4 Private Capital Insights from Q1 2024 and What They Mean for You

April 11, 2024

Private capital is a large, diverse market that has historically rewarded disciplined, long-term investors. Aprio Wealth Management believes strongly in private capital investments and has invested significant time, energy, and resources to bring organization, experience, guidance, and access to assist clients in achieving their personal financial goals.

If you would like to discuss how private investments may fit into your portfolio, please reach out to your Aprio advisor or Adam Niestradt, CFA, our Director of Private Capital.

1. Allocating to private markets in recessionary times has rewarded long-term investors

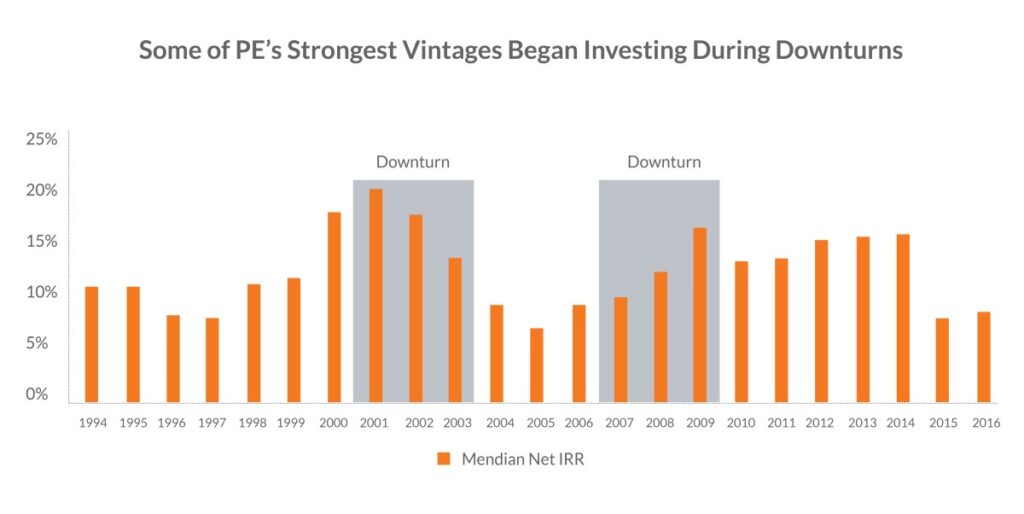

Staying resilient through short-term economic stress and allocating when it seems the hardest pays off in long-term returns. As highlighted above, market stress generally leads to a decrease in transaction volumes and lower fundraising.

Many private capital investment commitments are drawn down over multiple years; as a result, capital is invested when the manager identifies attractive investments typically over a two-to-four-year period after the commitment was made. Therefore, commitments during challenging times often have capital invested during the early stages of a recovery leading to stronger returns.

What this means for you: It is common to become more defensive when markets have experienced losses and there are several macroeconomic uncertainties; however, private capital is focused on long-term value creation from long-term minded investors. With that in mind, funds raised during or immediately following challenging markets have been rewarded with above average returns.

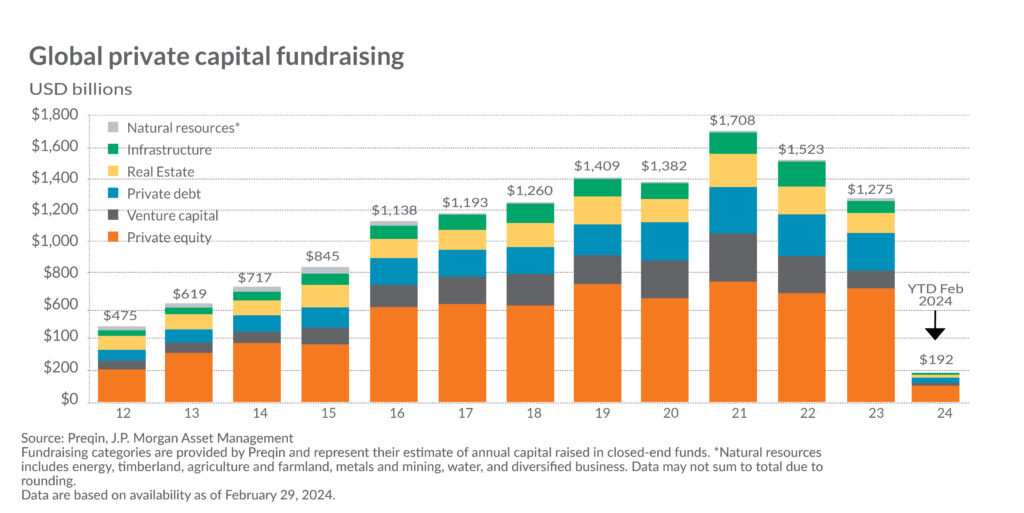

2. Private capital deal volume is decreasing

Fundraising has contracted dramatically across all areas of the private capital sector after a decade of increases. While a portion may be a reversion to more traditional fundraising levels, “the denominator effect” is contributing too. Institutional investors, the largest allocators to private markets, have target ranges and max allowances for their private capital exposure that are dependent on the size of their overall portfolio.

