5 Private Capital Insights from Q1 2025 and What They Mean to You

March 13, 2025

The private capital market continues to evolve as liquidity conditions improve, valuations reset, and sector-specific opportunities emerge. Private equity distributions have turned positive, signaling a rebound in liquidity and potential for reinvestment. While M&A activity is on the rise, particularly in take-private deals, retail real estate remains a stronghold due to constrained supply and rising rents. Private credit continues to offer attractive yield premiums over public bonds, presenting an alternative for income-focused investors. Meanwhile, venture capital is undergoing a valuation reset, creating opportunities for disciplined investors to enter at more reasonable price points. As the market shifts, investors should focus on fundamentals, liquidity strategies, and sector-specific trends to navigate the changing landscape effectively.

If you would like to discuss how private investments fit into your portfolio, please reach out to your Aprio advisor, Simeon Wallis, CFA, Partner and Chief Investment Officer, or Adam Niestradt, CFA, Director of Private Capital.

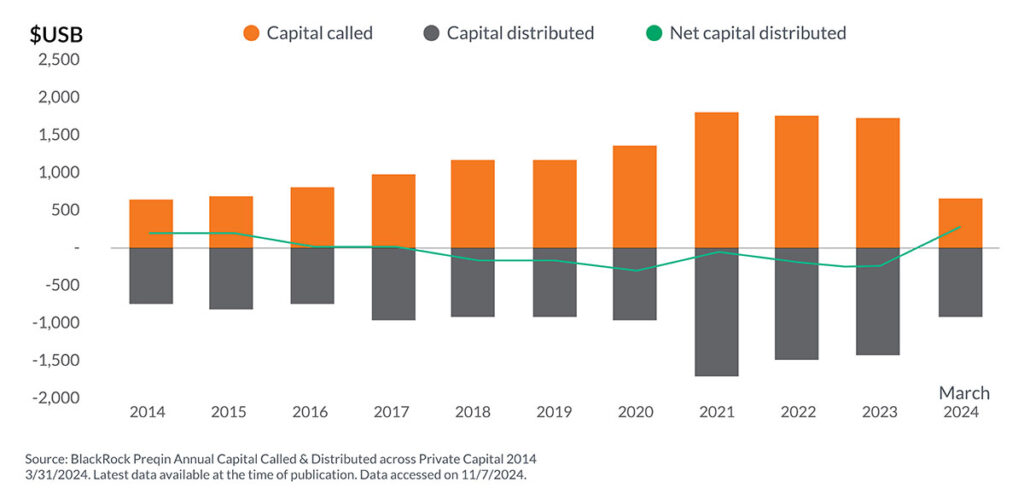

1. Pace of distributions and future expectations

Distributions make a comeback

Breaking an eight-year streak, distributions have started to outpace capital calls.

In early 2024, private capital distributions turned positive after years of net negative returns. Fund managers are beginning to exit investments and return capital as liquidity improves. Stabilizing market conditions, lower interest rates, and stronger M&A activity are supporting this trend. If macroeconomic conditions continue to normalize, distributions are expected to rise further.

What this means for you: Higher distributions improve liquidity and allow for reinvestment into new opportunities. Investors who have been in a capital deployment phase will start to see meaningful cash returns, especially in private equity and real estate. Exit conditions are improving, which could lead to higher valuations. However, investors should closely monitor exit multiples and market trends to assess sustainability.

2. M&A activity and aging private equity assets

Number of Private-Equity portfolio Companies

M&A activity has been muted for the last three years as higher interest rates increased borrowing costs and reduced corporate valuations. Private equity and venture capital firms hold $2.6 trillion in dry powder, with a growing backlog of aging portfolio companies. Nearly 50% of private equity holdings are over five years old, with close to 30% at seven years old or more. However, financial sponsors have been active in take-private deals, surpassing $200 billion in 2024. Public companies see private ownership as an opportunity to restructure outside the pressures of the quarterly earnings reports.

What this means for you: Pent-up exit activity could accelerate as deal conditions improve. Investors should expect more liquidity events, particularly through strategic sales and IPOs. Private equity managers with aging portfolios may be under pressure to realize returns. Secondary markets could present opportunities as investors seek liquidity solutions for older holdings.

