2025 State Unemployment Insurance (SUI) Taxable Wage Bases

February 4, 2025

At a glance

- The main takeaway: SUI taxes are payable by an employer based upon a specified amount of an employee’s taxable wages each year.

- The impact on your business: It’s important to review each state’s maximum wage base as many states revise their wage base annually.

- Next steps: Aprio’s Employment Tax Services team can help you identify the maximum wage base in your state, so your SUI tax rates are accurately established for 2025.

Schedule a consultation today to learn more.

The full story:

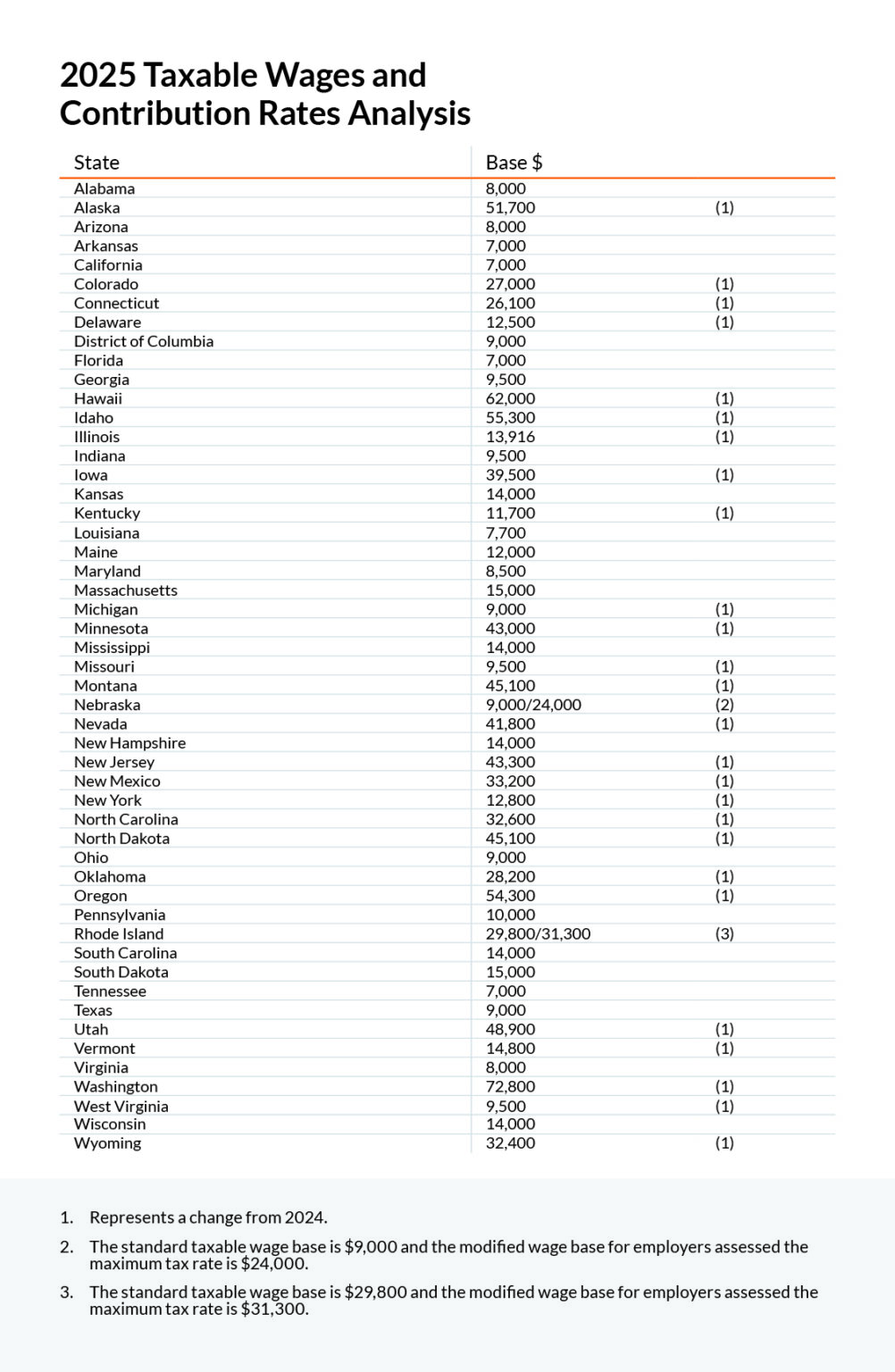

Similar to the Federal Unemployment Tax Act (FUTA), State Unemployment Insurance (SUI) taxes are payable by an employer based upon a certain amount of an employee’s taxable wages each year. Unlike FUTA, which has had a taxable wage base set at $7,000 per employee since 1978, many states revise their maximum wage base annually based upon several factors, including:

- Economic condition of the state

- SUI reserves on hand

- The average annual wage of employees in the state

As a result, some states will have taxable wage bases that vary beyond the minimum allowable by law, which mirrors the $7,000 FUTA base. For example, the highest SUI taxable wage base for 1025 at the time of this notice is $72,800 in Washington.

Please confirm with your payroll department and/or provider that your SUI taxable wage bases, and by extension your SUI tax rates, are accurately established for 2025.

Recent Articles

About the Author

Scott Schapiro

As the leader of Aprio’s Employment Tax and ERC Services, Scott applies more than 39 years of payroll tax experience to his leadership of the Employment Tax team. His long-term focus and passion allows him to assist clients in the complex and ever-changing world of federal, state, and local employment taxes.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.