As the public equity and fixed income markets decreased materially in 2022, institutions’ private market exposure increased on paper. As a result, many institutional investors hit or exceeded their private capital allocation guidelines, which will lead to a slowdown in institutional investment activity in private markets for new allocations.

What this means for you: This is an opportunity for investors to increase their exposure to private markets. When there is less capital in the system chasing the same deals, managers have better pricing and term setting power, which has resulted in a stronger performance following public market stress.

3. Private credit offers an attractive risk/return profile

Source: Pitchbook

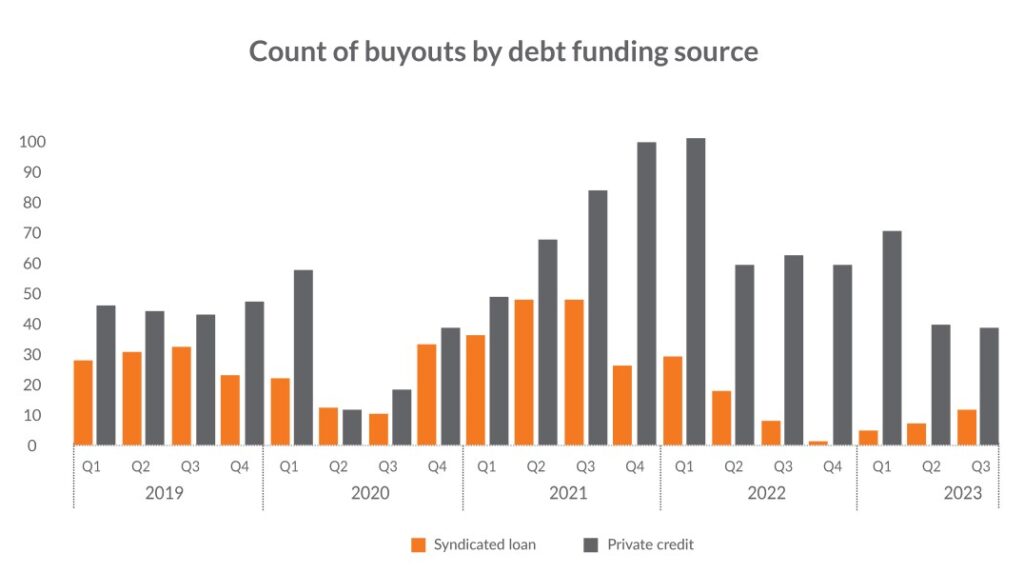

Private credit refers to the sourcing of debt by private companies whose lenders are not investment, regional or large banks. This financing can be used for any business purpose but is often associated with M&A activity. Private credit has expanded quickly due to regulatory changes after the Great Financial Crisis as traditional bank lenders subsequently exited the market (shown in the graph on the right).

