4 Private Capital Insights from Q2 2024 and What They Mean for You

June 13, 2024

Private capital is a large, diverse market that has historically rewarded disciplined, long-term investors. Aprio Wealth Management believes strongly in private capital investments and has invested significant time, energy, and resources to bring organization, experience, guidance, and access to enable clients to achieve their personal financial goals.

If you would like to discuss how private investments fit into your portfolio, please reach out to your Aprio advisor or Adam Niestradt, CFA, our Director of Private Capital.

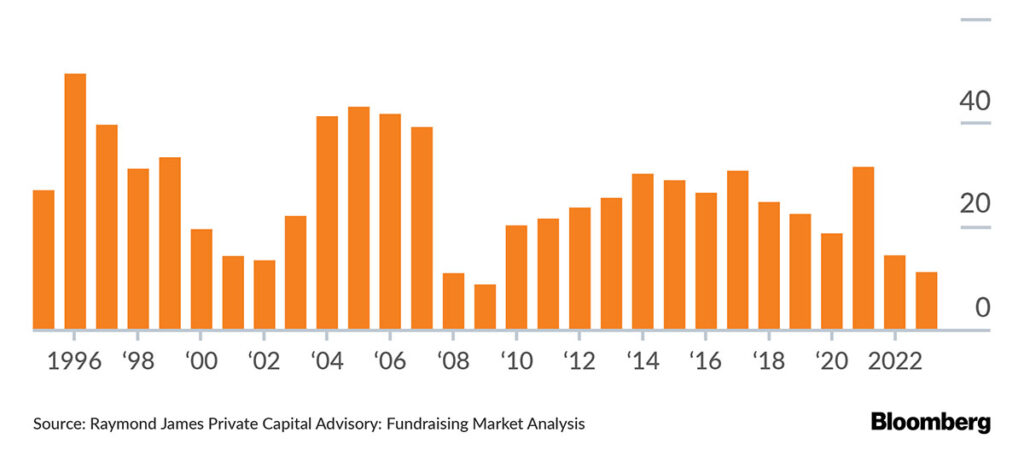

1. DPI is the New IRR

Distributions from private equity funds have declined steadily. In fact, funds are holding their portfolio companies longer due to the headwinds of higher interest rates, which has reduced deal exits. As a result, limited partners (LPs) are focusing on private equity managers who have demonstrated a long track record of buying at attractive valuations, improving portfolio company EBITDA through operational improvements, and returning capital to investors in a timely manner. While many funds financially engineered returns during an era of low interest rates, looking forward, we believe firms that significantly improve their portfolio companies’ profitability will separate themselves from peers as they will have the flexibility to distribute more capital to their LPs.

Key Terms:

- DPI: Distributions to Paid in Capital – A measure of the actual cash the fund has returned to investors in distributions from exiting investments and recapitalizing portfolio company balance sheets.

- IRR: Internal Rate of Return – A calculation based on when capital was called from LPs and when it was returned to them via distributions. IRR is influenced heavily on the value the private equity firm places on the investment and the timing of when the capital was called and returned.

What this means for you: In the prolonged era of low interest rates, private equity firms could window-dress their IRRs using tools, such as quickly returning small amounts of capital, over-leveraging their companies, and delaying capital calls through lines of credit. This created a short-term illusion of high performance, but with little chance of delivering comparably high returns over the life of the fund.

Aprio’s private investment due diligence involves in-depth analysis of a manager’s historical performance, employing a variety of metrics to determine the true success of a manager over time. While it can be enticing to allocate to the newest fund from a manager who demonstrates a high IRR with recent funds that are still active, if only a small fraction of that performance has been realized through distributions, a deeper analysis is required to assess whether the probability of that return is sustainable.

2. The size of the private market is very large

The number of private companies exceeding $1B in revenue significantly exceed those of public companies.

The percentage of privately held companies that generate $250 million in revenue is significantly greater than the percentage that are publicly traded. This reflection indicates that over decades the private equity markets have increased substantially, while the regulatory burden and commensurate costs for public companies have increased. As a result, companies have decided to stay private longer with ample options to raise capital. By staying private for longer, when companies go public they are larger; in other words, more value creation is captured by private market investors than in prior decades.

What this means for you: The size of the private market relative to the public market, in terms of the number of companies, highlights how limited an investor can be if public stocks are their only option. The private markets represent a large, diverse market of profitable companies that are choosing to stay private longer. We believe that the thoughtful inclusion of private equity and private credit can help increase overall diversification and provide the potential for increased returns if one is willing to forgo shorter-term liquidity, while able to source and access the best private managers.

