6 Manufacturing & Distribution Insights from Q1 2025 and What They Mean for You

January 21, 2025

The U.S. manufacturing sector is at an inflection point, marked by improving new orders, better-aligned inventories, and rising rail traffic—a clear indicator of reshoring momentum. While input prices for most industrial metals continue to decline, natural gas prices remain an outlier, reflecting uneven cost trends. Transportation metrics reveal a dynamic landscape: container rates are rising due to strong demand, while truck rates are declining as localized networks face fewer constraints. At the same time, EBITDA margins are improving in both industrial and transportation sectors, signaling opportunities for manufacturers to enhance productivity and operational efficiency.

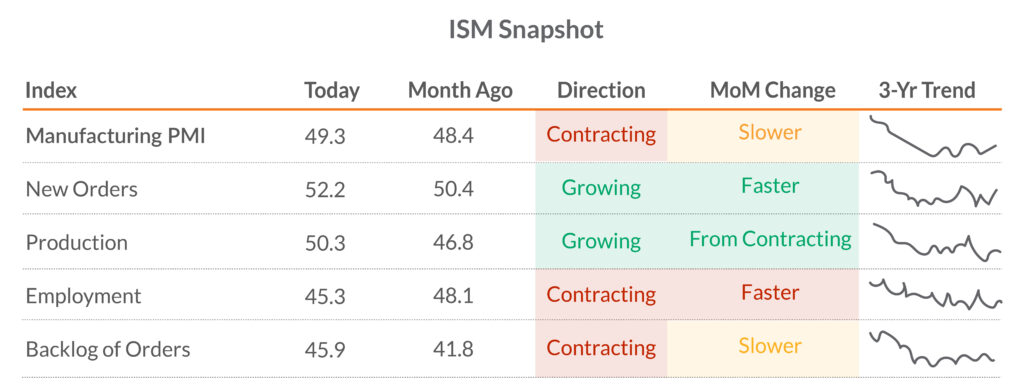

1. Manufacturing PMI Shows Signs of Stabilization

Source: Institute of Supply Management (ISM)

The latest ISM Manufacturing PMI data shows the sector is still contracting, with a PMI reading of 49.3, although this is an improvement from a PMI reading of 48.4 last month. New Orders and Production are now in growth territory, with faster month-over-month momentum, signaling improving demand and increased activity on the factory floor. However, Employment remains in contraction, accelerating its decline, reflecting ongoing challenges in labor availability or adjustments in workforce planning. Backlogs of Orders, while contracting, are declining more slowly, which could indicate a gradual alignment of supply chain capacity with demand.

What this means for you:

The ISM data shows improving demand, with growth in New Orders and Production, but ongoing challenges with labor shortages and supply chain alignment, as reflected in contracting Employment and Backlogs. To grow cash flows and protect balance sheets, companies should focus on operational efficiency by investing in automation and streamlining processes to reduce reliance on labor. Falling input costs provide an opportunity to renegotiate supplier contracts, but rising natural gas prices require close attention. Businesses should try to align inventory levels with demand, explore additional revenue streams, and position themselves to capitalize on reshoring trends to ensure both short-term stability and long-term growth.