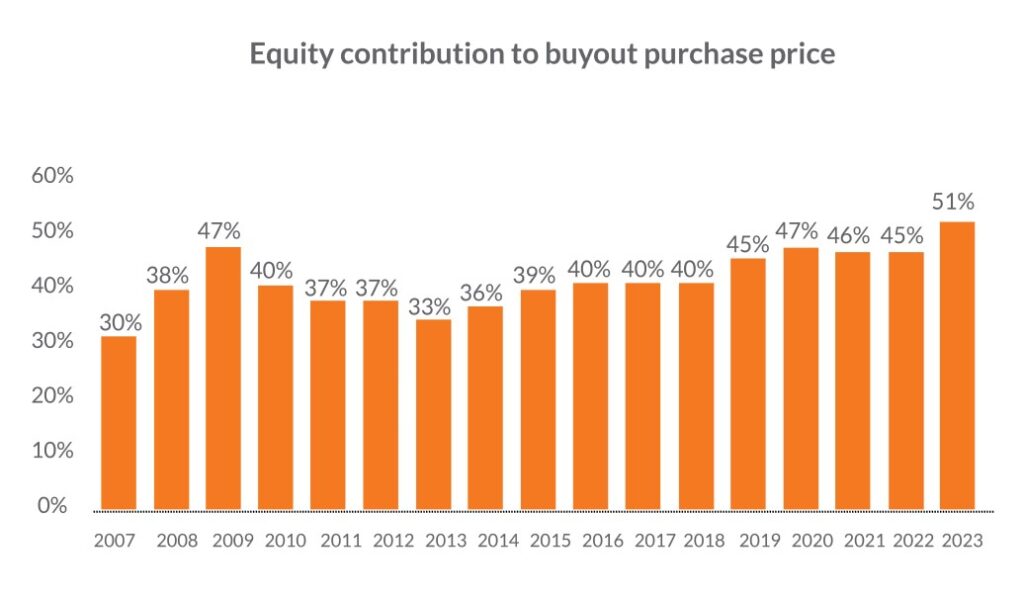

An important trend is the increase in equity contributions by sponsors in private equity (buyout) transactions. With higher interest rates on debt, private equity sponsors are investing more equity into their deals, thus creating more cushion for debt investors if there are periods of financial stress.

As the graph on the left highlights, equity contributions are at the highest levels in more than 15 years, and materially higher than previous years when high levels of leverage were used during the periods of ultra-low rates.

What this means for you: We strongly believe in the opportunities in private credit due to higher yields in the private markets, stronger underwriting, and covenant protections compared to public market loans. Equity contribution increases by sponsors help offset the risks of overleveraging buyout deals. We have multiple private credit funds that focus on different segments of the market in both evergreen and drawdown structures to take advantage of this attractive risk/return dynamic.

4. Opportunities exist in real estate debt

Larger banks limited commercial real estate lending in the second half of 2022, due to changing regulatory capital requirements, balance sheet losses on long duration investments, and other challenges. In early 2023, lending was further constrained by the failure of regional banks, such as Silicon Valley Bank, Signature Bank, and First Republic Bank. The fear triggered by bank failures caused depositors to transfer money from local and regional banks to the largest money-center banks, such as JPMorgan Chase and Bank of America, further straining the lending ability of banks most engaged in real estate.

This union of factors has created a vicious cycle in commercial real estate investment. A reduced supply of capital from traditional sources has driven financing costs higher, while increased asset price volatility has further widened bid-ask spreads between buyers and sellers, resulting in traditional capital providers being less likely to lend.

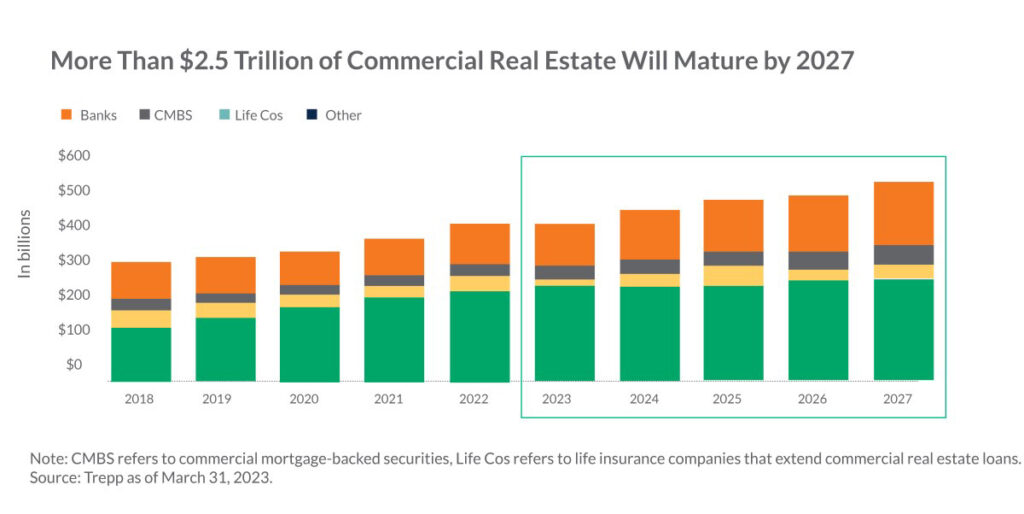

Meanwhile, the need for commercial real estate financing is enormous. As Figure 2 shows, according to real estate data provider, Trepp, more than $2.5 trillion in commercial real estate debt is scheduled to mature by 2027.

What this means for you: We expect these traditional sources of real estate debt financing to remain on the sidelines, given the lack of liquidity in markets and heightened regulatory scrutiny. However, real estate markets still need debt capital, and this is creating an extremely attractive environment for non-traditional lenders, such as real estate debt funds. Our preference is for larger funds with sponsors that have deep experience investing in both the debt and equity of real estate transactions.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Adam Niestradt

Adam Niestradt, CFA is the Director of Private Capital at Aprio Wealth Management. Adam has over a decade of investment experience with high and ultra-high net worth families with a focus on private capital investments. To discuss these ideas and how they may affect your current investment strategy, email Adam directly at adam.niestradt@aprio.com

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.