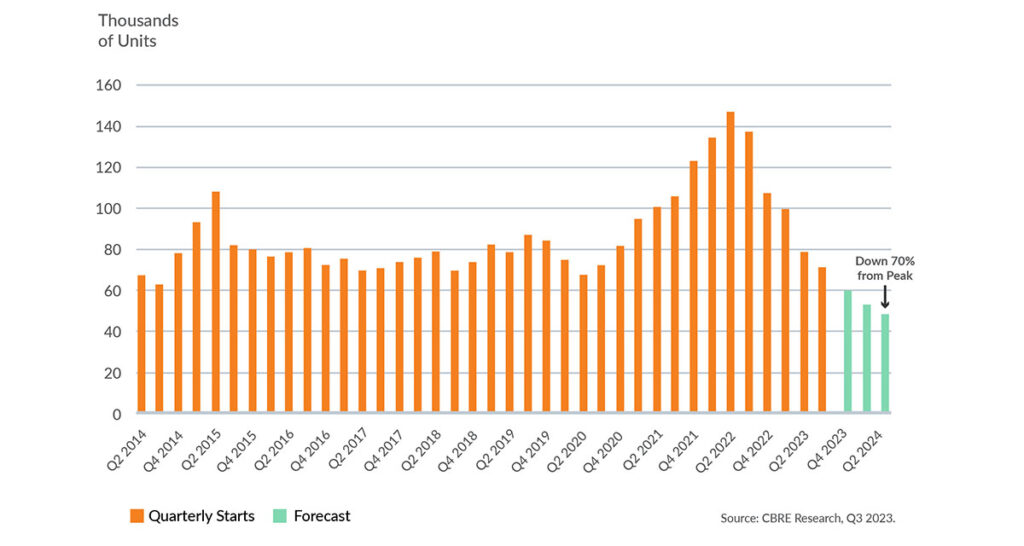

3. Multifamily construction starts have contracted meaningfully

Figure 16: Historical & Forecast Multifamily Construction Starts

Rising interest rates, a severe shortage of single-family houses, and decreased development of new multifamily units have caused homeownership challenges nationwide. According to CBRE, the premium for an average monthly mortgage payment vs. monthly rent is expected to stay above 35% in 2024, although it is expected to moderate from 52% in 2023 . The drop in multifamily starts by 70% from its peak in 2022 is dramatic, but it is still expected to be 24% below its pre-pandemic levels. [1]

What this means for you: We believe that the decline in multifamily housing starts sets up a strong recovery in occupancy and rent growth. While we expect short-term pressure on rents in markets that are still experiencing supply growth from multifamily housing starts in recent years, headwinds, such as higher interest rates, increased labor, and increased insurance costs, should restrict additional supply. Private investments are long-term by nature, so weathering short-term challenges can be meaningful for long-term performance.

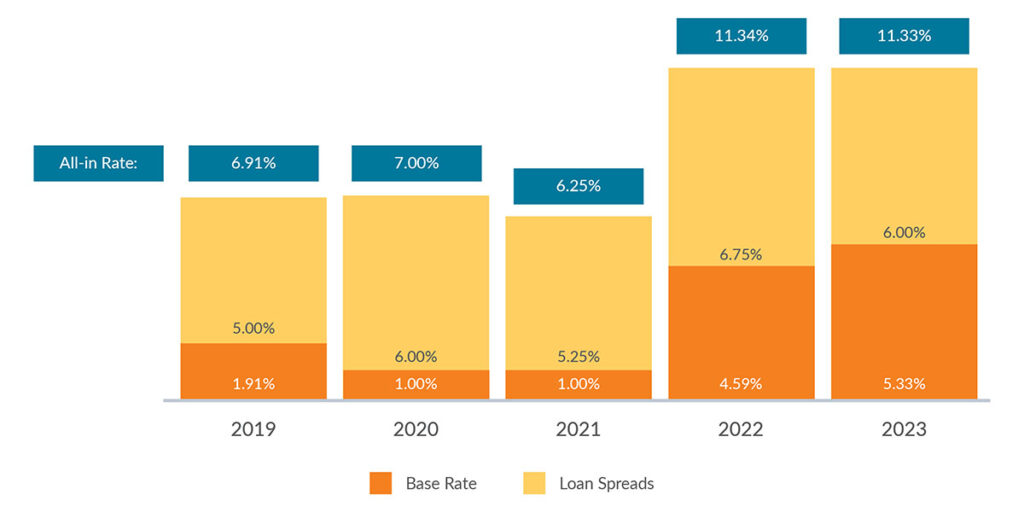

4. Opportunities in private credit

Private Credit Benefits From Higher Yields, Widening Spreads¹⁸

Private credit refers to the sourcing of debt by private companies whose lenders are not investment, regional, or large banks, and is often associated with M&A activity. Lenders earn interest rates from two sources:

- The “base rate” or “reference rate,” which is set by short-term Libor/SOFR, and

- The credit spread, which reflects the market’s perception of the risk of the companies’ ability to repay the loans.

The increase in private credit yields in recent years has been driven by higher base rates; however, credit spreads remain elevated as well compared to pre-and post-pandemic levels.

What this means for you: Not all private credit managers are created equal. Recent media coverage has raised concerns about the rapid rise in private credit compared to traditional sources of lending. Yet, what is often missed is that this is not a new leverage entering the system, but rather a reallocation from bank lenders to private lenders. We believe in partnering with managers who have experienced multiple credit cycles and executed their strategy through them, with a demonstrated history of strong credit underwriting that resulted in lower defaults. Additionally, we favor the newer funds of experienced managers where the majority of capital has been deployed after the increase in interest rates. The quick and large increase in rates created stress for companies when their cost of debt rose substantially. Focusing on portfolios that have less loans that were made during the zero-interest rate environment helps mitigate the risks from those legacy positions.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

[1] 2024 U.S. Real Estate Market Outlook Report, CBRE (2023), https://sprcdn-assets.sprinklr.com/2299/f3d6f5d4-8239-422f-a2bf-8d29d6b0c5de-1608051784.pdf.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Adam Niestradt

Adam Niestradt, CFA is the Director of Private Capital at Aprio Wealth Management. Adam has over a decade of investment experience with high and ultra-high net worth families with a focus on private capital investments. To discuss these ideas and how they may affect your current investment strategy, email Adam directly at adam.niestradt@aprio.com

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.