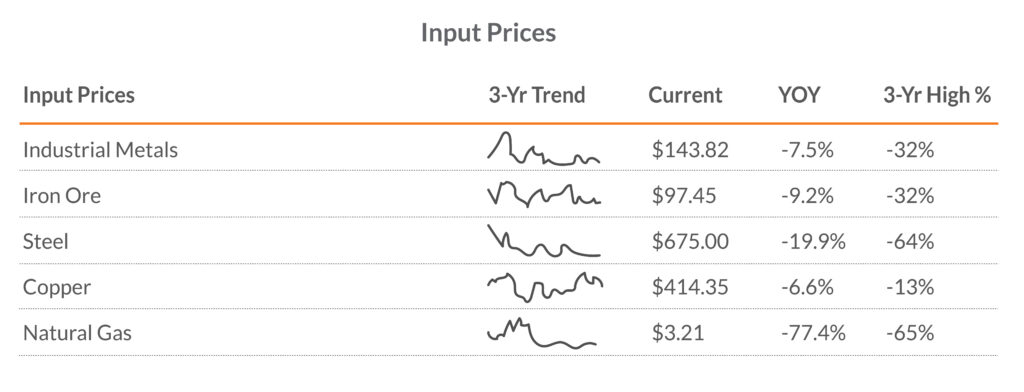

2. Input Prices Are Mixed for Manufacturers

Source: Bloomberg Finance, LP

Input prices remain cool with year-over-year declines in key commodities such as steel (-19.9%) and other industrial metals (-7.5%). However, natural gas prices have surged by 77.4% off trough levels, adding potential pressure on energy-intensive operations.

What this means for you:

To the extent that one can, manufacturers should leverage declines in metal prices to reduce production costs through pre-buys and other means to improve margins, while addressing the surge in natural gas prices through energy efficiency initiatives and alternative sources. Adopting strategies like hedging or fixed-rate contracts can further mitigate cost volatility and ensure financial stability.

3. Trends in New Orders and Inventories Show Signs of a Recovery

Source: Bloomberg Finance, LP

New orders have exceeded inventories for three consecutive months, marking a recovery from previous contractions. Historically this has been a good leading indicator of industry health. This improvement reflects better alignment of production and procurement strategies with current demand, coupled with a stabilization of supply chains.

What this means for you:

With supply chains stabilizing, businesses can enhance inventory turnover by integrating demand forecasting tools and real-time analytics. This approach allows for swift adjustments to market changes, minimizing overstock or shortages while boosting efficiency. Agile planning and regular inventory reviews are crucial for maintaining balance in a dynamic economic climate.

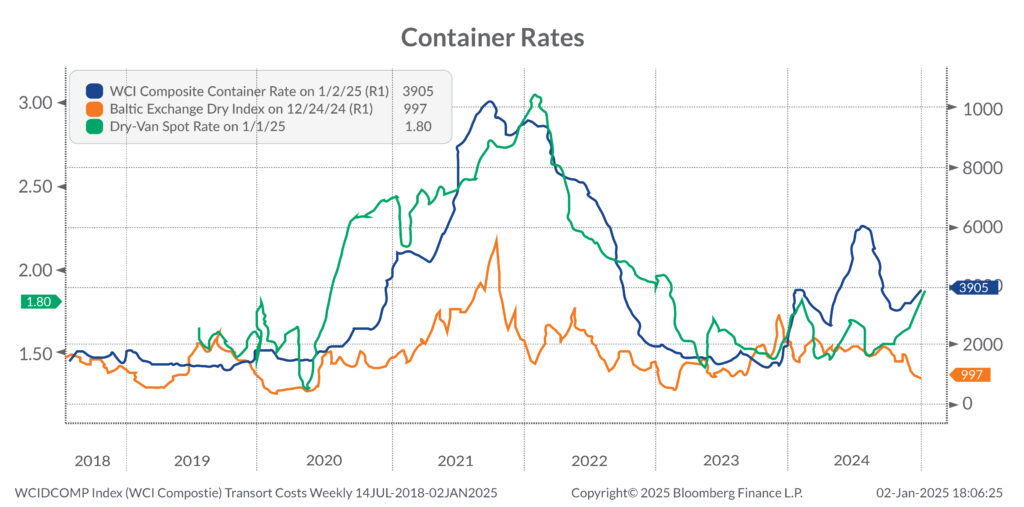

4. Transportation Rates Highlight Shifting Trends

Source: Bloomberg Finance, LP

Logistics indicators reflect both challenges and opportunities. The WCI Composite Container Rate increased to $3,905 per container, driven by higher demand, which may have been impacted by pre-buying ahead of potential tariff increases or implementation. Meanwhile, the Baltic Exchange Dry Index fell, reflecting a slowdown in bulk shipping activity and highlighting ongoing challenges in global trade and demand. However, dry-van spot rates rose, reflecting increasing demand pressures and potential constraints in localized distribution networks.