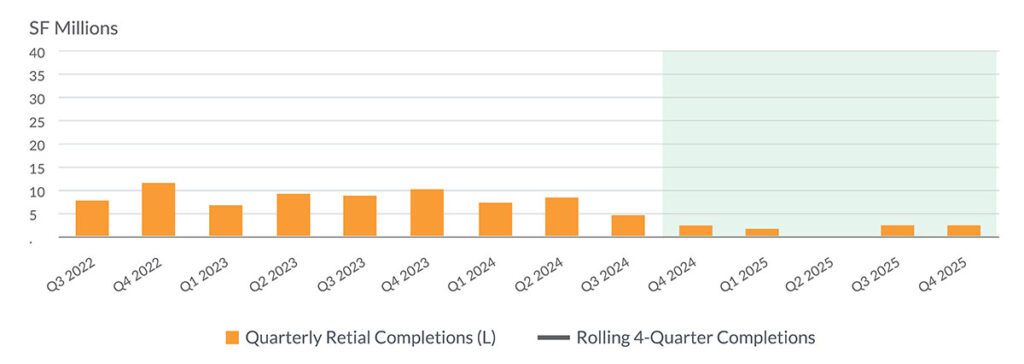

3. Supply and demand in U.S. retail real estate

Retail real estate supply remains constrained, with new completions rapidly declining since 2023. Despite forecasting that suggests there will be fewer new retail developments through 2025, demand remains strong, especially from grocery, healthcare, and experiential retail tenants. However, tight vacancy rates and limited supply continue to push rental prices higher.

What this means for you: Limited supply favors existing retail property owners, supporting higher rents and property values. Investors should focus on well-located assets in high-demand submarkets. Redevelopment and acquisitions present opportunities to capitalize on constrained supply. However, expansion in retail real estate will be difficult, making asset selection critical for investors.

4. Private credit vs. public bond spreads

Exhibit 2: BDC yields noticeably higher than high yield bonds

Private credit continues to offer a significant yield premium over public high-yield bonds. Business development companies (BDCs) have consistently outperformed corporate high-yield bonds since 2019, reflecting the illiquidity premium and higher risk profile. Private credit yields remained elevated post-COVID, underscoring demand for direct lending strategies.

What this means for you: Private credit remains an attractive alternative to traditional fixed income, offering higher yields. Investors should consider middle-market lending opportunities, where spreads compensate for liquidity and credit risk. With banks pulling back from direct lending, private credit is well-positioned for continued growth. However, credit risk and economic downturn exposure should be closely monitored.

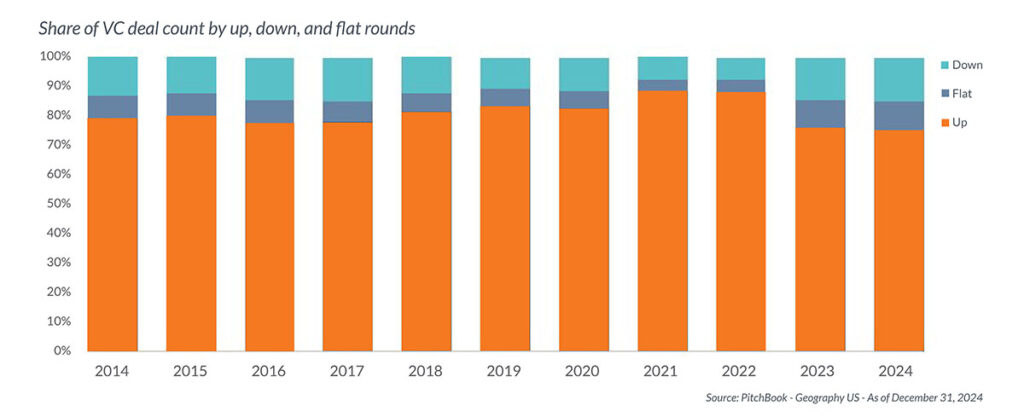

5. Venture capital valuations and down rounds

Greatest percentage of flat and down rounds in a decade

The share of flat and down rounds in venture capital funding has reached its highest level in a decade. Startups that last raised capital during the pandemic boom are now struggling to maintain valuations. High interest rates, inflation, and lower liquidity have slowed venture deal activity, resulting in late-stage startups taking longer to raise capital, often at flat or lower valuations.

What this means for you: Venture capital is in a period of reset, creating opportunities for disciplined investors. Overvalued startups from the zero interest-rate policy (ZIRP) era are being repriced, allowing for better entry points. Investors should focus on companies with strong fundamentals and revenue traction such as AI, which remains a bright spot dominating venture dealmaking and attracting premium valuations.

Disclosure:

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Adam Niestradt

Adam Niestradt, CFA is the Director of Private Capital at Aprio Wealth Management. Adam has over a decade of investment experience with high and ultra-high net worth families with a focus on private capital investments. To discuss these ideas and how they may affect your current investment strategy, email Adam directly at adam.niestradt@aprio.com

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.