6 Key Restaurant Industry Insights and What They Mean for Your Business

September 2, 2024

2024 Third Quarter Report

What we are seeing in restaurants

Restaurant operators should brace for tighter market conditions as performance metrics contract. While transaction growth is stabilizing, the quick service and fast casual segments are seeing slight declines, and same-store sales growth is plateauing. Rising costs, particularly in food away from home and protein prices, could dampen consumer spending while squeezing restaurant margins. Additionally, high turnover rates in non-management roles continue to hinder operational efficiency and service quality, which means owner/operators should focus on optimizing labor management, streamlining operations, and strategically adjusting menu offerings to maintain profitability.

Here are six key takeaways to keep in mind as we head into the last few months of the year:

1. Restaurant business conditions weaken further

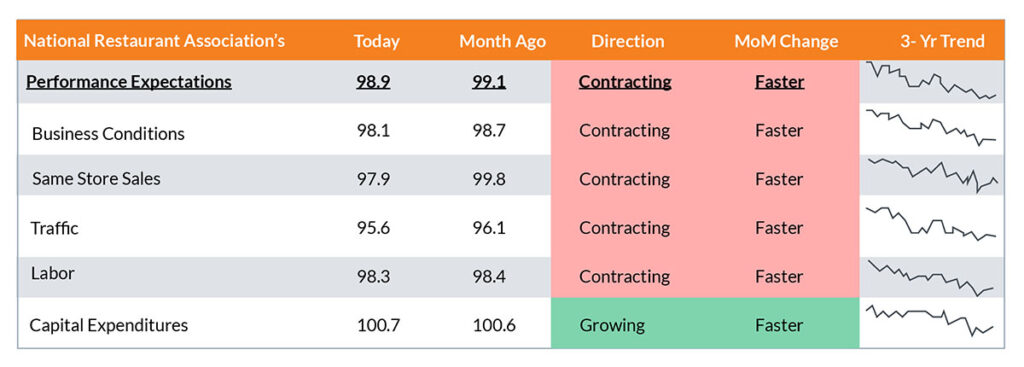

The National Restaurant Association’s performance expectations indicate a contraction across most metrics compared to the previous month. Business conditions, same-store sales, traffic, and labor are all experiencing faster contraction rates. Capital expenditures, however, show slight growth.

What this means for you: The accelerated contraction in key performance areas suggests tightening market conditions. Restaurant owners should explore cost-saving measures and focus on operational efficiencies to navigate these challenges. Despite these headwinds, the slight growth in capital expenditures indicates optimism about long-term growth and productivity investments.

2. Transaction growth reverts to year-over-year declines

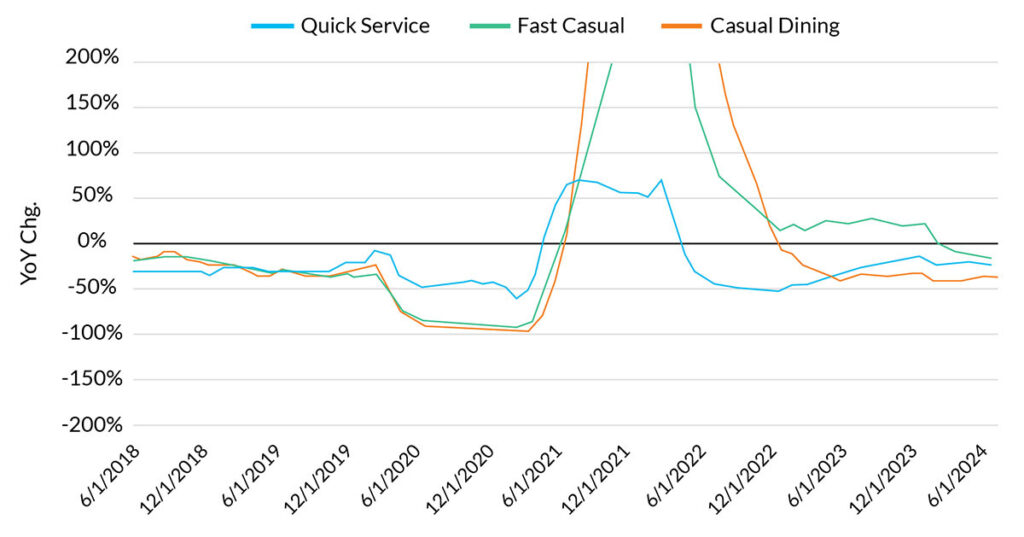

Transaction growth across quick service, fast casual, and casual dining sectors has reverted to year-over-year declines. All three categories experienced significant rises post-pandemic but have quickly regressed to pre-pandemic declines.

