6 Key Tech Industry Insights and What They Mean for Your Business

March 8, 2024

2024 First Quarter Report

What we are seeing in technology

Economic uncertainty and high capital costs have led to a decline in venture capital deals, while generative AI, particularly in training language learning models (LLM), is driving growth in the tech market. Publicly traded companies see high valuations, but fintech firms are trading at a discount. Layoffs in the tech sector have increased amid economic stress and a shift in focus towards cash flow and profitability. Slowing software GDP growth suggests reduced demand, and cloud security spending is rising due to AI-driven cyber threats.

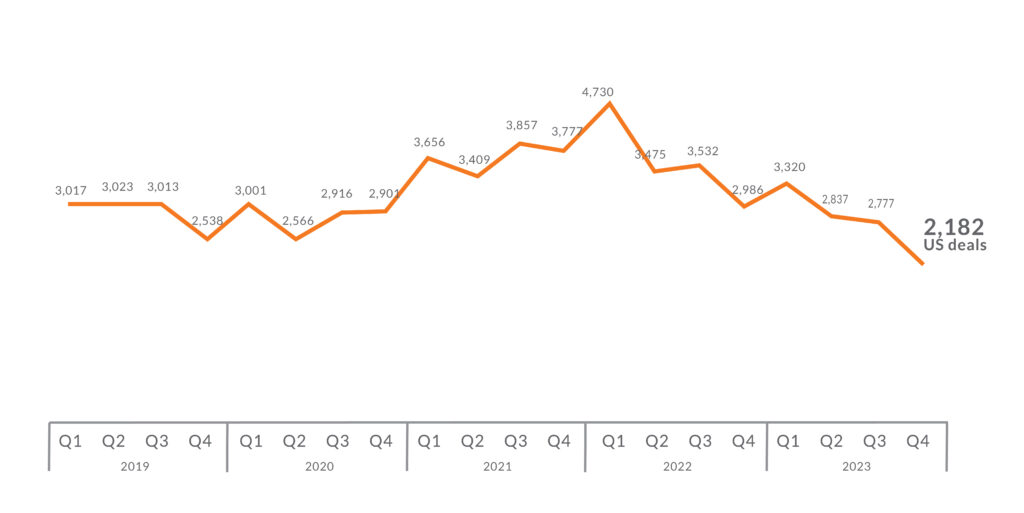

1. Venture capital deals decline to pre-pandemic levels

Economic uncertainty and unreceptive public markets have dealmakers more cautious with their dry powder. Consequently, venture capital deals have declined to a 10-year low following a post-pandemic boom in 2020-2021.

What this means for you: Outside of AI, expect the fundraising environment to remain challenging over the near-term and dealmakers to be more selective. To navigate this type of environment, focus on minimizing cash burn through maximizing operational and capital efficiency, assume elongated periods of funding, and look to forge partnerships to leverage synergies and strengthen your competitive position.

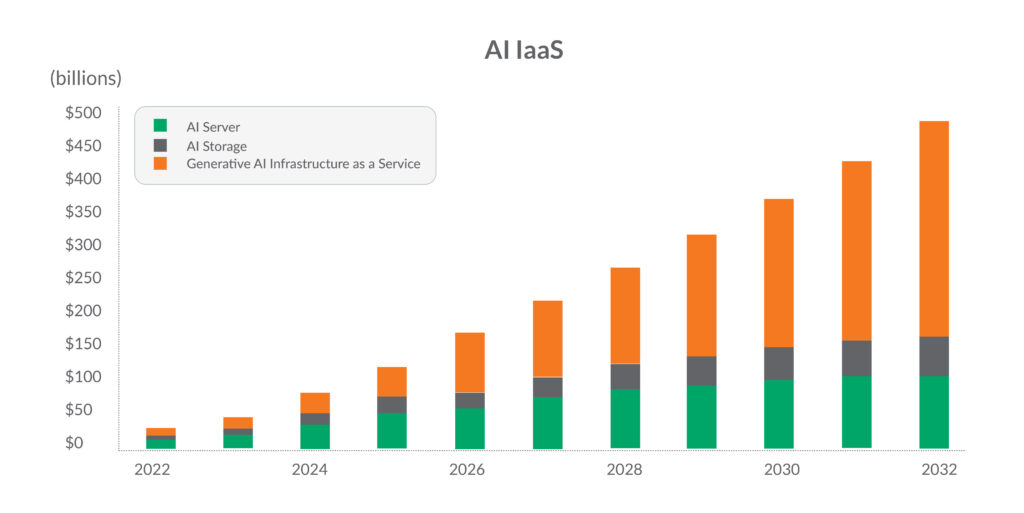

2. LLM training to drive growth in IT infrastructure

While growth should occur across AI investments, training in LLMs is set to be a key driver in the generative AI market, as demand for servers and storage units at data centers rise. The growth rate for generative AI and infrastructure-as-a-service is expected to eclipse the growth rate of servers and storage as companies deploy greater use of the public cloud for deploying LLMs.