What this means for you:

Manufacturers should anticipate higher transportation costs in the near term, driven by rising container rates and increasing demand pressures in the logistics sector. However, falling truck rates offer a potential reprieve for localized distribution, emphasizing the importance of regional supply chains and shorter distribution routes to manage costs effectively and enhance delivery efficiency.

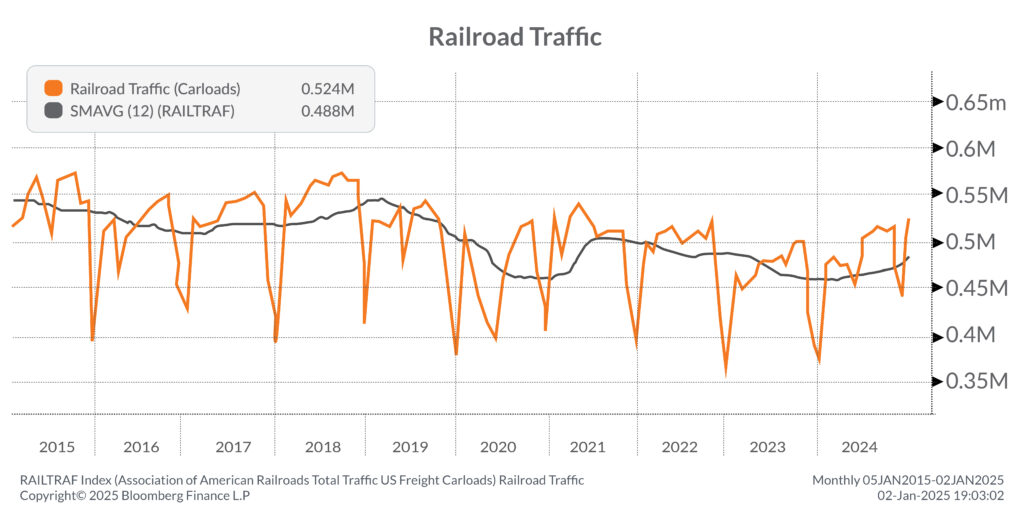

5. Railroad Traffic Shows Resilience Amid Supply Chain Shifts

Source: Google Trends

Railroad traffic is picking up, signaling a rebound in activity and greater utilization of domestic rail networks. This upward trend underscores the essential role of rail networks in supporting reshoring efforts and addressing increasing logistics demands. As rail traffic grows, it reinforces its position as a dependable backbone for manufacturers navigating shifting supply chain dynamics and seeking stable transport solutions.

What this means for you:

As reshoring accelerates alongside rising rail traffic, manufacturers can capitalize on domestic transport reliability to strengthen supply chain resilience. By investing in advanced manufacturing technologies and fostering local partnerships, they can mitigate higher labor costs and enhance operational agility, positioning themselves for long-term growth.

6. EBITDA Margins Are Improving Across Small-Cap Industrial Sectors

Source: Bloomberg Finance, LP

The S&P 600 Industrials sector is seeing a steady improvement in EBITDA margins, driven by streamlined operations and stable demand conditions. Similarly, the transportation sector’s margins are rebounding as efficiency initiatives, improved logistics, and moderating fuel costs take hold.

What this means for you:

The improving margins in both industrials and transportation highlight the importance of focusing on productivity in challenging demand environments, including maintaining disciplined cost controls. For transportation-reliant businesses, enhanced logistical strategies and the adoption of advanced technologies are imperative to sustaining this positive trend and ensuring operational efficiency.

This commentary is brought to you by our advisors at Aprio. Have any questions? Don’t hesitate to contact our team today.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Adam Beckerman, CPA, CGMA

Adam Beckerman is Aprio’s Manufacturing and Distribution Leader and Assurance Partner. Adam's team of 30 professionals focus on the manufacturing industry with 20+ years of experience enabling the success of manufacturing start-ups, growth companies and businesses preparing for equity events.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.