What this means for you: The stabilization and subsequent decline in transaction growth suggests a potential shift in consumer behavior or spending power. It’s essential to analyze customer preferences and adjust marketing strategies to reignite growth. Casual dining establishments may focus on maintaining their current clientele while investing to attract new customers.

3. Growth in same-store sales stabilizes

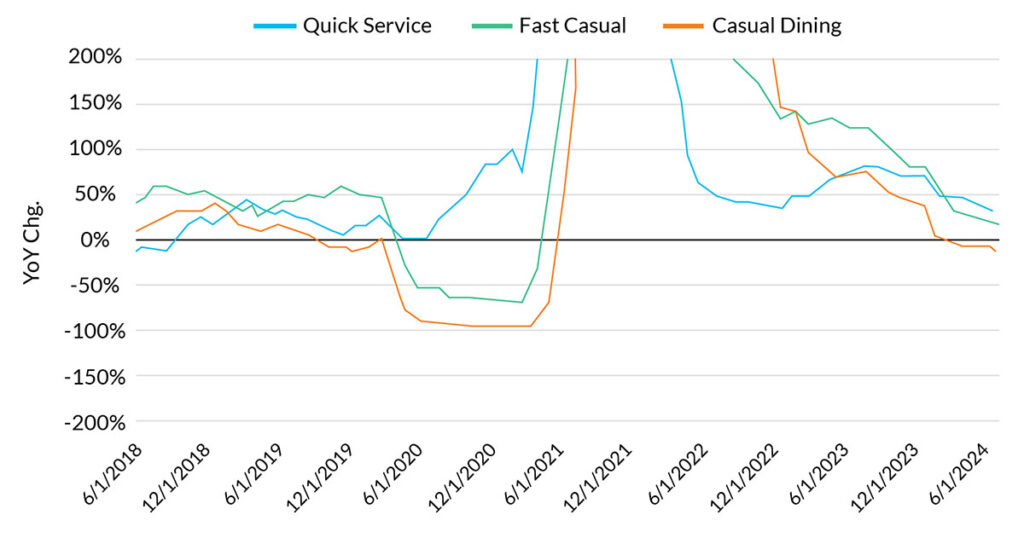

Like transaction growth, same store-sales rose post-pandemic, but more recently, sectors have seen sales experience a gradual decline. Current trends indicate that growth is normalizing.

What this means for you: Growth momentum is waning. Restaurant operators should prepare for modest growth, and possibly, plateauing sales. Strategic initiatives such as menu innovation, loyalty programs, and targeted promotions could help sustain sales levels and drive incremental growth.

4. Cost of dining out continues to outpace the cost of eating in

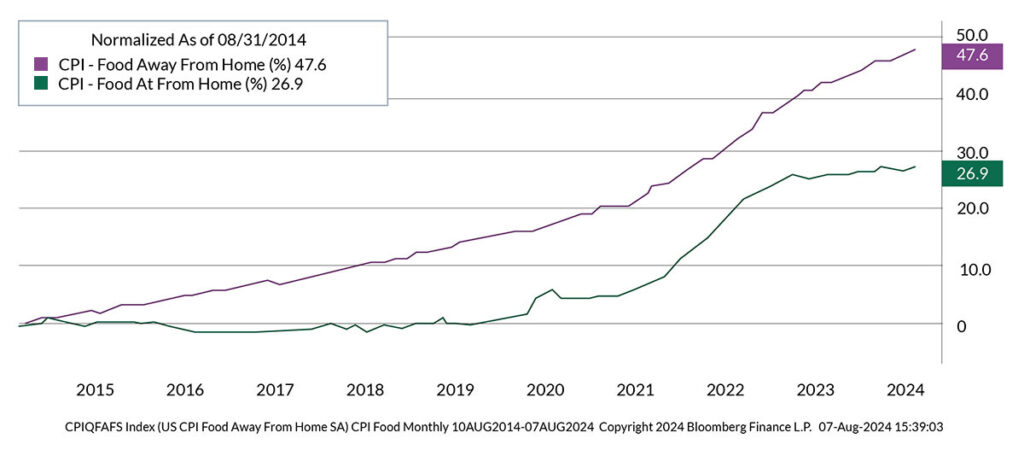

CPI data highlights a sharper increase in the cost of food away from home compared to food at home over the past decade. This gap has further widened in recent years, with food away from home increasing notably faster.