What this means for you: Investing in or expanding your offerings to leverage generative AI infrastructure and services could be strategically advantageous for your business’ growth and success. If there is an opportunity to leverage generative AI and infrastructure-as-a-service, it could accelerate further growth.

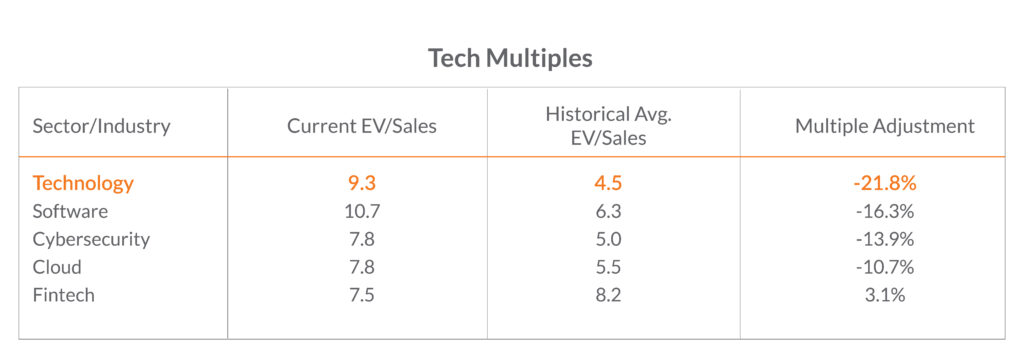

3. Publicly traded tech companies are trading at large premiums

Valuations of publicly traded companies are above historical averages as the wave of remote work and generative AI drive valuations higher. The exception is fintech companies, which are trading at a discount relative to history.

What this means for you: Despite venture capital deals decreasing, valuations remain high. This provides optimism for companies with fast growth and a path to profitability that may consider an exit, such as through an IPO or acquisition in 2024.

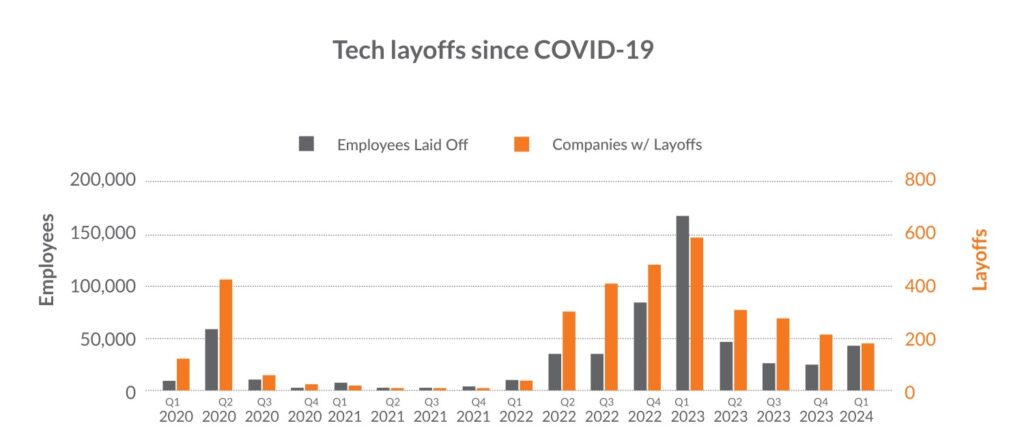

4. The number of layoffs per company are rising in 2024

Layoffs in the tech industry have slowed after the large wave in 2022 that arose due to the post-pandemic over-hiring. However, since the start of 2024, layoffs per company have begun to increase as companies focus on cash flow and profitability.

What this means for you: Increased layoffs in the tech industry may present both challenges and opportunities. It’s essential to remain vigilant, adaptable, and empathetic to the impact on employees and the broader business ecosystem. Expect competitors to reduce headcount to protect margins, potentially at the expense of developing new products. Use this as an opportunity to hire great talent that may become available.

