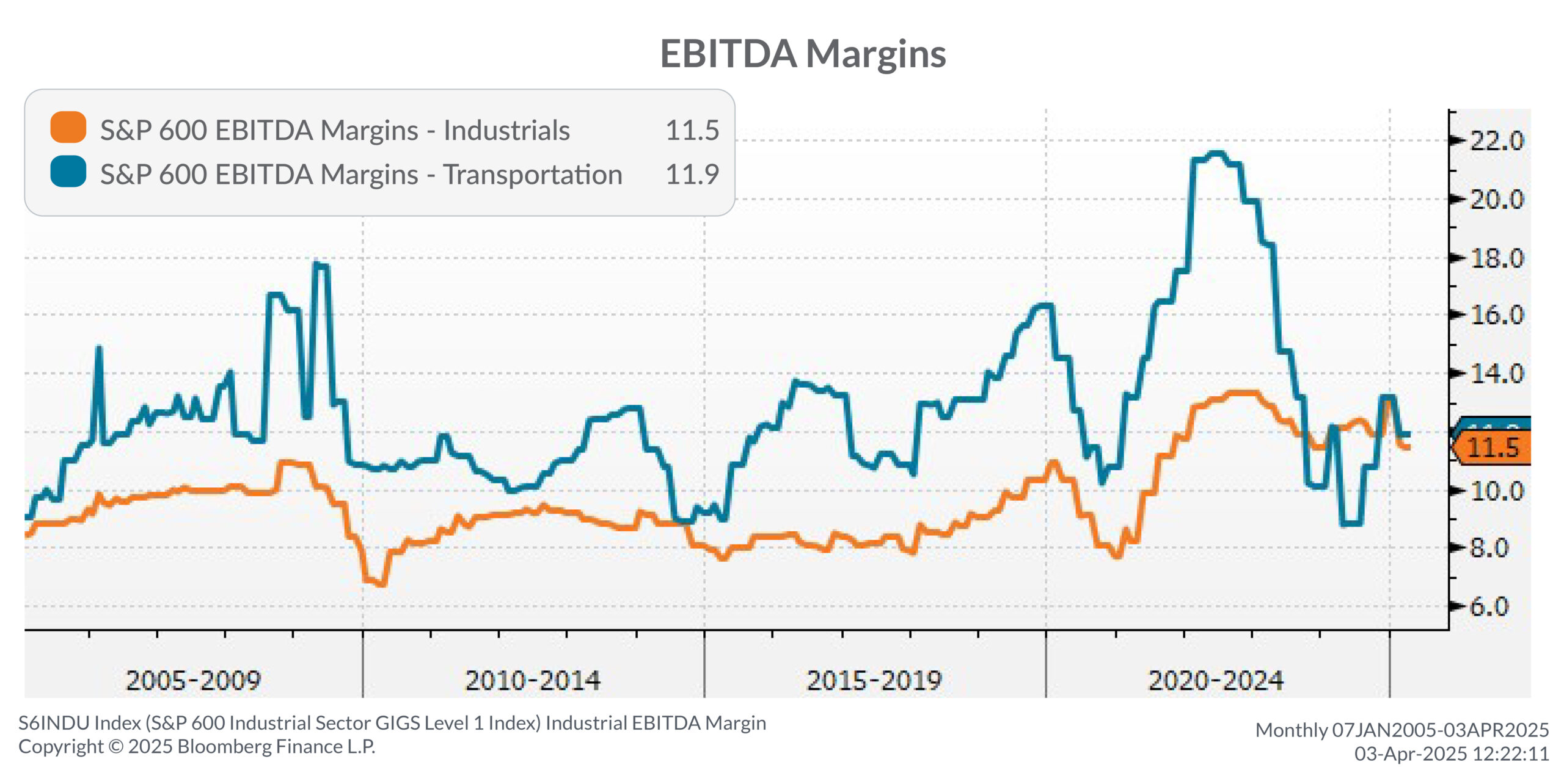

6. Margins are Holding Steady, but with Different Stories Beneath the Surface

Source: Bloomberg Finance, LP

EBITDA margins for small-cap Industrials (11.5%) and Transportation (11.9%) remain positive but have been unseated from their highs. Industrial margins are flat year-over-year, while Transportation is feeling pressure from rising fuel, insurance, and labor costs. With 2025 tariffs pushing input prices higher and a potential slowdown ahead, protecting margins will take more active cost control and pricing discipline.

What this means for you: Staying profitable in this environment means staying efficient. For manufacturers, that means tightening operations and evaluating sourcing. For distribution and logistics-heavy firms, focus on route efficiency, load optimization, and fuel management. Margins are holding, but the buffer is getting thinner.

This commentary is brought to you by our advisors at Aprio. Have any questions? Don’t hesitate to contact our team today.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Adam Beckerman, CPA, CGMA

Adam Beckerman is Aprio’s Manufacturing and Distribution Leader and Assurance Partner. Adam's team of 30 professionals focus on the manufacturing industry with 20+ years of experience enabling the success of manufacturing start-ups, growth companies and businesses preparing for equity events.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.