What this means for you: Rising costs for dining out may pressure consumer spending and restaurant margins as consumers evaluate dining out’s relative value. Operators need to manage costs effectively while justifying menu prices through enhanced value propositions, such as superior service, unique dining experiences, convenience, or high-quality ingredients. Marketing strategies highlighting the benefits and value of dining out can help mitigate the impact of rising prices.

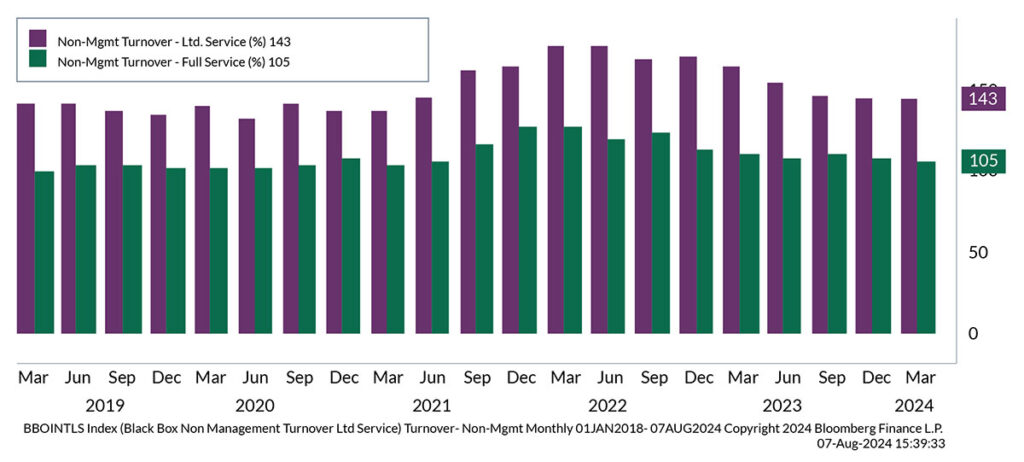

5. Employee turnover has come down but remains high overall

Annual turnover rates for non-management staff in limited-service and full-service restaurants have remained high, with limited service showing a higher turnover rate (143%) compared to full service (105%).

What this means for you: High turnover rates indicate challenges in employee retention, impacting service quality and operational efficiency. Restaurant operators should further invest in employee engagement initiatives and career development opportunities to reduce turnover. Enhancing workplace culture and offering flexible working conditions can also improve retention rates.

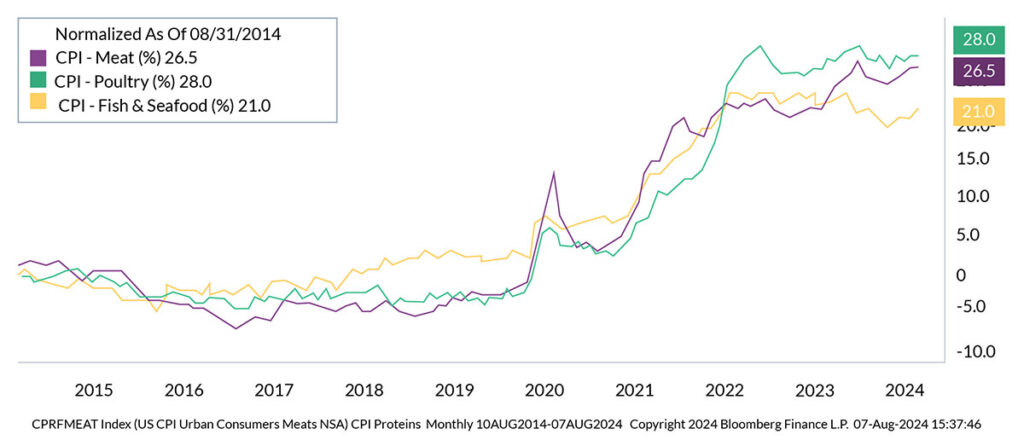

6. Protein costs remain elevated

CPI data for meat, poultry, and fish and seafood indicate significant price increases post-pandemic that remain elevated, with poultry experiencing the highest inflation at 28.0%, followed by meat at 26.5%, and fish and seafood at 21.0%.

What this means for you: Rising protein costs directly impact menu pricing and profitability. Restaurants should consider alternative sourcing, menu innovation, and product bundling to maintain profitability. Communicating these changes transparently to customers can help manage expectations and sustain loyalty.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies. Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Tommy Lee

Tommy Lee, CPA, is the Partner-in-Charge of Aprio’s Restaurant, Franchise, and Hospitality practice. Tommy serves as a strategic tax and business advisor to the executives and owners of middle-market restaurant, franchise, and hospitality operations across the nation. Schedule a consultation with Tommy if you are searching for industry-specific tax and advisory expertise.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.