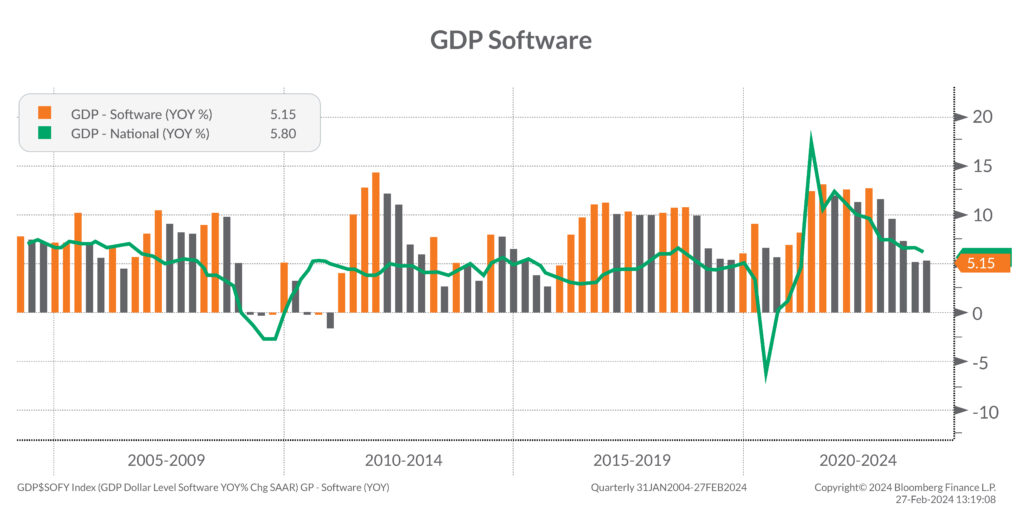

5. The growth rate of software GDP is slowing

GDP growth for software, which has historically been above average, has slowed below the broader economy’s GDP growth rate. A slowdown in software GDP may indicate more scrutiny by consumer and corporate purchasers as well as extended sales cycles.

What this means for you: While a slowing GDP growth rate for software may present challenges for tech companies, it also creates opportunities for those that can adapt quickly, innovate products, and provide value to customers. By staying agile, customer-focused, and financially prudent, your company can navigate the market slowdown.

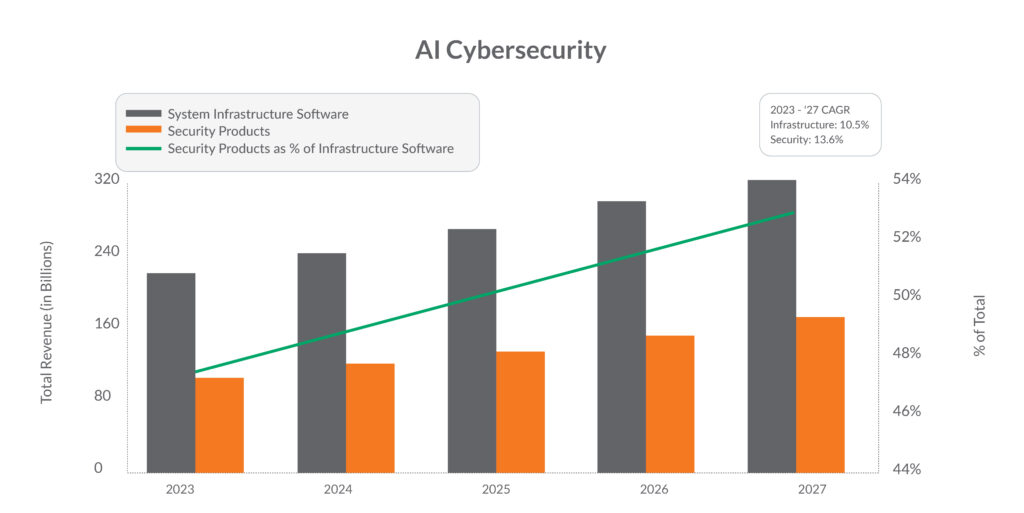

6. AI cyberattacks increases the demand for cybersecurity

The investment in cloud security is forecasted to become a greater percentage within cybersecurity budgets across industries. Security has typically been a small non-discretionary portion of IT budgets, but increased spending on cloud security will be essential for companies as cyberattacks have become increasingly more sophisticated due to AI.

What this means for you: Anticipate an increase in your budget to accommodate the growing need for cybersecurity. The shift towards increased spending on cloud security presents opportunities for security-oriented tech companies, while budgets for other technology products may be negatively impacted. Consider whether your company is likely to benefit or be threatened by the increased cybersecurity spending related to AI.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (March 1, 2024) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Mitchell Kopelman

National Leader in Aprio’s Technology Practice, and Tax Partner, Mitchell works with SaaS companies in FinTech, HealthTech, Transaction Processing, Blockchain and Gaming. Whether a company is pre-revenue, starting up, growing, or preparing for a liquidity event, Mitchell works with them to maximize their potential at each stage. He is known for promoting research, innovation and entrepreneurship by enabling companies to be successful, regardless of where they are in their business lifecycle.

(404) 898-8231

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.